This document covers

- Conditions to be satisfied for claiming deduction u/s 80GG

- Amount of deduction available u/s 80GG

- Example for Computation

- Form 10BA and its contents

- How to file form 10BA ?

1. Conditions to be satisfied for claiming deduction u/s 80GG

The following conditions needs to be satisfied for claiming deduction u/s 134 of IT Act 2025 (u/s 80GG of IT Act 1961)

- The taxpayer should not be receiving any house rent allowance exempt Schedule III (Table: S. No. 11) of IT Act 2025 (u/s 10(13A) of IT Act 1961) from the employer

- The house should be occupied by the assessee for his own residence

- The expenditure incurred by the taxpayer on rent of any furnished or unfurnished residence should exceed 10% of his total income arrived at after all deductions under chapter VIA

- The taxpayer or his spouse or his minor child or an HUF of which he is a member should not own any house at the place where he ordinarily resides or perform duties of his employment

- If the assessee owns any residence at any place other than referred to above, such residence should not be in occupation of the taxpayer

- The taxpayer should file a declaration in the prescribed form confirming the details of rent paid and fulfilment of other conditions along with income tax return

2. Amount of deduction available u/s 80GG

The deduction will be the least of the following.

- Actual Rent paid (-) 10% of the total income of the taxpayer before allowing the deduction.

- 25% of total income (Gross income-deduction u/s Chp VIA except 80GG)

- 5000 per month

3. Example for Computation

Mr Ram, a businessman, has a gross total income of Rs 460000. He is paying a rent of Rs 12000 per month. What is the amount of deduction available u/s 80GG?

- Actual rent paid (-) 10% of total income: (12000*12)- (10%*460000) = 98000

- 25% of total income: 460000*25%= 115000

- 5000 per month= 60000

As Rs 60000 is least of above, 60000 is the deduction u/s 80GG.

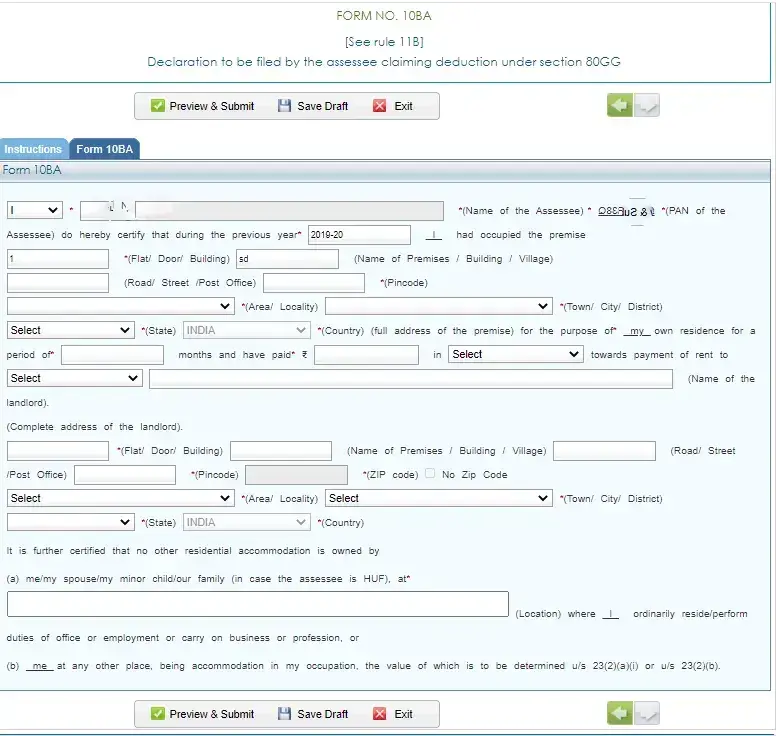

If the taxpayer wants to claim deduction u/s 80GG, he/she needs to submit form 10BA in Income tax e-filing portal as a supporting document. The following are the details in form 10E.

- Name of the taxpayer

- PAN of the taxpayers

- Previous year

- Address of residential house

- No of months

- Mode of payment (Cash/bank/cheque)

- Landlord name and Address

The taxpayer claiming deduction towards rent paid u/s 80GG should submit Form 10BA in Income Tax portal before ITR eFiling. Otherwise rent paid u/s 80GG will be disallowed as deduction

5. How to file form 10BA ?

- Login to https://www.incometax.gov.in/iec/foportal/

- Go to e-file Menu > Income Tax Forms > Form 10BA

- Enter the details requested in the form and click to submit

- The below is the format of 10BA

Sample Form No 10BA

4.8 ★★★★★ Excellence since 2016

4.8 ★★★★★ Excellence since 2016