4.8 ★★★★★ Excellence since 2016

4.8 ★★★★★ Excellence since 2016 Home > EZTax.in Money > Investments

Making investments to grow your money is essential. Most investments these days carry an amount of risk. Learning from other's mistakes and/or mistake made are important to make wiser decisions. Know top 7 common mistakes in investment in India and how to avoid them.

Investors are prone to making mistakes, especially when they are new. One way to learn is by making those mistakes yourself. However, one can also learn from the mistakes of others and avoid making those mistakes to begin with. Here are 7 common investment mistakes and how to avoid them.

Putting away investing is one of the most common mistakes people make. The excuse is mostly of not having enough time or money to invest. However, one should start investing as early as possible as time is an important factor that helps your investments meet your financial goals.

Investing into something not understanding how the investment works is a common investment mistake. For example, if you are investing in a stock, you should have an idea of the financial health of the company and its future prospects. Otherwise, it is advisable to invest in the equity markets through mutual funds. Even when investing through mutual funds, it is important to invest in the right kind of funds.

For example, mid-cap funds may not be right for the first-time investor with a low risk appetite and a large-cap fund would be more suitable. With time and experience, you can of course expand your investment horizon.

Investments should be made based on logic ad rational decisions and not on your emotions. However, behavioural biases are likely to creep into investing. Most of us tend to get emotionally carried away when an investment is doing well, and panic may set in when investments go wrong. Such emotions may lead us make wrong investment decisions based on impulse.

For example, investing into an apartment for a rental income needs to keep tenant's requirements more than yours.

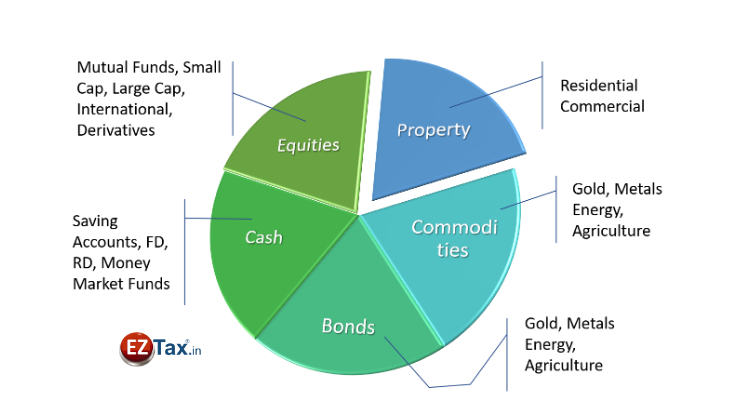

This means that you should not put all your investments in to one asset class or single stock or a certain industry. Understand different asset classes and their risks to balance your portfolio.

Even if a certain stock is performing very well, one should not be tempted to put all their money into that. This is because if the stock crashes, you stand to lose all your money. So, your investments should be properly diversified in various stocks across multiple industries. Same applies if you are investing through the mutual funds route.

Investors would ideally like to get in when the markets are at the lowest and get out when the markets are at the highest. But timing the market is not possible even for the most experienced investors. Trying to do so is one of the worst investment mistakes one can make. As the saying goes, your time in the market is more valuable than trying to time the market. You should always invest with a long-term perspective.

One should never invest in the stock markets hoping to become a millionaire overnight. Stock markets may return more than 10 per cent return per annum, but in some cases the returns can also be negative. Hence, when investing in a stock market it is important to understand that a market will have bull and bear phases and one needs to be prepared to handle it. Also, never invest in the equity markets to meet any financial goal that you have may have in the next 3-5 years as when the markets go down, they may take a while to recover.

Following a tip that is likely to make your money is another major investment mistake to avoid, whether it is coming from a friend or a colleague or even some expert on television. Investing based on any unsubstantiated piece of information is never a wise thing to do. Rather, one should make investment decisions based on thorough research of their own. Remember, if something sounds too good to be true, it actually is.

Not just new investors, even experienced investors tend to make mistakes. Avoiding the mistakes mentioned above will help you become a better investor.

Disclaimer: This article provides an overview and general guidance, not exhaustive for brevity. Please refer Income Tax Act, GST Act, Companies Act and other tax compliance acts, Rules, and Notifications for details.