Authored by COE Team, EZTax

Last Reviewed: Mar 03rd 2026

This document covers

- Background

- How to prepare Income Tax Returns with Cryptos?

- Reporting of Crypto Income

- Taxability of Crypto Income

- Crypto data preparation from various exchanges

- Binance Crypto Instructions

- WazirX Crypto Instructions

- Zebpay Crypto Instructions

- CoinDCX Crypto Instructions

- Coin Switch Crypto Instructions

- How gains are calculated - an example?

- When to report Crypto income under Foreign Assets?

- What to consider when paying & preparing TDS Return for Crypto Sale?

- Practical Challenges with Crypto Taxation

- FAQs

1. Background

A cryptocurrency (aka crypto) is a digital or virtual currency designed casually and later became popular, used as a currency in certain parts of the world, to buy things like a typical physical currency (Indian Rupee) do. Govt of India, CBDT (Central Board of Direct Taxes) coined as "VDA" (virtual digital asset) to encapsulate cryptos, and other digital currencies along with NFTs (non-fungible token).

Starting from FY 2022-23, Crypto is considered as a "special asset" where the tax rate applicable would be 30% without indexation, without expenses (including mining expenses), without set-off against any income within the year (including the crypto income), and without carry forward losses to future years.

Except it is considered for taxation in India, for all other purposes, cryptos / VDAs / NFTs are un-regulated, un-recognised assets in India.

Refer more on Cryptos @ Crypto Tax Help Center

2. How to prepare Income Tax Returns with Cryptos?

Before start preparing taxes from crypto income / activity, one need to prepare the crypto income for reporting and/or tax computation. Also, et times, a foreign born crypto income need to be reported under 'Foreign Assets' schedule.

Finish in 7 mins

Free & Paid Plans

★★★★★

2.A. Reporting of Crypto Income & how to prepare data

Important things to consider when reporting the Crypto Income for income tax filing. Also refer the below table to understand who should file taxes from the perspective of crypto income or activity.

- Jurisdiction:

Determine whether the exchange is in India or outside India? You may check based on the registered office of the company / firm.

- Tax Residency Status:

Determine whether you are a tax resident of India or NRI? You may use Tax Residency Status Calculator

- Trading Data:

Get the Trade History * (Transaction Statement) from the Exchange website for FY 2022-23 (from 1st Apr 2022 to 31st Mar 2023). The data need to be copied into the EZTax template to upload to compute taxes.

Few of the exchange / broker instructions are listed below.

2.B. Taxability of Crypto Income

Table to identify who should pay, file taxes, and report crypto assets.

| Tax Residency Status? | Crypto Exchange Jurisdiction* (Indian/Foreign)? | Crypto Taxability? | Need to report the assets ? | File ITR in India ? |

|---|

| Resident (ROR) | Indian | Taxable | Yes | Yes |

| Resident (ROR) | Foreign | Taxable | Yes | Yes |

| Non-Resident (NRI) | Indian | Taxable | Optional | Yes |

| Non-Resident (NRI) | Foreign | Non-Taxable | No | No |

* Statement names may differ based on the Exchange / Broker / Intermediary

2.C. Crypto data preparation from various exchanges

There are 1000's of crypto intermediaries or exchanges in the world, but we choose few prominent exchanges to provide data preparation instructions. The remaining would be as similar as the instructions given.

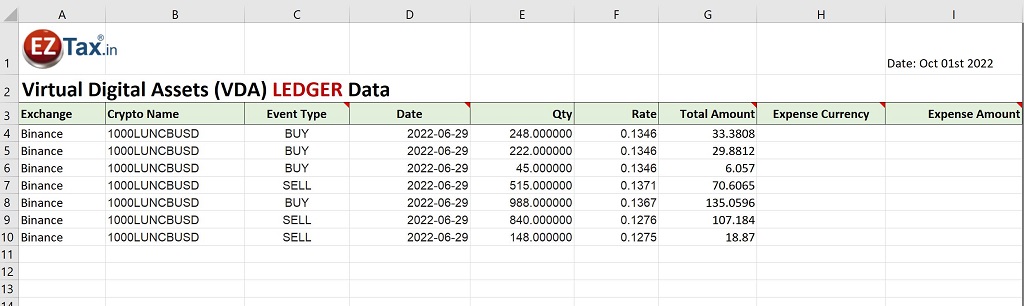

Crypto / VDA Ledger Excel Sample Data from EZTax.

* Rate & Total Amount can be in their respective stable coin currency or real currency. EZTax will convert the 'Total Amount' column whose cryptos backed with 'USD', 'GBP', 'EURO', 'YEN', 'USDT', 'USDC'. For remaining currencies, these two columns to be converted into INR before uploading.

2.C.i. Data preparation instructions for Binance

How to download Trade History from Binance ?

- Login to https://www.binance.com/en

- Go to Orders on the top right side of page.

- Select the relevant orders i.e., Sport Order, Margin Order, Futures order or P2P order or Options order.

- Select the "Trade History" on the left side of page.

- Click on Export and select big data download and enter the period

- Click on Generate

- Download the Statement once it is available.

How to prepare data and upload to calculate ?

- Login to EZTax.in/self > go to Self Service > and select crypto income in 'Tax Profile' screen

- Download the Ledger Template from EZTax.in

- Enter the data from your statements to EZTax Template as follows

- Enter the Exchange name as "Binance" under the head "Exchange".

- Copy the Column "Symbol" from Binance Trade History and paste in EZTax Ledger template under the head "Crypto Name".

- Copy the Column "Side" from Binance Trade History and paste in EZTax Ledger template under the head "Event Type".

- Copy the column "Date" from Binance Trade History and paste in EZTax Ledger template under the head "Date".

- Copy the columns "Quantity", "Price" and "Amount" from Binance Trade History and paste in EZTax Ledger template under the head "Quantity", "Rate" and "Total Amount"

- Save the file and upload in EZTax and save the data.

2.C.ii. Data preparation instructions for WazirX

How to download Trading Report from WazirX ?

- Login to https://wazirx.com/

- Go to Account Settings on top right side of page.

- Click on download Reports on the right side of the page.

- Select the "Trading Report" and select the period.

- Select Exchange Trades, P2P trades, OTC trades, Deposits and Withdrawals, Additional transfers, current coin balance, STF Trades, Wazirx Binance Transfers, Account ledger and request Trading report.

- The report will be sent to the email. Download the report.

How to prepare data and upload to calculate ?

- Login to EZTax.in/self > go to Self Service > and select crypto income in 'Tax Profile' screen

- Download the Ledger Template from EZTax.in

- Enter the data from your statements to EZTax Template as follows

- Enter the Exchange name as WazirX under the head "Exchange".

- Copy the Column "Market" from WazirX Trade Report and paste in EZTax Ledger template under the head "Crypto Name".

- Copy the Column "Trade type" from WazirX Trade Report and paste in EZTax Ledger template under the head "Event Type".

- Copy the column "Date" from WazirX Trade Report and paste in EZTax Ledger template under the head "Date".

- Copy the columns "Volume", "Price" and "Total" from WazirX Trade Report and paste in EZTax Ledger template under the head "Quantity", "Rate" and "Total Amount".

- Copy the column "Fee paid" and "Fee Amount" from WazirX Trade Report and paste in EZTax Ledger template under the head ""Expense currency" and "Expense Amount"

- Save the file and upload in EZTax and save the data.

2.C.iii. Data preparation instructions for Zebpay

How to download Trade Statement from Zebpay ?

- Login to https://zebpay.com/

- Click on Menu and select the Statements.

- Select "Statement Type" i.e., Lending/Trade/Fiat/Send and Receive/Tax Invoice/Earning

- Select the time period and click on submit.

- The report will be sent to the email. Download the report.

How to prepare data and upload to calculate ?

- Login to EZTax.in/self > go to Self Service > and select crypto income in 'Tax Profile' screen

- Download the Ledger Template from EZTax.in

- Enter the data from your statements to EZTax Template as follows

- Enter the Exchange name as Zebpay under the head "Exchange".

- Copy the Column "Coin Name" from Zebpay Account Statement and paste in EZTax Ledger template under the head "Crypto Name".

- Copy the Column "Transaction type" from Zebpay Account Statement and paste in EZTax Ledger template under the head "Event Type".

- Copy the column "Transfer Date" from Zebpay Account Statement and paste in EZTax Ledger template under the head "Date".

- Copy the columns "Quantity", "Rate" and "Total" from Zebpay Account Statement and paste in EZTax Ledger template under the head "Quantity", "Rate" and "Total Amount".

- Save the file and upload in EZTax and save the data.

2.C.iv. Data preparation instructions for CoinDCX

How to download Order history from CoinDCX ?- Login to https://coindcx.com/

- After login, click on “Orders” at the top right-hand side of the screen

- Click on “Order History” from the orders dropdown.

- Click on Download CSV at the right hand side of the screen

- Select the status as “All” and select the “duration”.

- The statement will be downloaded in CSV File

Generally, P&L Report is not available in the CoinDCX website. Contact CoinDCX support to get the profit & loss report for the financial year. It will be available in ZIP File. Extract the Zip file and password is PAN.

How to prepare data and upload to calculate ? (Ledger Template)?

- Login to EZTax.in/self > go to Self Service > and select crypto income in 'Tax Profile' screen

- Download the Ledger Template from EZTax.in

- Enter the data from your statements to EZTax Template as follows

- Enter the Exchange name as CoinDCX under the head "Exchange".

- Copy the Column "Market" from CoinDCX Trade Report and paste in EZTax Ledger template under the head "Crypto Name"

- Copy the Column "Side" from CoinDCX Trade Report and paste in EZTax Ledger template under the head "Event Type".

- Copy the column "Created at" from CoinDCX Trade Report and paste in EZTax Ledger template under the head "Date".

- Copy the columns "Total Quantity", "Price per unit" from CoinDCX Order History and paste in EZTax Ledger template under the head "Quantity" and "Rate"

- Select the “Fiat Currency” applicable for all the transactions.

- Save the file and upload in EZTax and save the data.

How to prepare data and upload to calculate ? (P&L Template)

- Login to EZTax.in/self > go to Self Service > and select crypto income in 'Tax Profile'screen

- Download the P&L Template from EZTax.in

- Enter the data from your statements to EZTax Template as follows

- Enter the Exchange name as CoinDCX under the head "Exchange".

- Select the Exchange Type as “Indian”

- Copy the columns "Sell Quantity", "Sell Price" from CoinDCX P&L Report and paste in EZTax P&L template under the head "Quantity" and "Rate"

- Copy the “Credit Date” from CoinDCX P&L Report and paste in EZTax P&L Template

- Multiple the Sell Qty and Buy price in CoinDCX P&L Report and enter the Purchase value in EZTax P&L Template

- Save the file and upload in EZTax and save the data.

Once the data is uploaded, EZTax will automatically read the gains and losses and do the necessary tax calculations. Refer Tax Summary page and Draft ITR Report for review of your taxes.

NOTE 1

While copying the data, make sure all the amounts are in INR NOTE 2

If the rate, and total amount columns are in 'INR', USD', 'GBP', 'EURO', 'YEN', 'USDT', 'USDC', eztax will convert them to INR. If the values in currencies otherthan the above, you need to convert them into INR before uploading the data. 2.C.v. Data preparation instructions for Coin Switch

How to download Trade Statement from Coin Switch ?

- Login to https://coinswitch.co/ or Open the coin switch app on mobile

- Click on the "profile icon" and select the "Reports".

- Click on "Account Statement" and select the Fiscal year or Custom Date (give start date and end date) and select the file type as "excel"

- Click on "Send Statement".

- The Account statement will be sent to registered email address.

2.D. How gains are calculated - an example?

Below is a scenario where Mr. Ram trading on Ethereum INR at the same exchange on the same day. Example narrates how the profit gets calculated.

| Crypto Name | Event Type | Event Date | Quantity | Rate | Total Amount | Profit / Loss |

|---|

| ETHINR | Buy | 2022-10-01 09:00 | 10 | 1200 | 12000 | - |

| ETHINR | Sell | 2022-10-01 10:00 | 10 | 1400 | 14000 | 2000 |

| ETHINR | Buy | 2022-10-01 11:00 | 20 | 3000 | 60000 | - |

| ETHINR | Sell | 2022-10-01 13:00 | 20 | 2500 | 50000 | -10000 |

| W.e.f FY 2022-23, one cannot set off his Rs 2000 profit with Rs 10,000 loss.

He needs to pay 30% tax on Rs 2000 i.e, 600 and the Rs 10,000 loss cannot be set off or carry forward. |

2.E. When to report Crypto income under Foreign Assets?

- If the exchange is located in India, there is no need to report under Foreign Assets for the holdings.

Example: Zebpay - If the exchange is located outside India, you need to report the same under Foreign Assets.

Example: Binance. - Following details needs to be reported under foreign assets

- Country in which exchange located.

- Nature of Asset as "Crypto/VDA"

- Date of Acquisition

- Cost of investment

- Income generated from such assets. This must match with the profit reported under EZTax Crypto Questionnaire

3. What to consider when paying & preparing TDS Return for Crypto Sale?

- Budget 2022 has introduced the concept of TDS on Virtual Digital Assets (VDA) w.e.f July 01st 2022

- Buyer of VDA is required to pay TDS @ 1% on the total amount of consideration if the aggregate amount exceeds Rs 10,000 in a financial year

- CBDT has released the guidelines for deduction of TDS on VDA

- Peer or Peer Transactions: Buyer is required to deduct TDS and file Form 140 of IT Act 2025 (Form 26Q of IT Act 1961) or Form 141 of IT Act 2025 (Form 26QE of IT Act 1961)

- Transfer of VDA through an exchange and VDA is owned by another person:

- Amount paid to Exchange by buyer directly or through a broker: Exchange is required to deduct TDS and file Form 140 (a.k.a Form 26Q)

- If the payment between exchange and the seller is through a broker(broker is not seller): Exchange and Broker are liable to deduct TDS. If there is a written agreement between the exchange and broker, the broker needs to deduct TDS and file Form 140 (a.k.a Form 26Q). Exchange needs to file Form 142 of IT Act 2025 (Form 26QF of IT Act 1961)

- Transfer of VDA through an exchange and VDA is owned by such exchange.

- Amount paid to Exchange by buyer directly: Buyer is required to deduct TDS

- Amount paid to Exchange through a broker: Broker is required to deduct TDS.

- The sellers can claim the TDS deducted as a credit while filing their Income Tax Returns

Finish in 7 mins

Free & Paid Plans

★★★★★

4. Practical Challenges with Crypto Taxation

Even though the CBDT has issued guidelines to remove difficulties with respect to TDS, there are certain issues in taxation of crypto's in India.

- Lack of Clarity: Budget 2022 has introduced the taxation on crypto currency transactions but the details and guidelines for implementation are not clear yet. CBDT is yet to release the guidelines regarding the same.

- Exchange Rates: There is no availability of exchange rates for conversion from 1 coin to another coin to bring the uniformity in sale and purchase prices.

- Data Standards: Every exchange or broker is providing the data in the different formats. There is no standard format for the exchanges or brokers. As the data is in different formats, it is very complex to obtain profit/loss for every transaction.

- Transaction Timing / Accuracy: In some reports provided by certain brokers, the sale transaction is happening before buy transactions, and it is creating the issues while computing profit and loss.

- Implementation of TDS: There is no clarity from the Income Tax department on TDS applicability if the sellers are outside India or foreign exchange is involved

- DTAA: Double taxation provisions are not yet clear. The crypto profits might be taxed in multiple countries and the provisions related to tax relief are not yet notified

- Non-Domestic Exchanges: If the taxpayers are trading in foreign exchanges, it will be difficult for the tax authorities to monitor them

To address these challenges, the Government needs to provide clear regulations an guidelines for crypto currency transactions

EZTax has analysed the notices for FY 2022-23 issued by the Income Tax Department over the last few days. There are some anomalies with respect to the notices issues

- There is no clarification from ITD with respect to exchange rate needs to be followed for crypto transactions. There would be some differences with respect to exchange rates used by exchanges and taxpayers. This needs to be addressed by ITD ASAP

- Every transfer is a transfer. In some cases, the taxpayers are converting USDT to INR and exchanges are deducting TDS on the same. There should be a proper way to capture these transactions

- There is no clarification on treatment of Crypto derivatives like TDS implications, Tax Audit, Turnover Computation etc

- During FY 2023-24 Income tax filing, EZTax has observed that some of the exchanges like CoinDCX is reporting the total trade volume including buy and sell instead of sale value. Due to this type of reporting, lot of taxpayers are receiving defective notices as the sale value reported by taxpayers in ITR is not matching with value reported by exchange in Form 168 of IT Act 2025 (Form 26AS of IT Act 1961)

5. FAQs

Crypto assets are un-regulated, un-recognised, and de-centralised in India. Cryptos in India are classified as different asset class as 'special asset'. Cannot be considered as 'Any Other Asset' for the purpose of taxation in India.

NFTs (non-fungible token) are based on the same blockchain technology that Crypto currency uses, but it's not a currency and is the key difference. 'NFT' could be associated with a real asset that can be sold such as an antique that is unique and is represented with a code and taxonomy.

No tax is levied on P2P transactions that are owned by the same person. But if the P2P transaction happened between two different persons outside of exchange, there would be taxability.

From time to time, brokers or developers issue a portion of crypto coin(s) through introductory offers. In such cases it's almost came into their wallet at free of cost. When sold such Cryptos / coins, the profit arise in such transaction is taxed.

Same is the case for a self-mined coin or equivalent transaction.

No losses can be set-off with any other income including any other crypto transaction.

No possibility to offset loss value against any gain as per the current tax rules on VDA.

But a lost asset may impact how you show assets and liabilities questionnaire while filing taxes in India.

In general, Taxation works on the intent of the transaction but in case of Cryptos / VDAs, it is considered as a "special asset" and cannot be treated as salary income.

TDS must be deducted by the employer or vendor if the cryptos value is more than Rs. 10,000

Typical salary income needs to be recognised in the company / firm / business books of accounts. Which must be in base accounting currency of that country. By looking at this, it is in general not possible to treat cryptos as base currency in any known countries in the world as on today. Hence, salary received in cryptos must be a casual transaction, and must be treated in accordance with the current Indian laws.

No possibility to offset loss value against any gain as per the current tax rules on VDA.

But a lost asset may impact how you show assets and liabilities questionnaire while filing taxes in India.

There is no affect of GST on Crypto transactions at this time. Govt of India is looking at the possibility of such.

Based on the inter-banking exchange rates in case such conversion rate is not available with the Reserve Bank of India (RBI, the Central Bank of India)

The issue with the crypto currency trading is that the cryptos are backed by stable coin / currency which is further backed by another real currency. In this case the relationship between stable currency and real currency is not 1:1. Hence the conversion of such currency is difficult due to lack of central data.

USDT and USD are not the same . USD is the official currency of the USA whereas USDT is a stable coin issued by private companies which operate on blockchain. USDT is used to transfer funds between exchanges without affecting the volatility of other crypto currencies

The value of USDT is not equal to 1 USD, as it depends on who is hosting such stable coin and the risks associated with it.

4.8 ★★★★★ Excellence since 2016

4.8 ★★★★★ Excellence since 2016