4.8 ★★★★★ Excellence since 2016

4.8 ★★★★★ Excellence since 2016 Home > Income Tax > Help Center > Re-issue of Refund

Detailed instructions on how to request re-issuing the Income Tax Refund from income tax india e-filing gov web site using a new bank account number, IFSC code, postal address.

Explains the detailed procedure and ways to re-trigger the Refund process by a submitting Refund Re-Issue.

Useful process to add new bank information, or changes to the existing (primary) bank account information due to postal check un-delivery, wrong bank information and/or other reasons that are stopping you to get the refund after your ITR eFiling. Also can be used after resolving PAN not linked to the bank account, PAN name is not matching with the name in bank account

This document covers

Go to https://www.incometax.gov.in/iec/foportal and click on login. If you don’t have account, please click on register and create an account.

Enter the User Id (PAN / AADHAR / OTHER USER ID). Now click on login.

After login, the following screen will appear. Go to Services and click on Refund Re-issue in the drop-down menu.

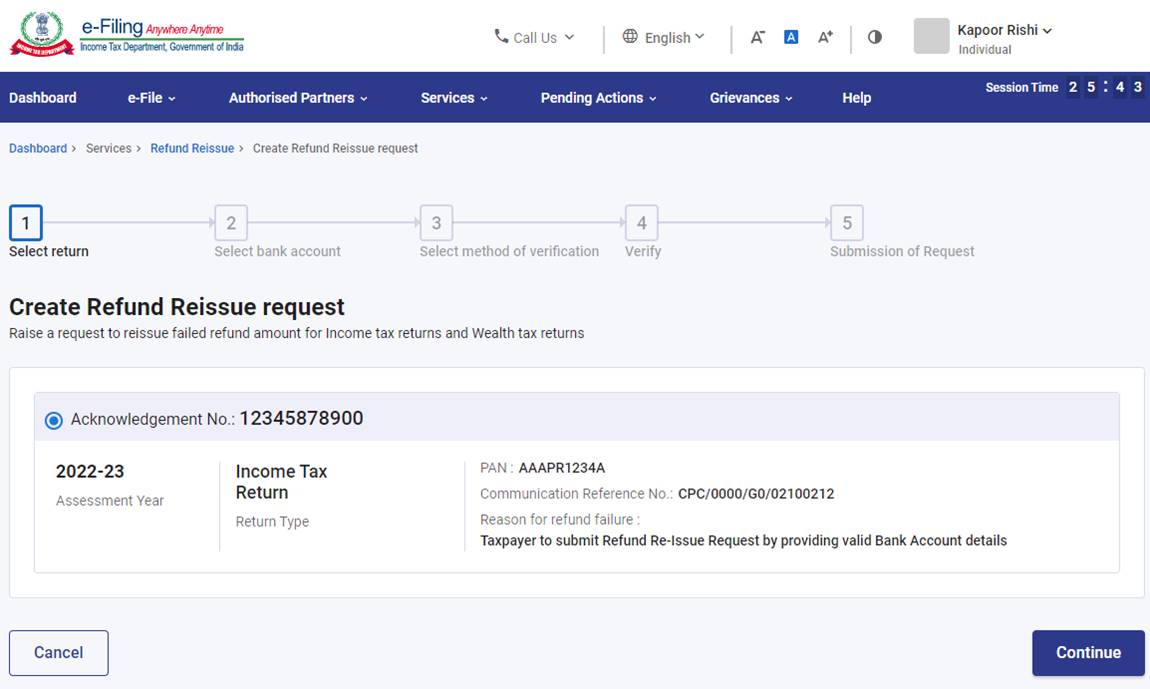

Click on Create Refund Re-issue request

Click on acknowledgement number of a particular assessment year that has a refund issue.

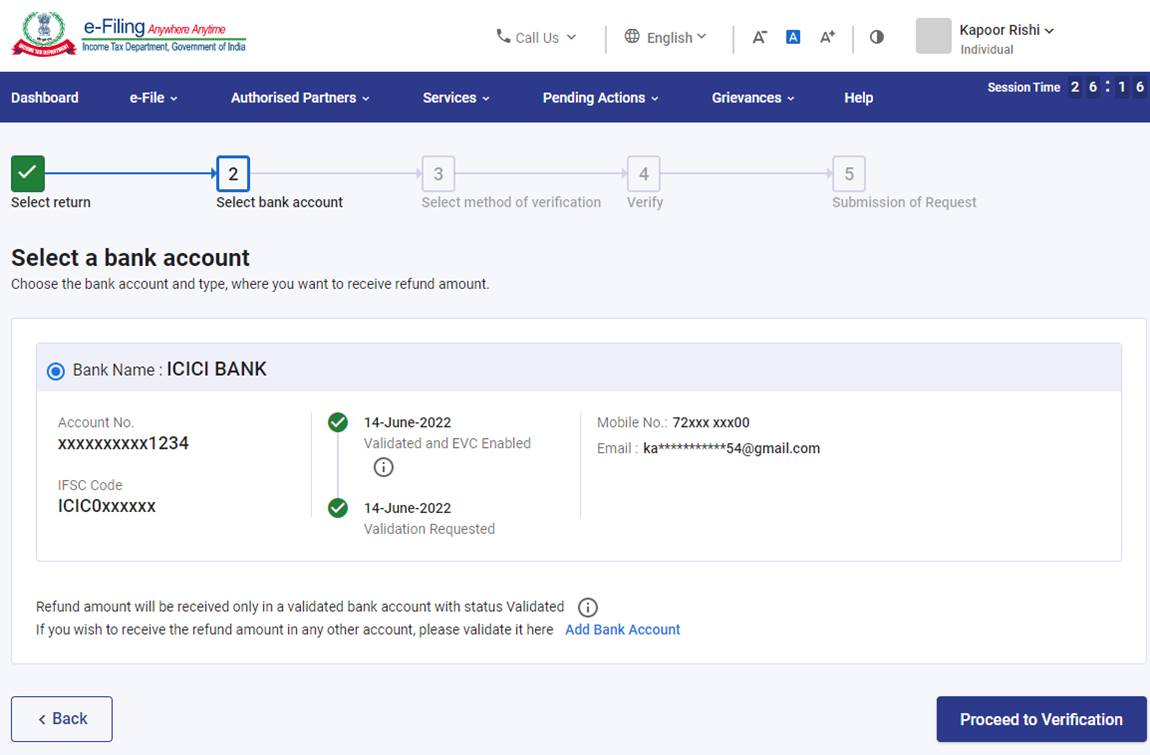

Click on Bank Name of a particular assessment year that has a refund issue.

The Bank account should be added, prevalidated and nominated for refund in profile section

Taxpayer need to enter OTP received to given Aadhar mobile Number and click on Validate.

Once submitted, ITD will process taxpayers request and refund credits to the given bank account.

Processing of Refund Re-issue request vary based on multiple factors on whether the bank is active, the PAN is linked with the Bank Account, and the mobile number given is updated in the bank account. Generally speaking the Refund Re-issue Request Processing Time is around 2 wks or 14 days.

In case the refund is not deposited in the bank account, advised to visit the portal and contact ITD customer service.

If you need any assistance on Refund Re-issue, Refund Tracking and/or notice handling use EZTax.in Services.

Disclaimer: This article provides an overview and general guidance, not exhaustive for brevity. Please refer Income Tax Act, GST Act, Companies Act and other tax compliance acts, Rules, and Notifications for details.