4.8 ★★★★★ Excellence since 2016

4.8 ★★★★★ Excellence since 2016 Home > Income Tax > Help Center > Tax P&L Statement

As more and more people trading in stocks, MFs, futures and options (aka FOs in short), tax P&L statement and/or equivalent statements are needed to prepare IT Returns, at the same time downloading and interpreting such statements is a feat of its own.

To know more refer Taxation on — Futures & Options (FOs) Trading

You can upload your file @ EZTax.in ITR self-service application to populate the data in to your ITR directly.

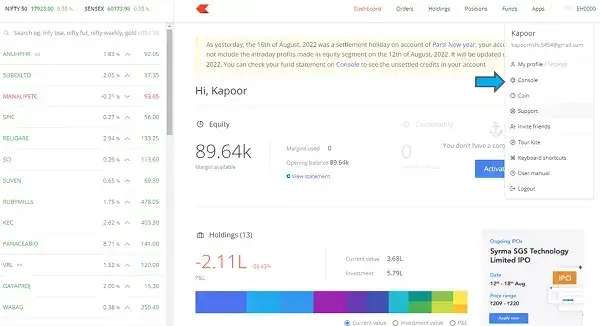

Login to https://kite.zerodha.com/ with the login credentials Once Dashboard Screen Go to top-right side menu Click Console On the Console Welcome Screen Go to Reports Menu (top-right) Click on Tax P&L Select FY 2024-25, from Q1 to Q4 Click on "Download Tax P&L report for all segments" link to download the excel report.

Zerodha: Kindly Go to Tradewise Exits Sheet and Enter the F&O, Currency, Commodity Turnover as per Column I.

If you are using

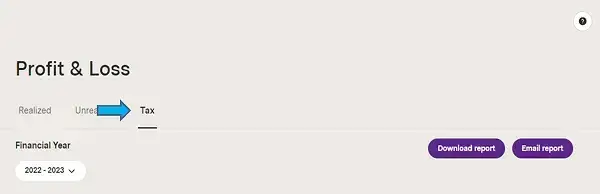

Login to https://login.upstox.com/ with the login credentials (using registered mobile number & OTP On the Welcome Screen Select Reports Click on Profit & Loss option Click on Tax tab (3rd tab) Select FY 2024-25 Download Report in Excel.

Upstox: Kindly go to F&O, Currency and Commodity Sheet and take the turnover as per Column U

If you are using

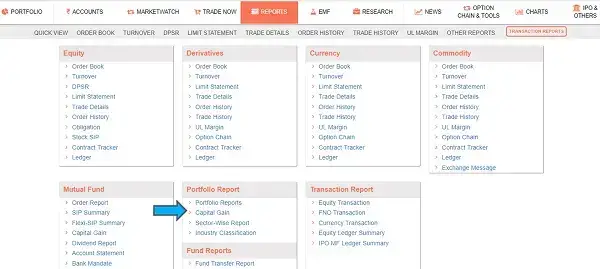

Login to https://www.sharekhan.com/ using credentials Select fifth tab "Reports" Click on "Capital Gain" link under "Portfolio Report" Section Now you see "Capital Gain Report" page, Select FY 2024-25 (right side) Click on Green color excel icon to download the data in excel form.

After downloading the sharekhan portal's tax P&L statement in excel Go to futures, options, commodity*, currency* tabs & add all the turnover and enter the amount below.

If you are using

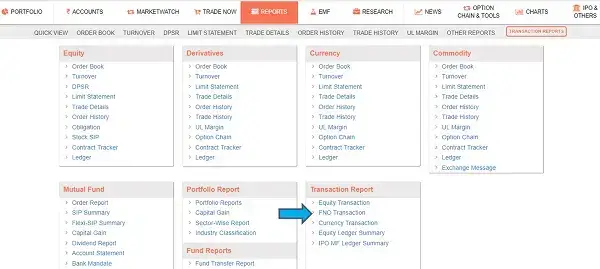

Login to https://www.sharekhan.com/ using credentials Select fifth (5th) tab "Reports" Click on "FNO transaction" link under "Transaction Report" Section Click on "TAX P&L" link in the 2nd level menu (last one) Now click on "TAX P&L DETAIL" Select "FNO" for Segment dropdown FY 2024-25 & Click "SHOW" Now Click on excel icon (2nd small icon) to download the tax P&L report in excel form.

After downloading the sharekhan portal's tax P&L statement in excel Go to futures, options, commodity*, currency* tabs & add all the turnover and enter the amount below.

If you are using

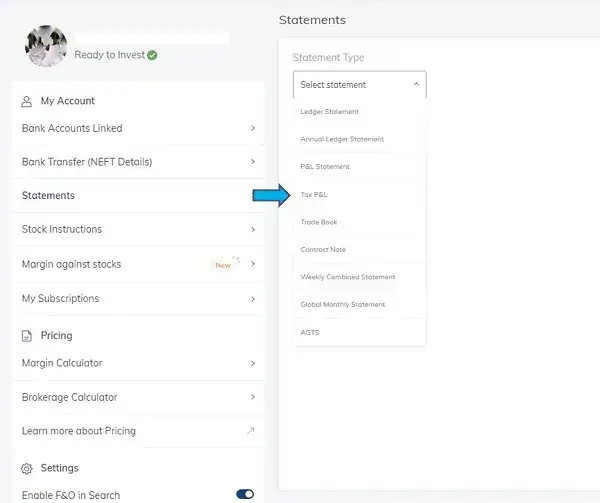

Login to https://www.paytmmoney.com/ using Credentials Click on "Stocks" menu Enter passcode Go to Top-Right User menu or your photo Select "Statements" on the left side Select "Tax P&L" under "Statement Type" dropdown Select FY 2024-25 Click on Download button to download the Equity data in excel form.

After downloading the Paytm portal's tax P&L statement in excel Go to futures, options, commodity*, currency* tabs & add all the turnover and enter the amount below.

If you are using

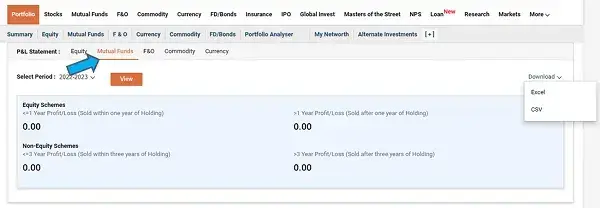

Login to https://secure.icicidirect.com/customer/login Click on " Portfolio " tab after Login Click on " P&L Statement " under Statements & Reports Select "Equity" Select Period FY 2024-25 Click on View Download " Excel " (right hand side)

a. Download ICICI Options and Option Plus Tradebook for F&O, Commodities and Currency and filter the Sell Transactions. Sum the Sell value and enter the amount in Sell Value of Options.

b. Download the Profit and Loss report and take the absolute sum of Gains and losses and enter the amount.

If you are using

Login to https://secure.icicidirect.com/customer/login Click on " Portfolio " tab after Login Click on " P&L Statement " under Statements & Reports Select "Mutual Funds" Select Period FY 2024-25 Click on View Download " Excel " (right hand side).

a. Kindly download ICICI Options and Option Plus Tradebook for F&O, Commodities and Currency and filter the Sell Transactions. Sum the Sell value and enter the amount in Sell Value of Options

b. Kindly download the Profit and Loss report and take the absolute sum of Gains and losses and enter the amount

If you are using

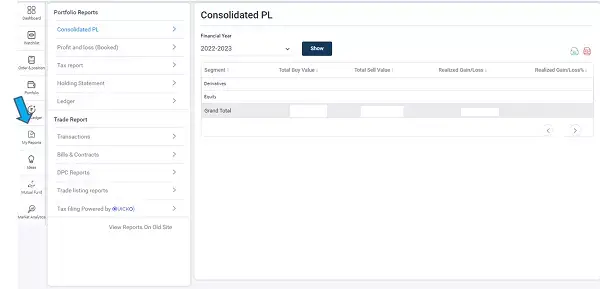

Login to https://login.5paisa.com/ using credentials on the left side panel menu, click on "My Reports" Click on Tax report under Portfolio Reports (left menu) Select Segment "Equity" / "Derivatives", Select "ALL" for List of traded instruments drop-down, Select FY 2024-25 Click on Green color Excel icon to download the report in Excel form.

After downloading the 5paisa portal's tax P&L statement in excel Go to futures, options, commodity*, currency* tabs & add all the turnover and enter the amount below.

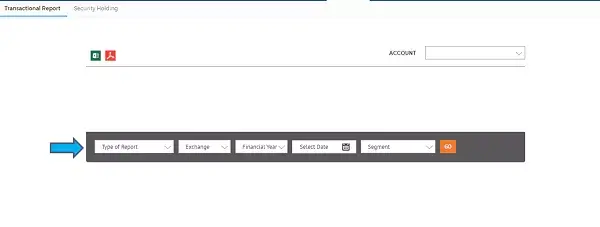

Login to https://trade.angelbroking.com/ using the credentials Click Reports in Welcome Screen Select Type of Report "P & L Summary" Select "All" Select FY 2024-25 Click "Go" Click on Excel icon (green) at To-Left side of the screen Use the Excel for upload and to populate trade data.

After downloading the 5Paisa portal's tax P&L statement in excel Go to futures, options, commodity*, currency* tabs & add all the turnover and enter the amount below.

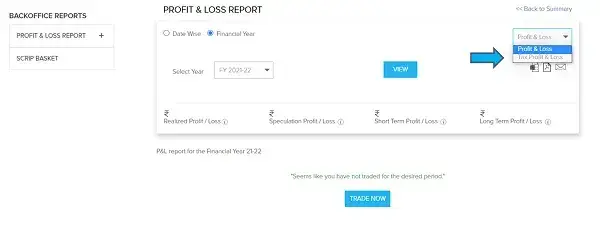

Login to https://www.reliancesmartmoney.com/ using the credentials On the Welcome Screen Go to top right corner and click on the user menu Click on Reports On the left side menu Click on Historical Reports to expand Click on Profit & Loss Report at the end Select FY 2024-25 Select "Tax Profit & Loss at the right-side dropdown Click View Click on excel symbol on the right-side to download the excel report.

After downloading the reliance portal's tax P&L statement in excel Go to futures, options, commodity*, currency* tabs & add all the turnover and enter the amount below.

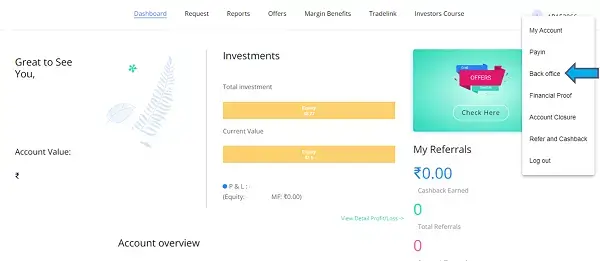

Goto https://bot.aliceblueonline.com/ Login with Credentials After Login Go to top-right user menu Click Back Office option Click on "Click here to Login" (blue button) Select the FY 2024-25 and click on Reports Click on "Global P&L Report" Here in the Global P&L Statement Section, click "View" Click on Excel at the left-middle of the screen to download the excel and use.

After downloading the alice portal's tax P&L statement in excel Go to futures, options, commodity*, currency* tabs & add all the turnover and enter the amount below.

Go to CAMS Online portal Select Period as Previous Financial Year (for FY 2024-25), enter email, PAN, download option, Select 'All Mutual Funds', JSON Format, give a password. Once you received an email, use the downloaded JSON file and upload using Browse button.

NOTE : CAMS Online is not differentiating Equity vs non-equity (Debt Funds etc.), if you have traded any non-equity funds, after uploading and saving data, under MANAGE section, edit the corresponding entry and change from Equity to Debt Fund and Save.

If you are using

Go to https://login.axisdirect.in/ and Login with Credentials After Login Go to Portfolio Reports and click on Capital gains and loss Statement Select the Financial Year or Custom Dates and click on Go Click on Download and select the format as xlsx and click on download consolidated report.

After downloading the Axis Direct portal's tax P&L statement in excel Go to futures, options, commodity*, currency* tabs & add all the turnover and enter the amount below.

Go to https://mfs.kfintech.com/ Select Period from Previous Financial Year (24-25)/ 2nd Last Financial year(2023-24) Enter email Id, PAN, select all mutual funds an select the statement format in pdf/excel Give the password for the file and click on submit.

After downloading the KFIN portal's tax P&L statement in excel Go to futures, options, commodity*, currency* tabs & add all the turnover and enter the amount below.

Go to https://www.binance.com/en Login with Credentials After Login Click on Transaction History under Wallet Click on Generate All Statements Select the date from 01st Apr 2024 to 31st Mar 2025, and click on Generate Once the file is generated, download and share the file.

After downloading the Binance portal's transaction history or Tax P&L statement in excel Filter / Sort the coin / asset wise, match the volume sold with bought quantity for every coin and determine the correct sale value and purchase value.

Once the sale and purchase values are determined, copy the same vertically and paste into EZTax Crypto excel.

After downloading the Fyers Global P&L Report or Tax P&L Statement in excel Go to Realized Profit/loss and take the absolute sum of profits and losses

Go to https://web.dhan.co/ and login with mobile number and password Click on your image at the extreme top right of the Page and go to My profile on Dhan Click on Statements & Reports at the left side of Page Click on Generate Statement for and select Profit & Loss Statement and select the custom time period and give the date from 01/04/2024 to 31/03/2025 and click on send email at the bottom of the page.

After downloading the Dhan Global P&L Report or Tax P&L Statement in excel Go to Realized Profit/loss and take the absolute sum of profits and losses

Login to https://www.indiainfoline.com/ and click on Login to trade with Client id and password Go to My account >> Portfolio>>P/L Summary/Realized Select the Product as Cash/ Commodity/Currency/F&O/IIL commodity If the product type is cash or F&O, Select the report as year wise and select the year range (ex: FY 2024-25) and click on show. (OR) If the product type is Commodity/Currency/IIL Commodity, Select the From date and To date and click on show. Click on Download Excel.

Go to https://trade.yesinvest.in/ and login with user Id, password and PAN Go to Reports (or 'Back Office Menu' in case you are using a mobile) and click on Profit and Loss Statement Select the From date and To date and segment as "All" and click on view Click on Download and download CSV.

Login to https://groww.in/ using your email Id and Password and enter the OTP and PIN Click on My profile (your Photo) at the extreme right side of the screen and go to Reports Click on capital Gains-Stocks for Equity+Intraday, Capital gains-Mutual Funds for Mutual Funds, Tax Report- F&O for Derivatives under Tax Filing Tab Choose Financial year and click on Download The file will be downloaded in xlsx format

Groww: Kindly go to F&O tab and take the turnover

If you are using

Login to https://ntrade.hdfcsec.com/ using your email Id and Password Go to Portfolio >>> Statements >>> Capital Gains Select the Financial year as "2024-25", Asser type as "All" and click on submit Download the statement in Excel

Login to the broker portal Go to Reports Menu Click on tax P&L Statement option Select for FY 2024-25 period Select futures, options, commodity, currency Download the report in Excel form.

Above is a generalised statement but if you have a scenario that need to be documented here, please share the information to support@eztax.in

Based on the broker statement, after downloading the other portal's tax P&L statement in excel Go to futures, options, commodity*, currency* tabs & add all the turnover and enter the amount below.

Disclaimer: This article provides an overview and general guidance, not exhaustive for brevity. Please refer Income Tax Act, GST Act, Companies Act and other tax compliance acts, Rules, and Notifications for details.