4.8 ★★★★★ Excellence since 2016

4.8 ★★★★★ Excellence since 2016 Home > Income Tax > Services > Assisted Tax FilingLast Updated: Feb 28th 2026

C Srinivas

Director-CR, ICFAI Business School

Had a great experience in filing my tax with EZTax. It is easy to use with step by step screens. The team provided quick, thorough and friendly support. EZHelp from their Self-Service Tax Filing Solution took care of most of my doubts. One only needs to upload Form 16 in pdf and the software takes care of everything else.

We promise to provide exceptional service, in case you are not satisfied with the service you purchased, we will provide an unconditional refund of EZTax.in Expert Assisted IT Filing fee you paid.

Click on Sign In button, Create an Account and provide your details. (You will need an e-mail, and a mobile number in order to create an account.)

We will send a verification link in an eMail. Click on the link to register / sign up to EZTax.in

Click on "Assisted Income Tax Filing" button in the Dashboard, and choose the type of tax return and other options before hitting Continue.

Once the ITR due date is over, you have an opportunity to select "Belated" IT Return up to the revision period for an assessment year. (For eg., Mar 31st 2022 for FY 2020-21 or AY 2021-22). Other Return types available to use are "Original", "Revised".

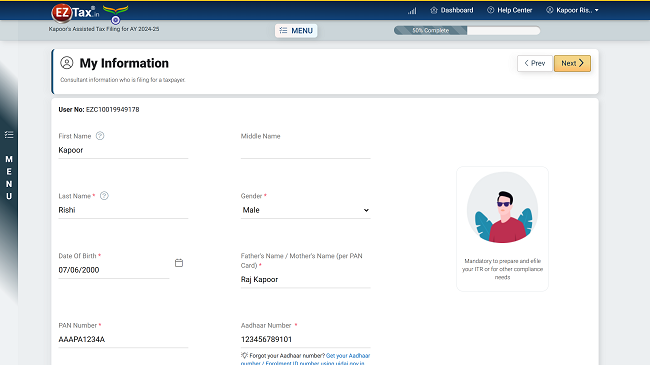

Provide your Personal information and your Permanent or Current Address.

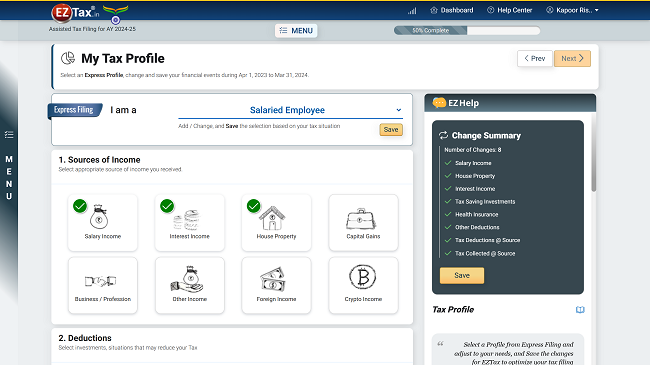

Choose an Express Profile that suits your need and continue and Adjust the selection based on financial events / income profile.

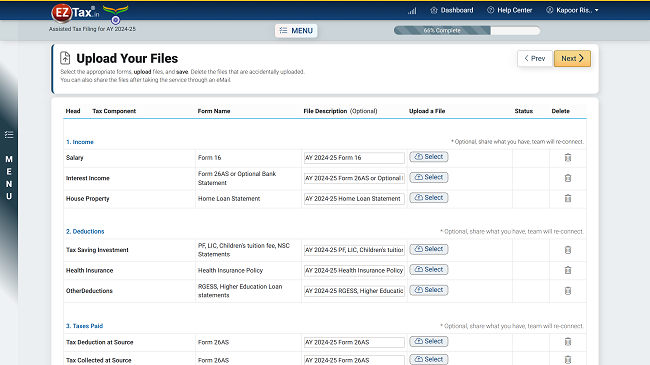

Upload files / images / documents into appropriate forms and continue. If you do not know how to upload the docs / files, you can send them to support@eztax.in once the service is taken from the email-id you used to take the service.

Most important documents out of all is Form 168 of IT Act 2025 (Form 26AS of IT Act 1961). You can share your PAN and Password of the Govt. ITD Portal to download by our team.

Please Note: If you are currently outside of India, Form 168 (a.k.a Form 26AS) may not be able to get downloaded due to Govt restrictions.

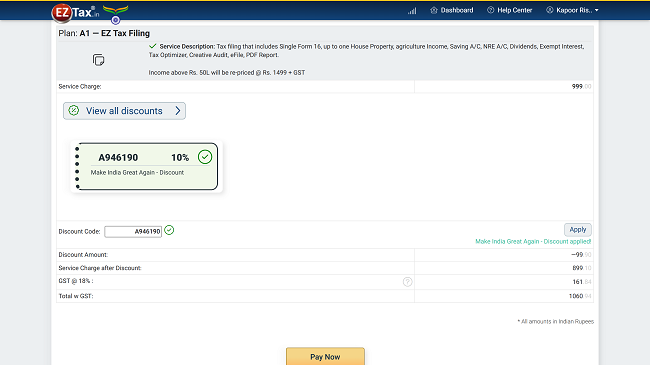

Make a payment, using any of the methods - ( Debit card / Net Banking / Wallet / UPI /... )

After Payment you will be redirected to Service Confirmation, and an email with the service confirmation.

Our Tax Expert will review your documents, re-price if necessary, and share the draft tax computation for your review. Upon a confirmation email from you to eFile, our team will eFile your IT Return.

An email with eFile status and an acknowledgement number will be sent to your eMail once eFiled. In few days after the eFiling, a formal Tax Invoice is shared to your email as well (this is in addition to the payment receipt we send after your Payment).

Note: We do not eFile your IT return without your email confirmation to our team. This is to make sure you are fully involved in the process.

After taking the service online

Disclaimer: This article provides an overview and general guidance, not exhaustive for brevity. Please refer Income Tax Act, GST Act, Companies Act and other tax compliance acts, Rules, and Notifications for details.