4.8 ★★★★★ Excellence since 2016

4.8 ★★★★★ Excellence since 2016 Home > GST > Help Center > Geo-Coding under GST

The Goods and Services Tax Network (GSTN) has pushed its new Geo-Coding Service to offer address verification for new and updated registrations. Learn more on how to use.

This document covers

Go to https://services.gst.gov.in/services/login. Enter the User Id (PAN / AADHAR / OTHER USER ID) and Password. Now click on login.

If you haven't updated the GST address with Geo-Coding, you would see a message to update principal place of business with geocoding.

Click on "continue" to update the Geocoded address in Dashboard.

As on Feb 17th 2023, GST has rolledout geo-coding functionality for two states (Delhi, and Haryana). Expected to rollout to other states in near future.

Check to see the current details of geocoded address of your principal place of business. Click on "Update Geocoded Address" button to update to a new geocoding.

Select the "Correct Address" by pointing out in the map given and press "Confirm" button. Latitude and Longitude will be automatically fetched by the system.

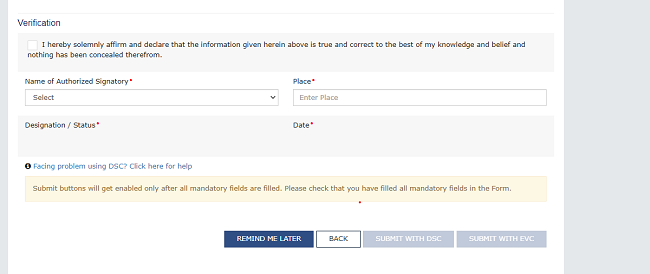

Once in the Verification page, Select the Verification check box, Select the "Name of the Authorised Signatory" and enter the "Place".

Now submit the above information using either DSC or EVC.

Disclaimer: This article provides an overview and general guidance, not exhaustive for brevity. Please refer Income Tax Act, GST Act, Companies Act and other tax compliance acts, Rules, and Notifications for details.