Senior Citizens to be exempted from filing ITR

Finance Minister Nirmala Sitharaman announced that senior citizens over 75 years will now be exempted from filing income tax returns (ITR) ease the compliance burden.

Home > Income Tax > Help Center > Indian Budget 2021Last Updated: Sep 22nd 2022

Finance Minister Nirmala Sitharaman announced that senior citizens over 75 years will now be exempted from filing income tax returns (ITR) ease the compliance burden.

The Union Budget 2021-22 looks like a senior citizen friendly budget. Finance Minister Nirmala Sitharaman announced that senior citizens over 75 years will now be exempted from filing income tax returns (ITR).

This benefit applies to elderly people, who are residents of India, with a Pension Income and Interest Income which is received in Bank. The bank paying income to them will directly deduct the necessary tax from their bank account. This move would ease the compliance burden on senior citizens who have been hit hard by the global pandemic situation.

In the 75th year of Independence of our country, we shall reduce the compliance burden on senior citizens

In the 75th year of Independence of our country, we shall reduce the compliance burden on senior citizens, Sitharaman said. For senior citizens who only have a pension and interest income, I propose exemption of filing of income tax returns, she added.

In 2018 Budget, several tax law changes were announced to provide more tax benefits to senior citizens. These tax benefit included – the introduction of a new section 80TTB in the Income Tax Act, 1961, the deduction for medical expenditure in case of no health insurance coverage, etc..

Under section 80TTB, seniors can claim up to Rs 50,000 interest income received from banks and post offices as a deduction from their income thereby making this type of interest income for senior citizens effectively tax-exempt up to Rs 50,000.

This step comes as a huge relief for the senior citizens who rely mostly on their earning from bank fixed deposits and post office schemes. TDS limit for bank fixed deposit interest was also hiked for senior citizens.

The senior citizen would have to provide a declaration to the bank.

"The declaration shall be containing such particulars, in such form and verified in such manner, as may be prescribed. Once the declaration is furnished, the specified bank would be required to compute the income of such senior citizen after giving effect to the deduction allowable under Chapter VI-A and rebate allowable under section 87A of the Act, for the relevant assessment year and deduct income tax on the basis of rates in force" the Budget document said.

Once this is done, there will not be any requirement of furnishing return of income by such senior citizen and super senior citizen for this assessment year

The tax slab for Senior citizens (aged 60 or above and below 80 years) until now are as follows.

| Income Tax Rates | Taxable Income (Rs.) |

|---|---|

| Nil | Up to ₹300,000 |

| 5 per cent | ₹3,00,001 to 5,00,000 |

| 20 per cent | ₹5,00,001 to 10,00,000 |

| 30 per cent | Above ₹10,00,000 |

The tax slab for Super Senior citizens (aged 80 or above) until now are as follows.

| Income Tax Rates | Taxable Income (Rs.) |

|---|---|

| Nil | Up to ₹500,000 |

| 20 per cent | ₹5,00,001 to 10,00,000 |

| 30 per cent | Above ₹10,00,000 |

Per EZTax.in Expert team, there were no specific pension or superannuation schemes designed specifically for senior citizens. They typically save their investments and annuities in bank FDs, Senior Citizen Savings Scheme (SCSS) or Post Office Monthly Income Scheme (POMIS). The interest income earned from this is fully taxable. Moreover, TDS is applicable if interest is more than Rs 50,000 per year.

In this case, the senior citizens required a big sum of money to ensure a good return. However, the returns were steadily falling. Hence, the current step in budget could ensure citizens have more cash in hand after their retirement.

More emphasis on Infrastructure spending, raised customs duty to create jobs. No new changes to Taxes (Income Tax & GST)

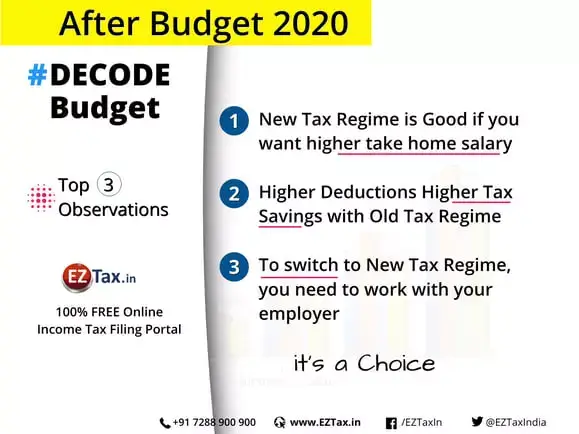

Top three observations from the analysis were

Pictorial analysis on New Vs Old Personal Income Tax Regime