4.8 ★★★★★ Excellence since 2016

4.8 ★★★★★ Excellence since 2016 Home > TDS > Expert Assisted TDS Filing ServiceLast Updated: Feb 23rd 2022

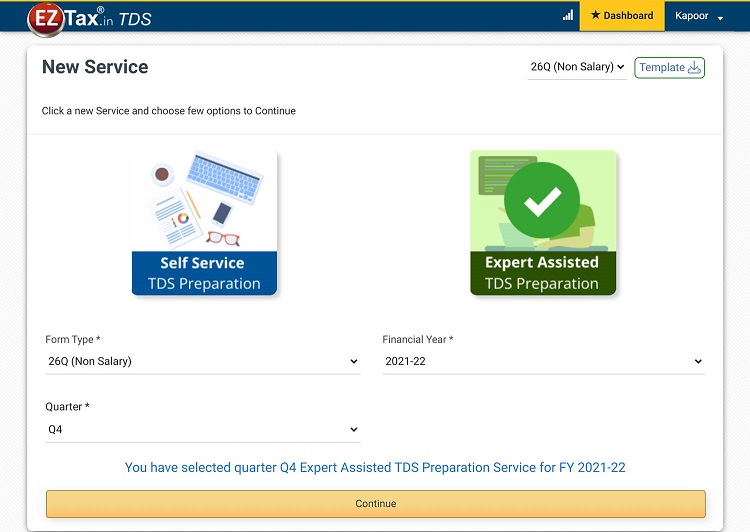

After register and logging into your EZTax.in TDS account, choose Expert Assisted TDS Filing for our CA to file your TDS return. Here in this screen, you need to select Form Type, Financial Year, and the Quarter for which you are filing your TDS for.

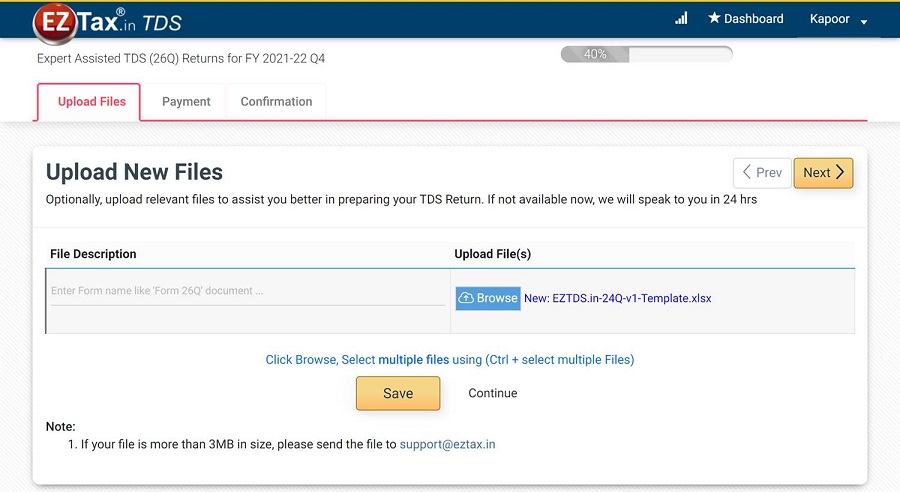

Then upload the files such as challans, deductee details, and other relevant documents. Once service is selected, Team EZTax.in will approach you to re-confirm to make sure you haven't missed any.

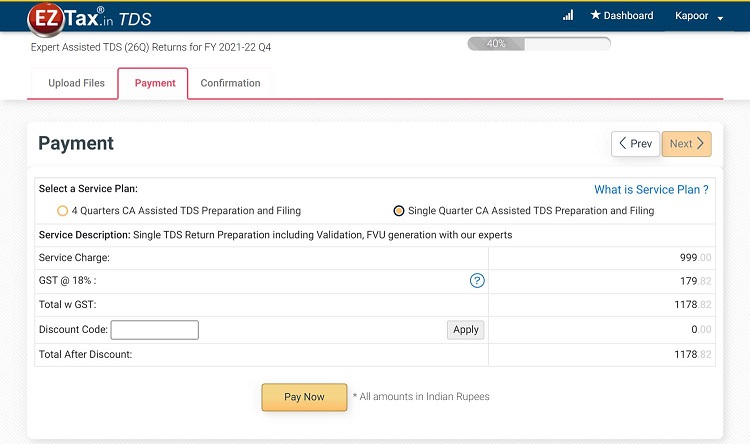

Choose the service plan and make payment for it.

Two Service plans are offered by us, which are: Our CA preparing your TDS returns either for one quarter or for all the four quarters. Our CAs provide you the right FVU file for you to upload at the Income Tax Department website as it requires your DSC to complete the filing. Our team will assist in case you need any help in uploading the FVU file.

After making the payment you will be given an acknowledgement which you can print and keep it for future reference purpose.