4.8 ★★★★★ Excellence since 2016

4.8 ★★★★★ Excellence since 2016 Home > Income Tax > Help Center > How to Register in Income tax portal with TAN ?

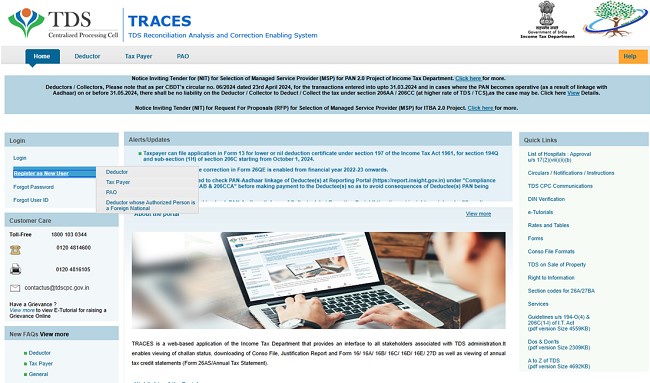

Filing the TDS returns requires Income Tax Portal account creation. The taxpayers cannot directly register in Govt. Income Tax portal using the TAN, hence to go through Traces website.

Learn more on how to create an account in different scenarios.

This document covers

Filing the TDS returns requires Income Tax Portal account creation. The taxpayers cannot directly register in Income Tax portal i.e, https://eportal.incometax.gov.in using the TAN. The tax deductor's or collectors are required to go through the Traces website also to create account in Income tax portal using TAN.

If the tax deductor or collector don't have traces account, they need to go through below steps to create account in Income Tax portal using TAN

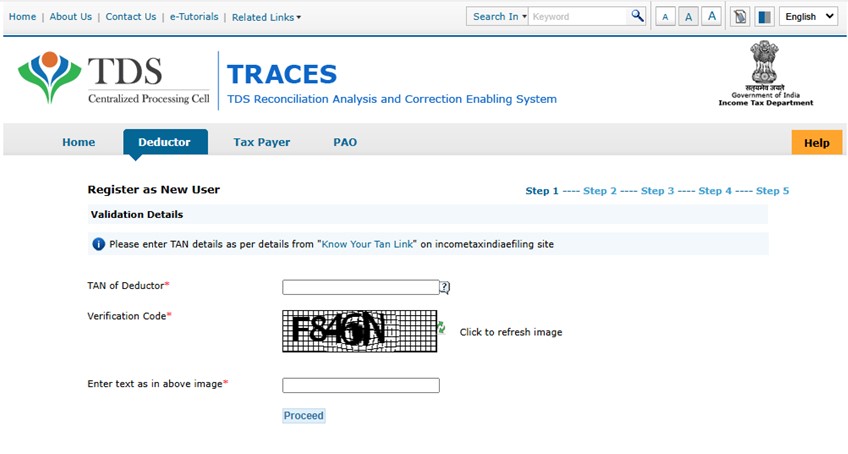

Enter the TAN of the deductor and enter the verification code and click on proceed.

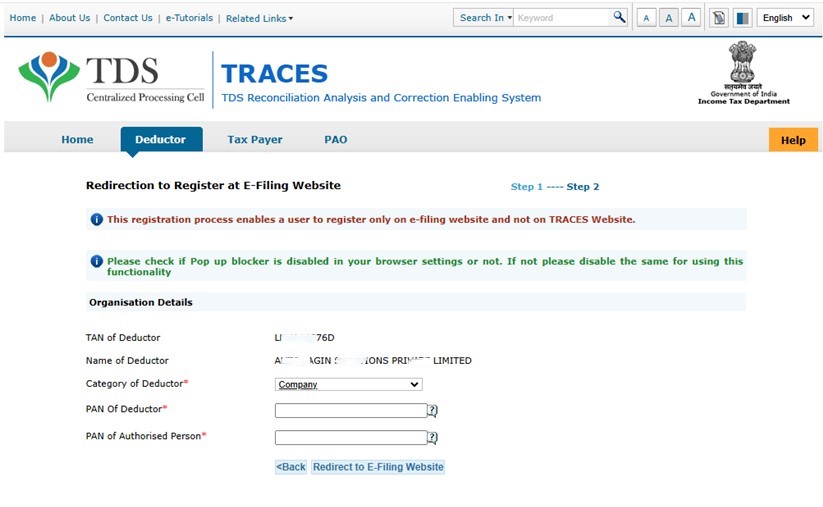

Select the category of the deductor and enter the PAN of Deductor and PAN of Authorized person and click on redirect to e filing Website

NOTE: Make sure your Pop up blocker is disabled in your browser

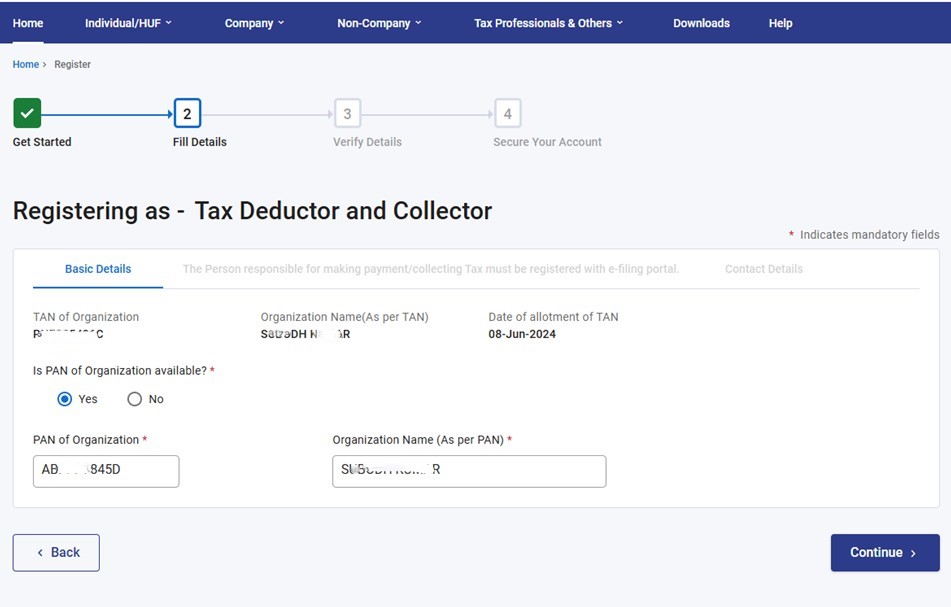

It will redirect you to Income Tax portal. Enter the PAN and Name as per PAN and click on Continue

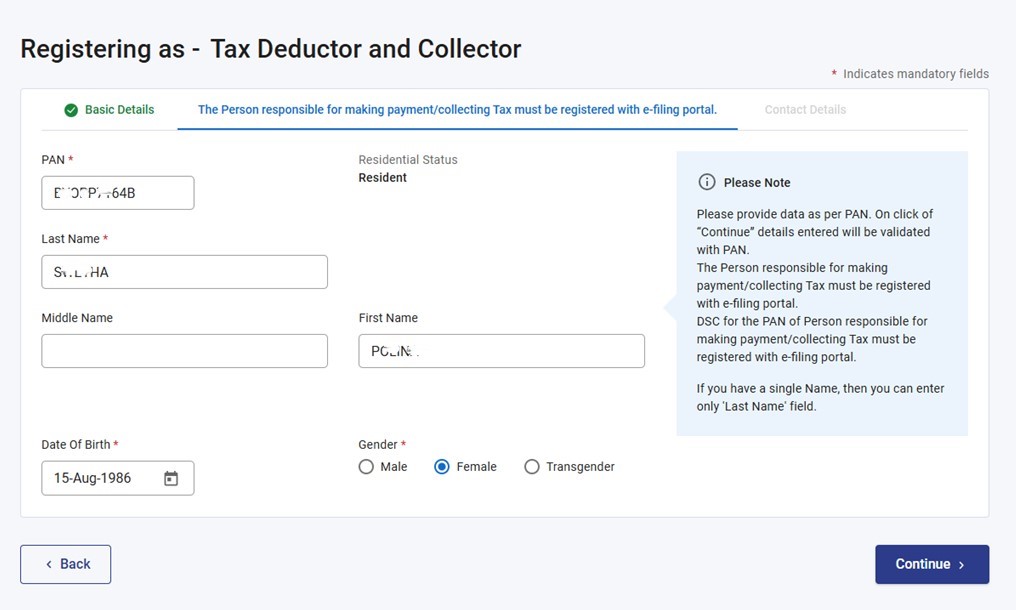

Enter the PAN , First Name, Middle Name and Last name and Date of Birth and Gender of Authorized Person and Click on Continue

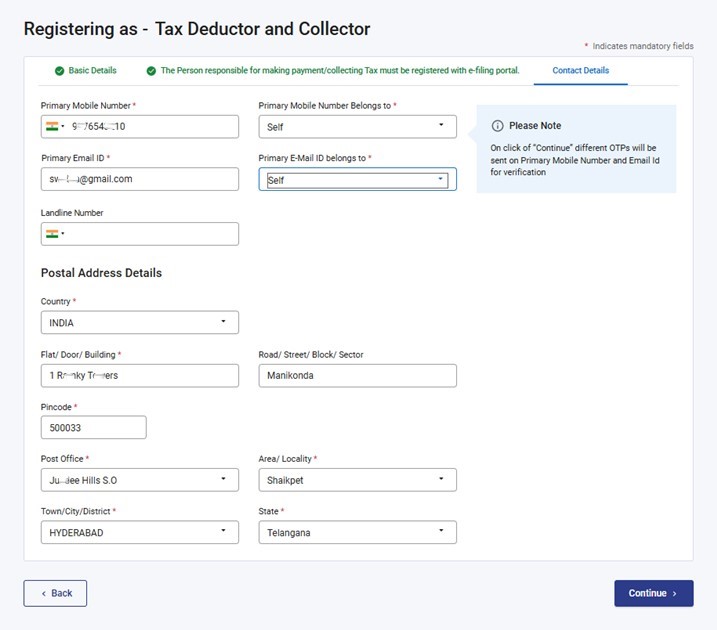

Enter the Mobile Number, Email Id and Address of the Authorized Person and click on Continue

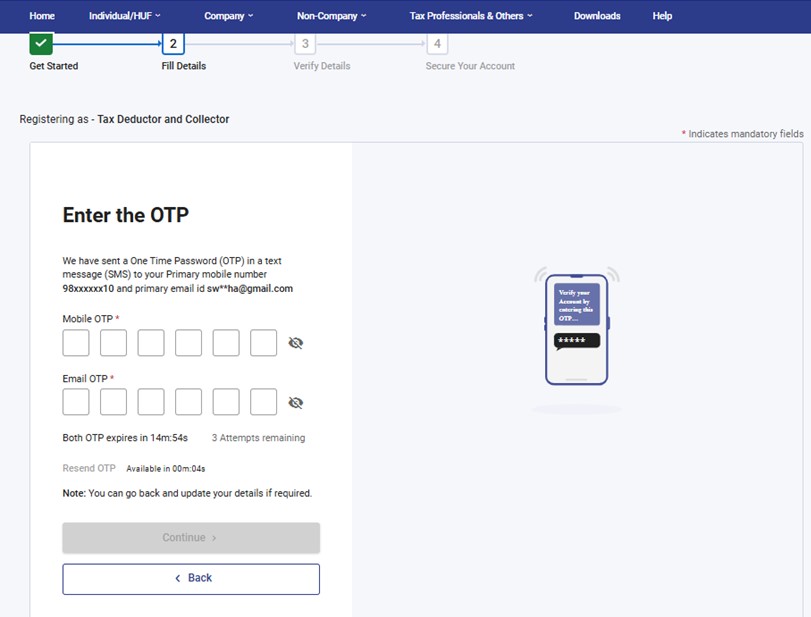

Enter the OTP's received on Mobile and email and click on Continue

After filling the total form, click on Continue, then It will pop-up a window, it will ask the tax deductor/collector confirmation to receive the OTP's given e-mail id and mobile number, If the given e-mail and mobile number are correct then tax payer should click on Confirm or else click on Back.

Set the password for login of ITD portal.

Registration is completed. Now Login to https://eportal.incometax.gov.in/iec using your PAN and Password and Go to Pending Actions >>> Worklist >>> Click on Approve

Now you can login to Income Tax Portal with TAN and Password you kept

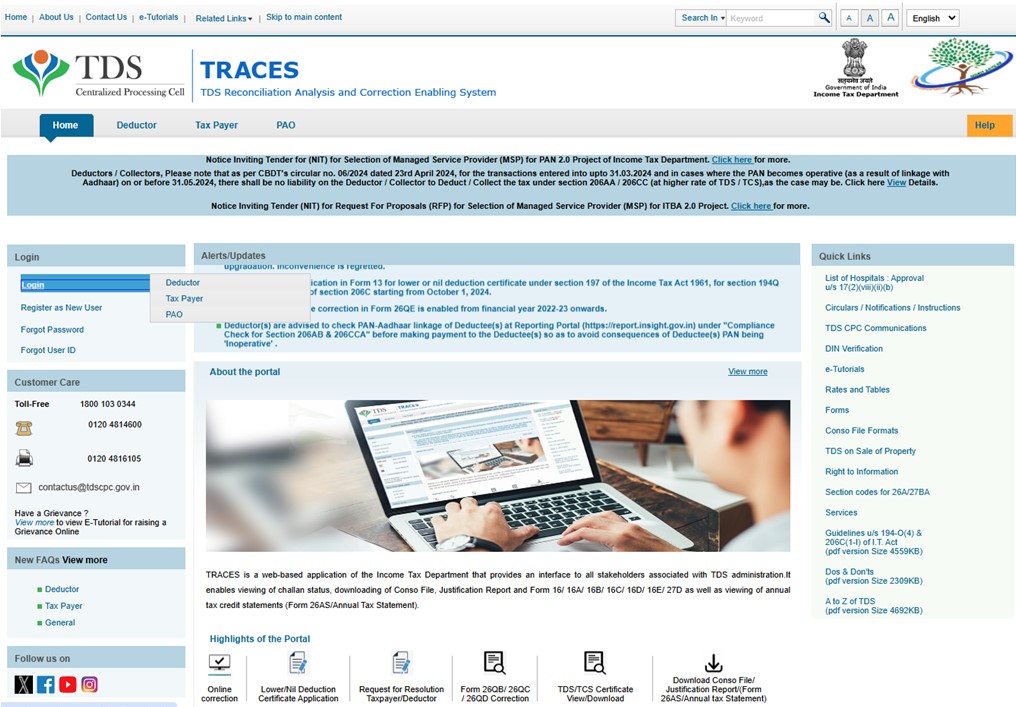

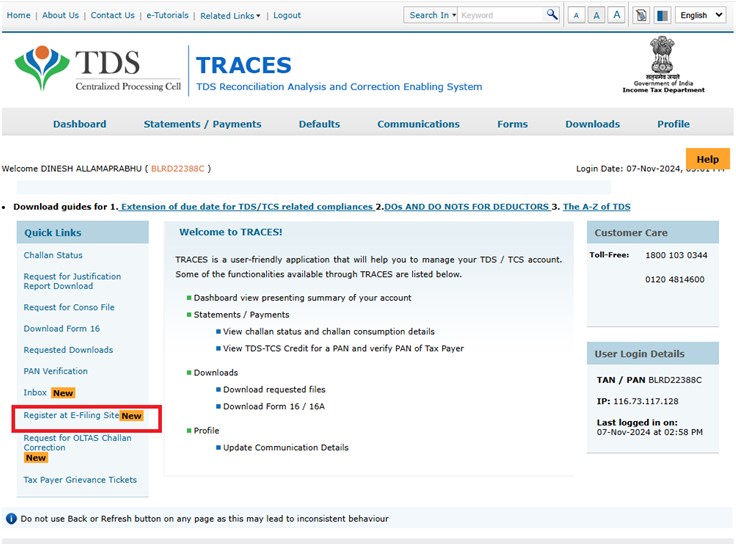

If the tax deductor or collector is already having Traces Account, the tax deductor or collector is required to follow below instructions

Once logged in, Click on Register at E Filing Site on the left hand side of the page

It will redirect you to Income Tax portal . Repeat the same steps from Point 4 to Point 11 as mentioned above (A- If Traces account Not activated)

Disclaimer: This article provides an overview and general guidance, not exhaustive for brevity. Please refer Income Tax Act, GST Act, Companies Act and other tax compliance acts, Rules, and Notifications for details.