4.8 ★★★★★ Excellence since 2016

4.8 ★★★★★ Excellence since 2016 Home > TDS > File Validation Utility File

Detailed step-by-step instructions explaining how to view / upload FVU file thru Income Tax India e-Filing Portal. Also, explains the importance of FVU file to have good tax compliance and filing your TDS returns correctly.

This document covers

FVU file means File Validation Utility. FVU is used to ensure that the e-TDS/TCS statements prepared does not contain any format level errors. EZTax is providing the software to generate FVU file for TDS returns / TCS returns through Prepare TDS Returns @ EZTax.in TDS more @ EZTax.in TDS.

Know more on what are specified financial transactions (aka SFT, aka high value transactions) and their threshold limits @ What are high value transaction limits for Income Tax Compliance?

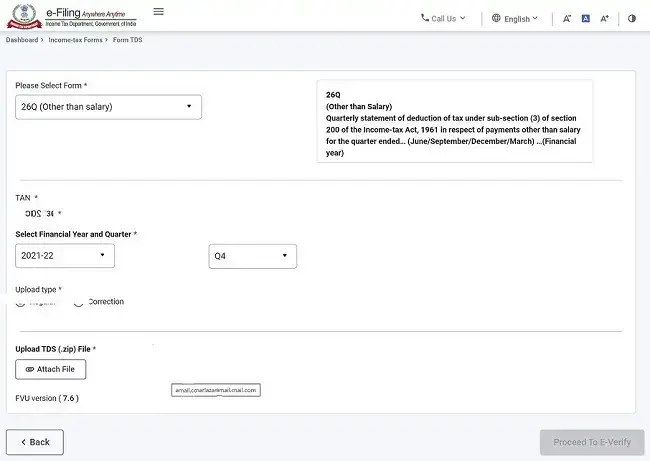

Once you generated the FVU File from EZTax.in TDS, kindly follow the below steps to upload the TDS return online. Similar instructions are sent to your registered email id post completion of TDS Return preparation @ EZTax.in TDS Portal

Once you generated the FVU File from EZTax.in TDS, kindly follow the below steps to upload the TDS return offline

Once the TDS/TCS returns are filed, it will take 3-7 working days for the Traces to process the returns. Once the returns are processed, you can login to Traces and download the Form 130 of IT Act 2025 (Form 16 of IT Act 1961) / Form 131 of IT Act 2025 (Form 16A of IT Act 1961) and give it to the deductees.

Go to https://www.incometax.gov.in/iec/foportal and click on login. If you don't have an account, please click on register and create an account.

Enter the User Id (PAN). Now click on login.

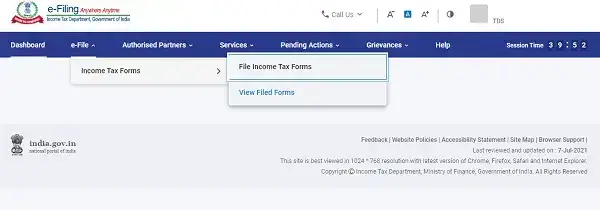

From Menu > eFile > Income Tax Forms > File Income Tax Forms.

Click "File Now" against "Deduction of tax at source (Form TDS)" (Quarterly TDS/TCS Return (Form 138 (a.k.a Form 24Q) , Form 140 (a.k.a Form 26Q) , Form 144 (a.k.a Form 27Q) , Form 143 (a.k.a Form 27EQ)))

Click Let's get Started

If this was asked by the EZTax Team to process your Tax Filing, please share the same in reply to our email.

Form 168 (a.k.a Form 26AS) is a TDS Credit statement, an important document when filing your taxes. Check @ How to View / Download Form 26AS ?

Form 168 (a.k.a Form AIS) is a comprehensive statement containing details of the financial transactions undertaken by you for a given financial year (FY). Different from Form 168 (a.k.a Form 26AS). Check @ How to View / Download AIS Statement ?

Disclaimer: This article provides an overview and general guidance, not exhaustive for brevity. Please refer Income Tax Act, GST Act, Companies Act and other tax compliance acts, Rules, and Notifications for details.