4.8 ★★★★★ Excellence since 2016

4.8 ★★★★★ Excellence since 2016 Home > Apps > GST Accounting Mobile AppLast Updated: Nov 19th 2025

GST Online Accounting Software Mobile App for Small Business from EZTax.in is a complete, Comprehensive Goods and Service Tax (GST) ready Accounting Mobile App (Application).

The app is to help you prepare GST Compliant Billing, Maintaining Books, preparing GST Returns, manage your expenses, Profit and Loss, Balance Sheet, Analytics that let you know how well your business is doing real-time, online, all on Mobile while you are on the Road.

EZTax.in GST Accounting App can be used to do all the things you would do on a PC browser but with greater convenience. With single subscription, you can use both on PC browser and on Android App. Download EZTax.in GST Accounting Android App now

1st page after Login to show you complete business with visual charts of Orders over the months and weeks, Real Time P & L for the current month, latest invoices, expenses, & purchases, along with the actions and reminders.

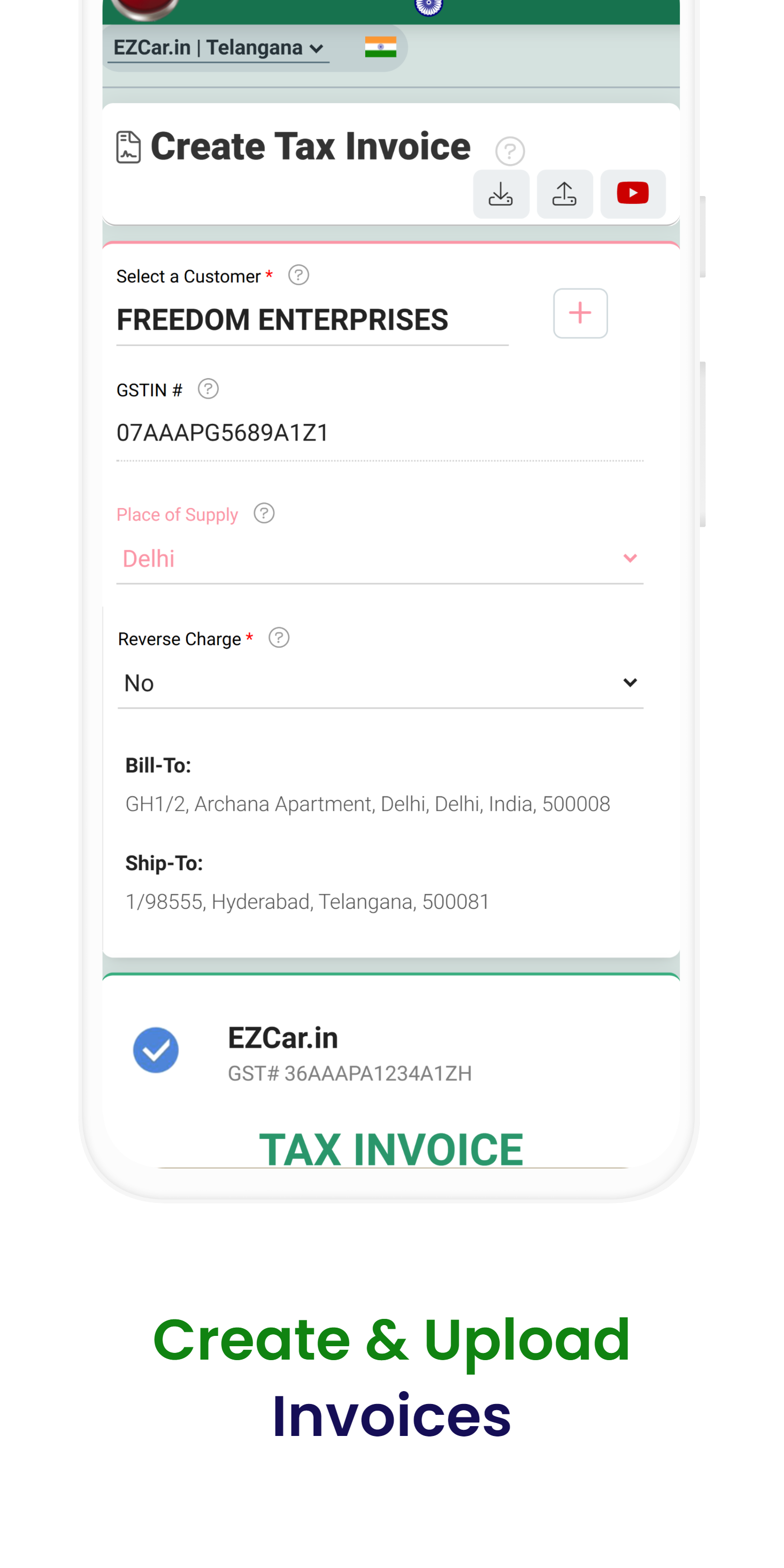

Complete provisions made for Estimates, Billing, Invoicing, Delivery Challans, Credit, Debit notes, Drafts, Templates and their conversions from one to another. Create beautiful GST Tax Compliant Invoices easily with your business logo, references such as transport option, PO references, terms & conditions, bank account information, Discount, Cess, extended product descriptions, due dates, reverse charge and place of supply provisions as per Indian GST Act.

Greater care taken to have single invoice capable to handle both exclusive, inclusive products, also possible to combine both products and services. Single invoice to have 1000’s of line items, and an auto delivery of the invoice saves time and money in comparison with the print and post.

Multiple formats were given to make sure you can print your invoices in appropriate paper, formats. A4, 3.125-inch POS format, along with portrait, landscape provisions.

Creating, managing Expenses, purchases, vouchers made easy. System will automatically, takes care of how a voucher entry to be treated to apply against P&L and Balance Sheet. No need to define Chart of Accounts (COA). Ledger groups can be created at Product or Service level that will auto apply to P&L, and Balance sheet.

GSTR-3B, GSTR-1, GSTR-2 returns are just a click away to review on the screen or to download JSON file to upload at government of India’s GSTN site, gst.gov.in Additional provision made upload paper-based invoices into the system before filing thru an excel interface. GSTR-2A reconciliation made easy with heuristics to identify the real difference between purchases and supplier invoices.

Make right decisions to get paid faster with Single click 360-degree view of your customer, supplier, product to know complete details including transactions, receivable, payable through visual charts.

With Artificial Intelligence (AI) enablement, solution alerts you when to, how to respond to your customer or supplier on your ageing of receivables, payables.

Multiple users to login and work under single licensing, Sales Analytics, Customized Views for Regular, Composition, Month Close Process, Multi-Channel GST returns, Multi-Country, Multi-Currency for Export Invoicing, Purchase Orders (PO), Conversion of Purchase Orders into a Purchase Entry, Excellent User Experience, Easy to understand language, Artificial Intelligence, above all, Count on our Outstanding Client Service. Possibly why SiliconIndia Magazine identified EZTax.in GST Accounting Software as the best among Online Accounting Software.

If you already registered Online at https://eztax.in/gst, just DOWNLOAD and start using the app on Android smart phones today. It’s FREE and takes few secs as the app is just 1.3MB, which is the smallest possible app size.

Otherwise, just download the GST App and REGISTER now to get 7 day free trial, get 70% OFF there after, and book your demo session to get to know from EZTax.in

Makers of EZTax.in, Comprehensive Self Service Tax Filing solution provider in India, covering Income Tax, TDS, Virtual Accounting Services, Registrations @ EZTax.in Home Page

Disclaimer: This article provides an overview and general guidance, not exhaustive for brevity. Please refer Income Tax Act, GST Act, Companies Act and other tax compliance acts, Rules, and Notifications for details.