4.8 ★★★★★ Excellence since 2016

4.8 ★★★★★ Excellence since 2016 Home > GST > Help Center > GST on Housing Maintenance (aka CAM) Charges

The number of people living in apartments or villas has recently increased dramatically. As more families choose to live in gated communities, high-rise societies, and so on, apartment culture is becoming the new normal. Security, lifts, clubhouses, maintenance, and other factors may all contribute to a growth in apartment culture.

However, in order to use all of the services, residents must pay a fee known as "maintenance charges". Residents are required to pay common area maintenance (CAM) charges to the "Housing Society" founded for the society. There are numerous questions about the imposition of GST on maintenance expenses.

Housing Society charges are often known as common area maintenance (CAM) charges.

This document covers

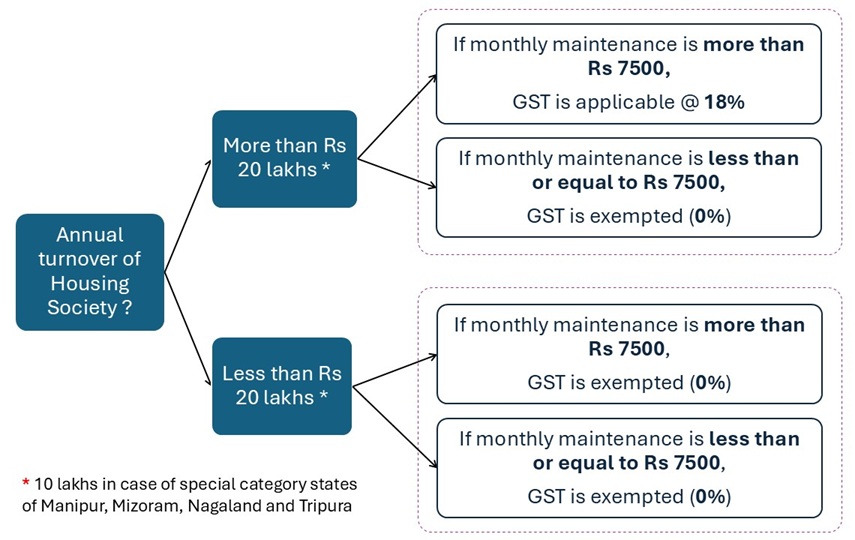

GST registration requirement is as follows

| Turnover | Monthly Maintenance | Requirement of GST registration |

|---|---|---|

| More than Rs 20 lakhs * | 7500 or less than Rs 7500 ( <=7500 ) | Not required (Optional) |

| More than Rs 7500 ( >7500 ) | Mandatory | |

| Less than Rs 20 lakhs * | 7500 or less than Rs 7500 ( <=7500 ) | Not required (Optional) |

| More than Rs 7500 ( >7500 ) | Not required (Optional) |

* 10 lakhs in case of special category states of Manipur, Mizoram, Nagaland and Tripura

The housing society can claim the input tax credit of GST paid on purchases of capital goods like generators, water pumps, furniture etc, input goods like pipes, hardware, sanitary etc and input services like repairs and maintenance

The housing society is required to file Monthly or quarterly GST returns in GSTR 3B, GSTR 1 depending on the turnover.

The common area maintenance charges (CAM) will be mostly calculated as follows

Currently, the dimensions of the units within the same gated community are varying, making the SFT-based method less suitable, as all residents share the common amenities. The by-laws are instrumental in fostering consensus and acceptance.

The common factors that influence the CAM charges are

Recently, a civil court has made a decision in favor of flat owner. In Arun Kumar Rao vs Purva Seasons Owners Association, the court has ruled that all the services of common area are enjoyed by all members of gated community irrespective of flat size and the association cannot charge CAM based on higher flat sizes. The court has directed the association that it cannot charge CAM based on area size and restricted it from changing its bye laws

Disclaimer: This article provides an overview and general guidance, not exhaustive for brevity. Please refer Income Tax Act, GST Act, Companies Act and other tax compliance acts, Rules, and Notifications for details.