4.8 ★★★★★ Excellence since 2016

4.8 ★★★★★ Excellence since 2016 Home > TDS > Self Service TDS Return Preparation & FilingLast Updated: Mar 05th 2026

Self Service TDS preparation service is a do-it-yourself service where you have the opportunity to upload the TDS information using excel template or manually entering to the screens to prepare TDS FVU file which can be uploaded in to income tax department portal to complete the filing.

EZTax.in TDS Portal covering Form 138 of IT Act 2025 (Forms 24Q of IT Act 1961), Form 140 of IT Act 2025 (Form 26Q of IT Act 1961), Form 144 of IT Act 2025 (Form 27Q of IT Act 1961), Form 143 of IT Act 2025 (Form 27EQ of IT Act 1961) and others. For events like TDS on rent paid, professional remuneration, commission paid, contractor payments, interest paid, payments made to non-residents (NRI). BTW: EZTax.in TDS is an authorised NSDL (Govt of India) utility.

After logging into EZTax.in TDS account you can see two services offered by us, they are Self-Service TDS Preparation, and Expert Assisted TDS Preparation.

For Self-Service TDS Preparation, you have two options, you can either download an excel template after choosing the appropriate TDS form and fill the form offline and later upload it at your convenience or else you can fill the Form Online and prepare your TDS FVU File.

On the top right corner of the Services screen you can see the Template button and form name, you can select the appropriate form, and click on the Template button to download the template.

Choose the service plan and make payment for it.

Two Service plans are offered by us, which are: One Quarter for one FVU Generation (or) Four Quarters for Four FUV Generations Up to Success FVU Generation.

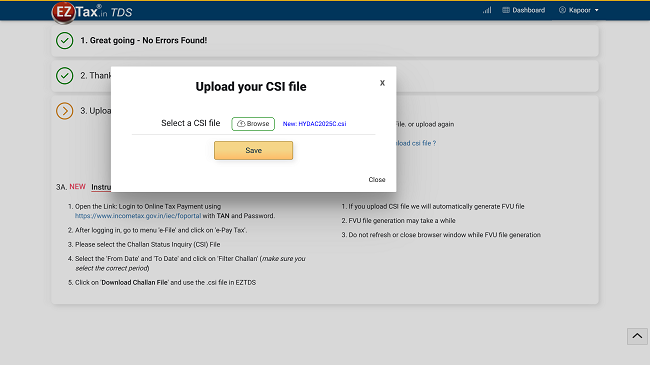

If no errors in your template, you can generate CSI file through the link provided and upload it. Link to download your CSI file

After uploading the CSI file, EZTax.in TDS will process your data and generate the FVU file will automatically if no errors found in the data provided.

After successful generation of FVU file generation, you will get the service summary page where you can download the PDF, and FVU File, which contains all the details of TDS transactions.

Disclaimer: This article provides an overview and general guidance, not exhaustive for brevity. Please refer Income Tax Act, GST Act, Companies Act and other tax compliance acts, Rules, and Notifications for details.