This document covers

- Types of Deduction in Disability

- Section 80DD: Deduction in respect of Maintenance including medical treatment of a dependent disabled

- Who can claim the deduction?

- Amount of Deduction

- Payments qualified for deduction u/s 80DD.

- Meaning of Dependant

- Section 80U: Deduction in case of Person with disability

- Who can claim the deduction?

- Amount of Deduction

- Meaning of Disability

- Filing of Income Tax Returns

- Medical authority for certifying autism, cerebral palsy, multiple disabilities & other disabilities for claiming

- Required details to file Form 10IA in Income Tax portal

1. Types of Deduction in Disability

The Income Tax Act 1961 provides for the deductions in respect of disabilities. The persons who are suffering with disabilities can claim tax deductions as per Income Tax Act. The following sections under Income Tax Act deals with disability

- Section 80DD : Deduction in respect of Maintenance including medical treatment of a dependent disabled.

- Section 80U : Deduction in case of Person with disability (Self disability)

2. Section 80DD: Deduction in respect of Maintenance including medical treatment of a dependent disabled

A. Who can claim the deduction?

Any Resident individual or HUF can claim the deduction u/s 127 of IT Act 2025 (u/s 80DD of IT Act 1961).

NOTE: Non-Residents cannot claim the deduction u/s 80DD

B. Amount of Deduction

The maximum deduction allowed u/s 80DD is as follows.

- Normal Disability (Less than 80%) – Rs 75,000

- Severe Disability (80% or more disability) – Rs 1,25,000

C. Payments qualified for deduction u/s 80DD

- Any amount incurred for the medical treatment including nursing , training and rehabilitation of a dependant person with disability (or)

- Any amount paid or deposited under a scheme framed in this behalf by the LIC or any other insurer for the maintenance of a dependant person with disability.

D. Meaning of Dependant

- In case of individual : Dependant means the following persons who are wholly or mainly dependant on such individual and not claiming deduction u/s 154 of IT Act 2025 (u/s 80U of IT Act 1961)

- Spouse

- Children

- Parents

- Brothers and Sisters

- In case of HUF : Dependant means any member of HUF who is wholly or mainly dependant on such HUF and not claiming deduction u/s 80U.

3. Section 80U : Deduction in case of Person with disability (Self disability)

A. Who can claim the deduction?

Any Resident individual can claim the deduction u/s 80U.

NOTE: Non-Residents cannot claim the deduction u/s 80U

B. Amount of Deduction

The maximum deduction allowed u/s 80U is as follows.

- Normal Disability (Less than 80%) – Rs 75,000

- Severe Disability (80% or more disability) – Rs 1,25,000

4. Meaning of Disability (80DD and 80U)

Disability includes the following

- Blindness

- Low Vision

- Leprosy Cured

- Hearing Impairment

- Locomotor’s disability

- Mental retardation

- Mental illness

- Autism

- Cerebral Palsy

- Multiple disability

5. Filing of Income Tax Returns

- The Taxpayers (individual or HUF) are required to file income tax returns to claim the deduction u/ s 80DD or 80U

- The taxpayers are required to get the certificate in Form 10IA from Medical Authority to claim deduction u/s 80DD or 80U

- NOTE: The taxpayers are required to get the fresh certificate after the expiry of the period mentioned in original certificate.

- W.e.f FY 2022-23, the taxpayers are required to file Form 10IA in Income Tax portal for claiming deduction u/s 80DD or 80U on or before the due date of filing income tax returns.

- The deduction u/s 80DD or 80U can be claimed only if the taxpayer opts for the Old Tax Regime.

NOTE - 1:

W.e.f FY 2023-24, the taxpayers who are claiming deduction u/s 80DD are required to report the following details in the Income Tax Return.

- Dependent Type — Spouse/ son/Daughter/Father/Mother/Brother/Sister

- Aadhaar number of Dependant

- PAN number of Dependant

- Form 10IA Acknowledgement Number

- Date of Filing Form 10IA

- UDID (Unique Disability Identity Card) Number

NOTE - 2:

W.e.f FY 2023-24, the taxpayers who are claiming deduction u/s 80U are required to report the following details in the Income Tax Return.

- Form 10IA Acknowledgement Number

- Date of Filing Form 10IA

- UDID (Unique Disability Identity Card) Number

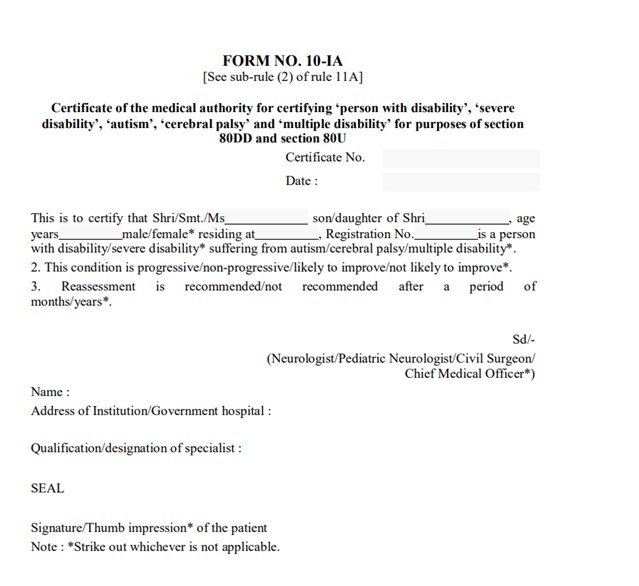

6. Medical authority for certifying autism, cerebral palsy, multiple disabilities & other disabilities for claiming u/s 80DD and 80U

The following medical authorities are eligible to issue Form 10IA for the purpose of claiming deduction u/s 80DD and 80U.

- A Neurologist having a degree of Doctor of Medicine (MD) in Neurology

- A Paediatric Neurologist having an equivalent degree in case of children

- A Civil Surgeon in a Government hospital

- Chief Medical Officer in a Government hospital.

The format of Form 10IA issued by the above officers should be as follows.

7. Required details to file Form 10IA in Income Tax portal

- Form 10IA certificate number

- Date of certificate

- Name of Medical Authority issuing certificate

- Address of Institution/Government hospital

- Qualification/designation of specialist

- Name of the Patient, Father’s Name and address

- UDID (Unique Disability Identity Card) number, if available, starting from AY 2024-25

4.8 ★★★★★ Excellence since 2016

4.8 ★★★★★ Excellence since 2016