4.8 ★★★★★ Excellence since 2016

4.8 ★★★★★ Excellence since 2016 Home > Income Tax > Help Center > Annual Information statement

Step-by-step instructions with pictures that show how to use the Income Tax India e-Filing Portal to view or download an Form 168 of IT Act 2025 (Form AIS of IT Act 1961) statement. Explains the significance of the Form 168 (a.k.a Form AIS) statement for good tax compliance and accurate return submission.

This document covers

Form 168 (a.k.a Form AIS) is a comprehensive statement containing details of the financial transactions undertaken by you for a given financial year (FY).

It's an important document that shows all the specified financial transactions and related information in one place. It's vital for every taxpayer to cross check before filing their Income Tax Return.

Know more on what are specified financial transactions (aka SFT, aka high value transactions) and their threshold limits @ What are high value transaction limits for Income Tax Compliance?

List of transactions that the Income Tax Department is keeping track of to create the Form 168 (a.k.a Form AIS) statement. The department is free to alter this list at any moment, but it is in the taxpayers' best interests to have one to begin with.

Form 168 (a.k.a Form 26AS) contains financial transactions that were recorded due to TDS payment by Self, Employer, other Taxpayer, a Business, or a Company.

On the other hand the transactions in Form 168 (a.k.a Form AIS) statement were collected based on the nature and transaction amount that crosses certain threshold from various sources like banks, financial institutions, and the regulatory bodies in India.

The transactions listed in Form 168 (a.k.a Form AIS) alone may not be able to identify taxable income but can arrive at such with the help of additional information from the taxpayer.

One can download their Form 168 (a.k.a Form AIS) statement from Income Tax India e-filing portal using the steps given below. Unlike Form 168 (a.k.a Form 26AS), Form 168 (a.k.a Form AIS) statement can be downloaded from any country.

Go to https://www.incometax.gov.in/iec/foportal and click on login. If you don't have an account, please click on register and create an account.

Enter the User Id (PAN). Now click on login.

After login, the following screen will appear. Go to Services and click on AIS (Annual Information Statement) in the drop-down menu.

Click on Proceed

Now click on AIS

Select AIS and Click on Down arrow button.

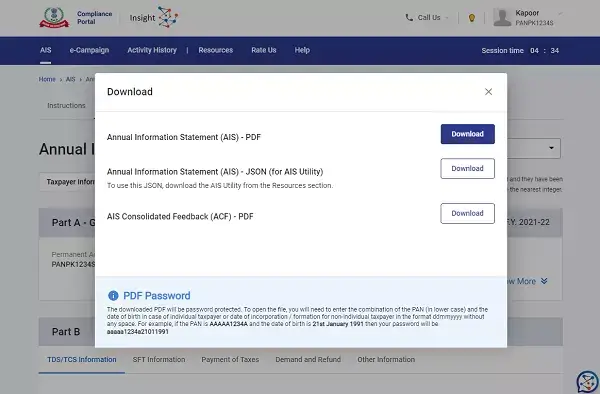

Click on download Option.

The password for opening your form AIS is your PAN (small case) and date of birth (ddmmyyyy) in aaapa1234a21011991 format.

If this was asked by the EZTax Team to process your Tax Filing, please share the same in reply to our email.

Form 168 (a.k.a Form 26AS) is a TDS Credit statement, an important document when filing your taxes. Check @ How to View / Download Form 26AS ?

Disclaimer: This article provides an overview and general guidance, not exhaustive for brevity. Please refer Income Tax Act, GST Act, Companies Act and other tax compliance acts, Rules, and Notifications for details.