4.8 ★★★★★ Excellence since 2016

4.8 ★★★★★ Excellence since 2016 Home > Apps > Income Tax Filing (ITR) AppLast Updated: Feb 26th 2026

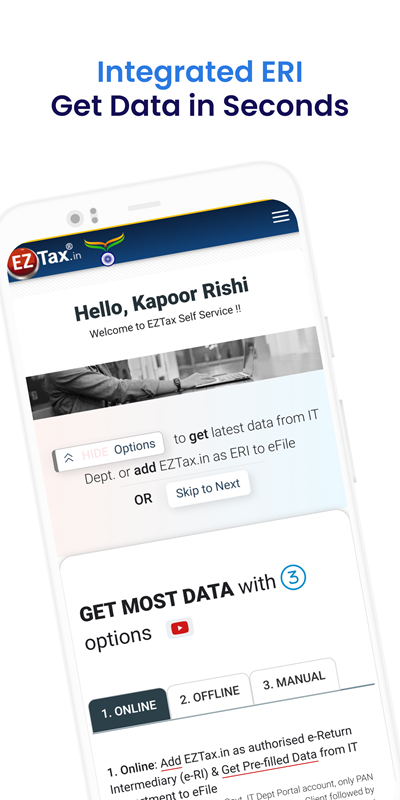

India's 1st fully functional AI-enabled Income Tax (ITR) Filing App with ERI integration to e-file ITR-1/2/3/4, download from Android Play Store, Apple iOS App Store, Microsoft Windows Store

Online tax questionnaire for any income level, numerous Form-130s of IT Act 2025 (Form-16s of IT Act 1961), agriculture income, investments, tuition income, commissions, house property, futures & options (F & Os), capital gains, business revenue, foreign income, assets, arrears, pension, deductions. We made filing easy and valuable! Create and eFile your Original, Revised, Belated, Updated, or Defective ITR with free to premium options.

EZTax.in Income Tax Filing (ITR) App does everything a PC browser does but more conveniently. One subscription works on PC browser and Android app. Download EZTax.in Income Tax Filing Android App now

With EZTax self-service tax efiling, you no longer require a tax professional. The only program in India that offer step-by-step advice through EZHelp to make filing easy is EZTax.

Find deduction and exemption advice on the screen. No more searching blogs for limits or tax knowledge. Yet, it's free*.

Express filing is a new tax filing option that asks questions based on your profile, such as salaried employee or trader. It's that EZ (easy)!

Select your profile, EZTax will refine your questionnaires for you.

Get most of your data straight from the IT department to cut down on data entry. You can still add more income or deduction forms and change the information before e-Filing.

Upload Form 130 (a.k.a Form 16) or enter your data directly in EZTax portal, add any number of salaries in a financial year.

Introducing EZTax Tax Optimizer, to save on taxes and increase the potential investment return. Per independent study* assesses on an average could save Rs. 10,000 or more on their taxes.

EZTax made it so simple that it will build a complex what-if scenario in real-time to show the current refund and new refund possible after recommendations for the coming year.

EZTax carries experience, intent to help you get peace of mind. Creative Audit, a smart feature help you in knowing the potential filing issues now to get you peace of mind you rightly deserve.

Allows you to fix the problem or ignore the alerts before filing your taxes.

Most people find taxes confusing. The EZTax tax summary page displays your income, deductions, exemptions, and other information.

Allows you to choose whether to fix the problem or ignore the alerts before you file your taxes.

We are by far the fastest e-Filer in the market today in India. Once prepared, takes just a few seconds to upload your return!

Once Filed, you can download your customized ITR Report in PDF format along with email communication with reminders.