4.8 ★★★★★ Excellence since 2016

4.8 ★★★★★ Excellence since 2016  4.8 ★★★★★ Excellence since 2016

4.8 ★★★★★ Excellence since 2016 Home > Income Tax > Service Plans > Self Service Tax FilingLast Updated: Feb 27th 2026

EZTax Self-Service Portal allows for quick and easy income tax preparation and e-filing in under 5 minutes.

Preparing taxes online is free; you simply pay for e-filing based on your tax profile. In addition to preparing taxes, you can save time, money by employing features such as India's 1st Express filing, Tax Optimizer, Creative Audit etc.

Prepare your income tax return for free and choose service plans to efile based on your income profile and ITR complexity. Pricing varies easy plans. All prices are excluding GST & Discounts.

| Plan | Income Source & Income | ITR Form | Price* |

|---|---|---|---|

| S0 | Ordinary Income, < Rs. 5 Lakhs | 199 | |

| S1 | Ordinary / Business Income, > Rs. 5 Lakhs | 299 | |

| S2 | NRI / Capital Gains / Trading / Business, < Rs. 5 Lakhs | 499 | |

| S3 | NRI / Capital Gains / Trading / Business, > Rs. 5 Lakhs | 999 | |

| S4 | S3 + Foreign Income | 1299 | |

| S5 | S4 + Crypto Income | 1499 |

* all prices are in INR, excluding GST

Discounts ?

ITR preparation at eztax is free and the discounts are available at the checkout (for optimisation, and e-Filing)

Tax Consultant ?

If you are, you can opt for bulk ITR filing at a discounted pricing starting with 40 filings plan (P1). More at Income Tax Filing Software for CA, CMA, ICWA, TRPs

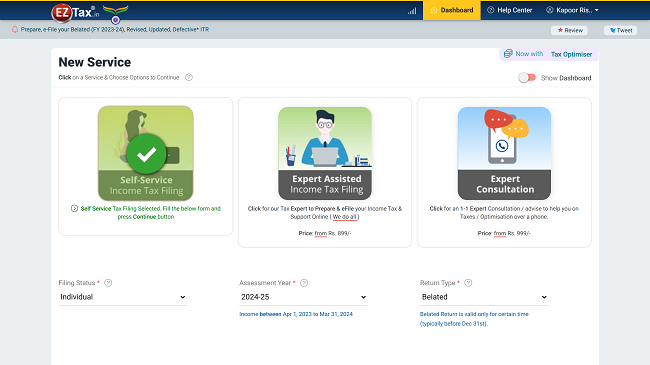

Select the Self-Service IT Filing service from the dashboard after the creation of an account (refer How to create a EZTax.in Account for IT Filing?) and login. Select appropriate options (Refer How to select a Service to File Income Tax Return?).

Once the ITR due date is over, you have an opportunity to select "Belated" IT Return up to the revision period for an assessment year. (For eg., Mar 31st 2022 for FY 2020-21 or AY 2021-22). Other Return types available to use are "Original", "Revised".

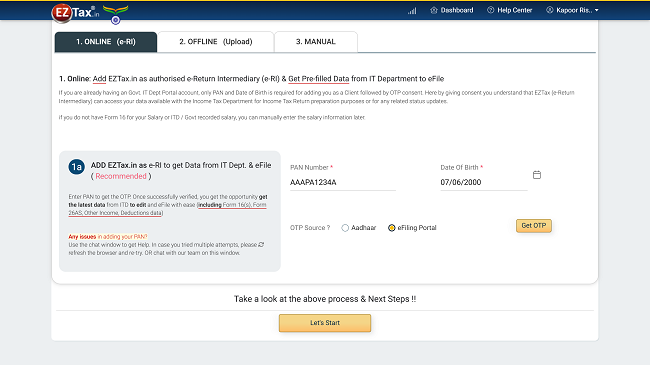

If you are already having an Govt. IT Dept Portal account, only PAN and Date of Birth is required for adding you as a Client followed by OTP consent. Here by giving consent you understand that EZTax (e-Return Intermediary) can access your data available with the Income Tax Department for Income Tax Return preparation purposes or for any related status updates.

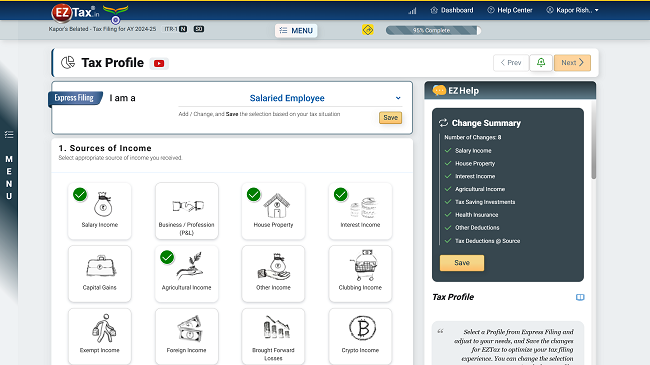

Introducing Express filing, a unique feature in filing your taxes where the tax engine will ask the relevant questions based on your profile, whether you are a salaried employee, trader, etc. It's that EZ (easy)!

Select your profile, EZTax will refine your questionnaires for you. More @ How to select Tax Profile while IT Filing ?

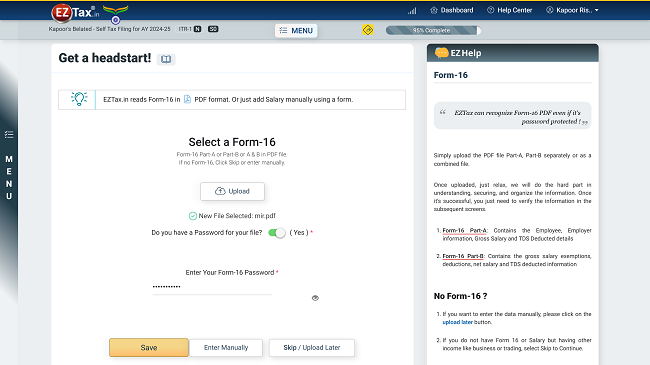

Smart. Intuitive. Convenient. Choice. We auto read your Form 130 (a.k.a Form 16) many ways to reduce your data key in.

More help on How to declare Income from Salary & House Property?

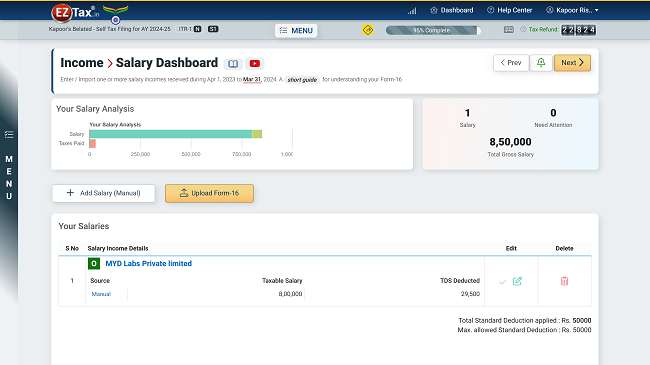

Review Salary information that was uploaded or added manually and add additional salaries if you have switched the jobs during the financial year you selected.

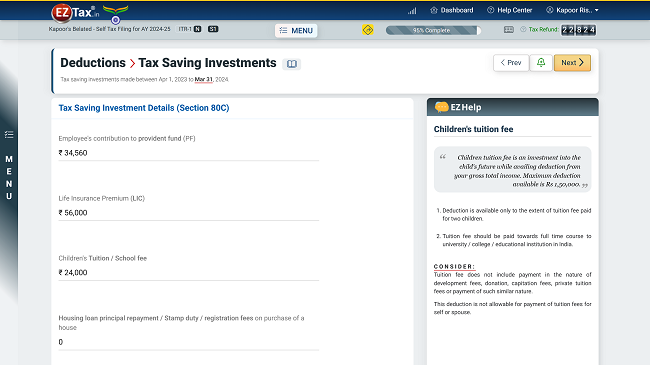

Deductions help in maximizing tax savings by reducing your taxable income.

Know more on How to declare Investments & Deductions?

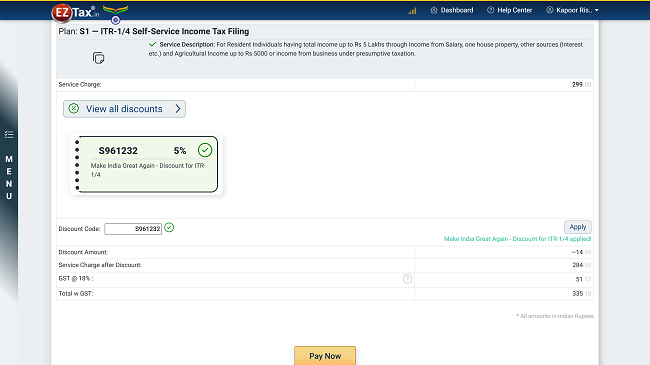

Choose the service plan and make payment for it.

We are by far the fastest e-Filer in the market today in India. Once prepared, takes just a few seconds to upload your return!

Once e-filed, you can download your customized ITR Report in PDF format along with email communication and reminders.

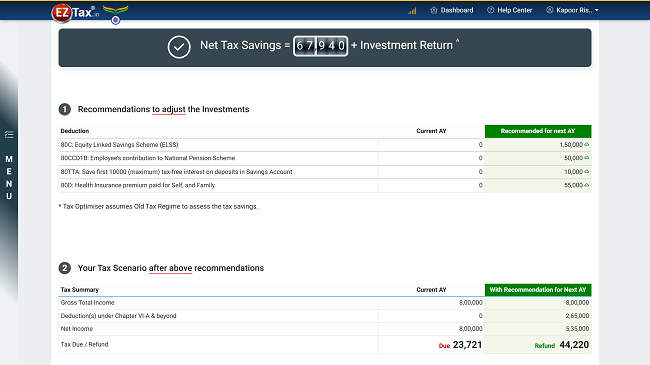

Introducing EZTaxTax Optimizer, to save on taxes and increase the potential investment return. Per independent study* assesses on an average could save Rs. 10,000 or more on their taxes.

EZTax made it so simple that it will build a complex what-if scenario in real-time to show the current refund and new refund possible after recommendations for the coming year. more details about Tax Optimizer

Know more on How to declare Investments & Deductions?

C Srinivas

Director-CR, ICFAI Business School

Had a great experience in filing my tax with EZTax. It is easy to use with step by step screens. The team provided quick, thorough and friendly support. EZHelp from their Self-Service Tax Filing Solution took care of most of my doubts. One only needs to upload Form 16 in pdf and the software takes care of everything else.

Disclaimer: This article provides an overview and general guidance, not exhaustive for brevity. Please refer Income Tax Act, GST Act, Companies Act and other tax compliance acts, Rules, and Notifications for details.