4.8 ★★★★★ Excellence since 2016

4.8 ★★★★★ Excellence since 2016 Home > Income Tax > Help Center > Register statement of financial transaction

As per section 508 of IT Act 2025 (section 285BA of IT Act 1961), specified persons are required to furnish statement of financial transactions or reportable accounts to the Income Tax Authority or such authority as prescribed.

Income Tax Department constructed a reportable account or Statement of Financial Transaction (SFT) portal to document these activities. Learn how to register for ITD reports?

This document covers

To file Statement of Financial Transactions, the specified persons are required to register as reporting entity first.

After login, Go to Pending actions and click on Reporting portal and click on proceed

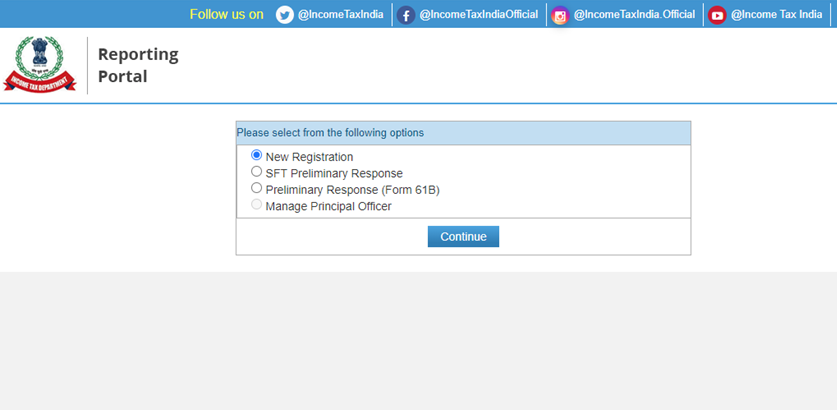

Select New Registration after redirected to reporting Portal and click on continue

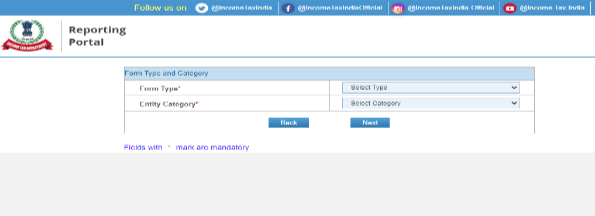

Select the Form Type as Form 61A/61B/61 and Select the Entity category and click on Next

Enter the details of the Reporting Entity and click on Add Principal Officer

Enter the details of Principal Officer and click on Submit. However, you can add Designated Director also.

Enter Designated Director Details and click on Submit

Upon Successful submission, a registration request number is generated. The Registration number is called ITDREIN. Temporary Login credentials will be sent to registered mobile no and email id. The user is required to change the password after login

If the user has not received the credentials to email, they need to go to https://report.insight.gov.in/reporting-webapp/login and click on forgot password. Enter the Pan and select option Using OTP. Enter the OTP and set the password

Disclaimer: This article provides an overview and general guidance, not exhaustive for brevity. Please refer Income Tax Act, GST Act, Companies Act and other tax compliance acts, Rules, and Notifications for details.