If you are a normal taxpayer, who want to file taxes online by yourself for your individual, professional, capital gains or business income, EZTax.in ITR Portal is affordable to use and eFile your Taxes. Check pricing @ Self Service - How to & Pricing

- If you are looking for Expert IT Filing where we take your information to collect, prepare, draft, and eFile your taxes, then the prevailing charges apply. Thank you.

- If you are a Tax Consultant looking for a software to e-file your client data, please read below to get the access

How it will help you?

Compared to typical filing you are going through every year, high-paid Softwares, Excels, Utilities etc, EZTax.in solution is Online, works anywhere, anytime, any device including mobiles, with ease of use, and comparatively low prices. EZTax.in makes your filing faster, cheaper, bring efficiency and your client satisfaction.

Pricing

Affordable plans to start from as low as 40 ITRs covering ITR-1/2/3/4, multiple years, various return types such as Original, Defective, Belated, Updated returns.

| Plan# | Number of ITRs | Price(Rs.) | Discount |

| P1 | 40 | 4,800 + GST | Up To —25% Discount Contact software@eztax.in for a discount coupon |

| P2 | 100 | 9,000 + GST | |

| P3 | 200 | 16,000 + GST | |

| P4 | 300 | 21,000 + GST |

Note: Number of ITRs counted based on per year per PAN per IT Return. Downloading a computation sheet (PDF) or JSON file or direct e-Filing under a service is counted as one utilised service. Change of PAN is allowed before downloading PDF / JSON or e-filing.

EZTax Features

- Client Manager : Client Manager part of dashboard let's you manage all of your clients from one screen.

- Straight through Process : 100% Straight through Process (STP), you no longer need to sign in to your Client's Income Tax eFiling Login to File their taxes.

- Functionality : Functionality Tax filing that includes multiple Form 130 of IT Act 2025 (Form 16 of IT Act 1961), multiple House Property, agriculture Income, Saving A/C, NRE A/C, Dividends, Exempt Interest, Tax Optimizer, Creative Audit, eFile, PDF Report, Commission/Contract/Other Income, Presumptive Income, Brought Forward Losses, Foreign Assets, Foreign Income, Capital Gains

- Form 130 (a.k.a Form 16) : Auto Reads most of the Form 130 (a.k.a Form 16) in PDF and image formats, an India's 1st Feature.

- Tax Optimizer : Show how your client can save on their Taxes thru Tax Optimizer an automated savings engine that saves your time during peak hours and reduce common mistakes in your recommendations.

- Form 168 of IT Act 2025 (Form 26AS of IT Act 1961) : Auto Reads Form 168 (a.k.a Form 26AS), and all of its components.

- Creative Audit : Creative Audit solution checks and makes ITR error free all before filing your client's tax return, gives peace of mind for you and your client.

- Tax Savings : India's 1st Online Tax Optimizer Solution to recommend tax saving options for your Clients.

- EZHelp : While EZHelp is to help your clients, you may switched on/off based on your preference.

- Never-Lost : Intelligent search to find a questionnaire or field based on a keyword entered by a tax consultant, speeding up the work.

- Highest Security Standards : We are either 1st to offer or very few to offer 256-bit encryption, and our clients data resides in India with the best data centres in the world.

- Online : No need to download the software, upgrade every year, works anywhere, anytime, any device such as pad, smart phone, laptop, or PC.

- Support : Call / Chat / eMail options are convenient way to connect.

How to get the access?

Below is the process to get the access of the software and get started quickly.

- Sign up for an account using your email address and then confirm it using a verification link to your e-mail.

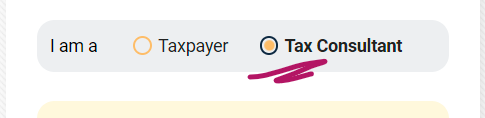

- Choose "I am a Tax Consultant." at the time of signup.

- Start working on your client's tax return from "Dashboard", using self-service option.

- As you add more services, the dashboard gets more features, such as the ability to look more deeply, etc.

- When you are planning to e-file your client taxes, send the registered email-id to software@eztax.in to get a discount against a plan you are interested.

- After you paid, you could use the ITR Review, the Tax Computation Sheet, JSON* (for updated and defective ITRs) , and direct e-filing, e-Verification etc.

- On your Profile page, you can see which Payments and Services the credit is used for.

Know more on Who is a Tax Consultant in India? and what to mind?

What kind of Tax Returns can be bulk filed?

The following ITR’s can be filed with EZTax.in

- Original, Belated and Revised ITR 1, ITR 2, ITR 3, ITR 4 for AY 2025-26 (FY 2024-25), when applicable.

- Updated Returns in ITR 1, ITR 2, ITR 3, ITR 4 for 5 years ( AY 2021-22, 2022-23, 2023-24, 2024-25, 2025-26 )

- Defective Returns for AY 2021-22, 2022-23, 2023-24, 2024-25, 2025-26

SUPPORT: If you have any queries, kindly send an email to software@eztax.in

List of schedules that are not part of EZTax

Some of the below schedules are very uncommon in a day-to-day ITR filings, hence EZTax has not offered them. In case, you need them, you download JSON and use the ITD utility to re-generate to use for your clients.

- Schedule Depreciation on Plant and Machinery and other assets (Schedule DPM & DOA, DE)

- Pass through income in the nature of income from other sources chargeable at special rates

- Details of Unabsorbed Depreciation

- Schedule PTI - Pass through income details from business trust or investment fund u/s 115UA, 115UB

- Schedule Tax deferred on ESOP

- Schedule ICDS - Effect of Income computation disclosure standards on profit

Tax Consultant Workbench

Visit Tax Consultant Workbench now and press Ctrl + D to bookmark