4.8 ★★★★★ Excellence since 2016

4.8 ★★★★★ Excellence since 2016 Home > Income Tax > Help Center > Downloading Form 26AS

Detailed step-by-step instructions for viewing and downloading Form 168 of IT Act 2025 (Form 26AS of IT Act 1961) via the Income Tax India e-Filing Portal, also through TRACES, and net banking. Also, it explains the importance of Form 168 (a.k.a Form 26AS) to have good tax compliance and file your returns correctly.

This document covers

Form 168 (a.k.a Form 26AS) is an important tax document in India, that every taxpayer need to refer at the time of Income Tax Filing, broadly contains the taxes that are paid on your PAN number.

Know more on what are specified financial transactions (aka SFT, aka high value transactions) and their threshold limits @ What are high value transaction limits for Income Tax Compliance?

Form 168 (a.k.a Form 26AS) contains the details of taxes paid and compliance information. Following are the major information accommodated in Form 168 (a.k.a Form 26AS).

Various ways to view / download Form 168 (a.k.a Form 26AS) are as follows and a detailed step-by-step instructions below.

Go to https://www.incometax.gov.in/iec/foportal and click on login. If you don’t have account, please click on register and create an account.

Enter the User Id (PAN / AADHAR / OTHER USER ID). Now click on login.

After login, the following screen will appear. Go to e-File and click Income Tax Return and click on View Form 26AS (Tax Credit) in the drop-down menu.

Click on confirm so that you will be re directed to TDS-CPC (Traces) website to view your form 26AS.

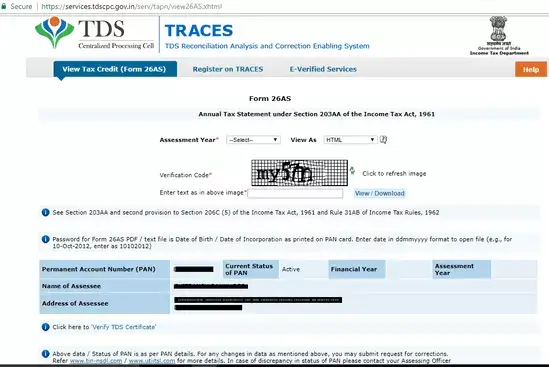

Now you are on the Traces Website (TDS-CPC). Select the box and proceed.

Click on the link View Tax credit (Form 26AS) at the bottom of the page to view form 26AS.

Select the Assessment year, format (HTML / text) in which you want to see your Form 26AS, and click on view /download.

The password for opening your form 26AS is your date of birth (DOB) in ddmmyyyy format. For example, if your DOB is 01-Jul-1974, enter the password as 01071974)

A taxpayer who has internet banking access with a bank authorised by the Income Tax Department to show tax credit can use this facility.

Source: Latest List can be available @ https://contents.tdscpc.gov.in

Form 168 (a.k.a Form AIS) is a comprehensive statement containing details of the financial transactions undertaken by you for a given financial year (FY). Different from Form 168 (a.k.a Form 26AS). Check @ How to View / Download AIS Statement ?

Disclaimer: This article provides an overview and general guidance, not exhaustive for brevity. Please refer Income Tax Act, GST Act, Companies Act and other tax compliance acts, Rules, and Notifications for details.