4.8 ★★★★★ Excellence since 2016

4.8 ★★★★★ Excellence since 2016 Home > Income Tax > Help Center > How to Check IT Notices

How to view your Income Tax (IT) notices or Outstanding Demand notices online using the incometax.gov.in portal, including graphics and step-by-step instructions.

As the department intensifies its efforts to nameless, faceless, machine-based notice handling and the number of notifications issued increases, it is imperative that individuals pay attention and check their notices online.

This document covers

Visit the website of the Income Tax Department (ITD). Visit the ITD Portal and log in with your PAN number and password. If you do not have an account, creating one is simple. Visit How to Create an Account on the ITD Portal for assistance.

With the taxpayer's income tax login, the notices and pending actions are organised by kind and accessible through three modules. Namely, 1. Compliance Module, 2. Work list module, and 3. e-Proceedings module

Check below content to see how you can see various entries made by IT Department.

After logging into the ITD Portal, navigate to the Compliance menu and pick the "View and Submit Compliance" option.

Now, view all IT Notices, Outstanding Demand Notices, and other compliance obligations, which differ based on your profile (e.g., Individual, HUF, AOP, corporation, etc.). Zoom the image to see how it appears.

Refer below relevant content to address your needs.

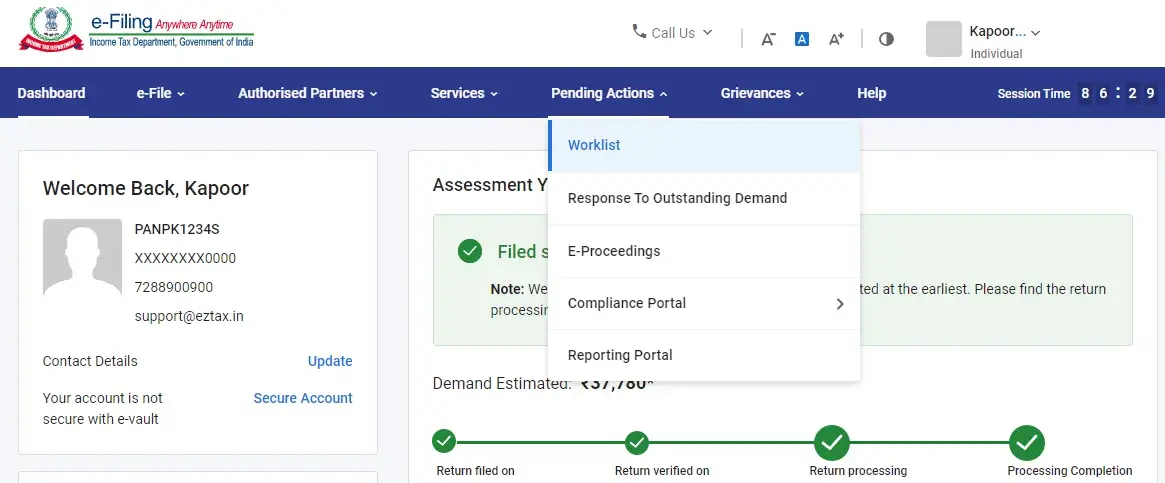

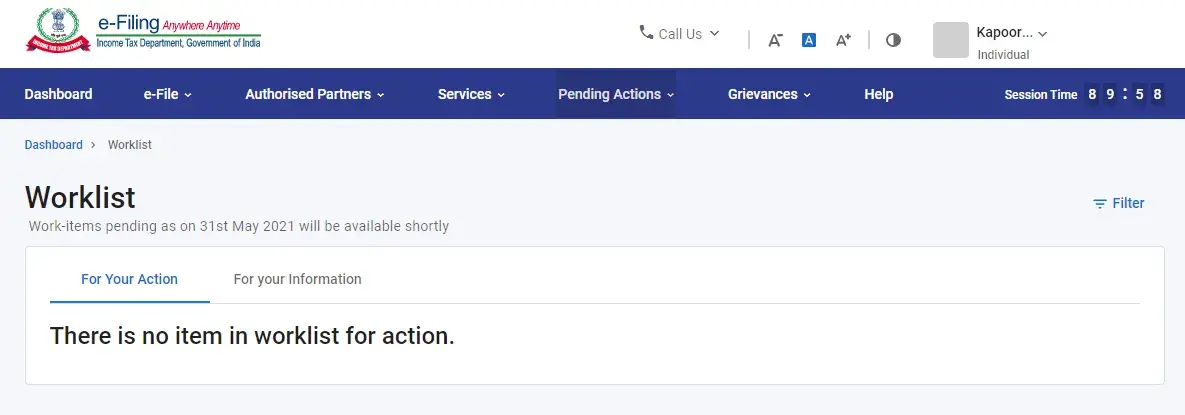

This module provides access to any pending proceedings and/or ongoing demands against the taxpayer. Taxpayer activities are provided under "For Your Action" in the work list module; refer the image.

If clicked, the system will display all pending actions and/or outstanding demands, as well as any pending e-verification requests, etc. kindly refer to the image.

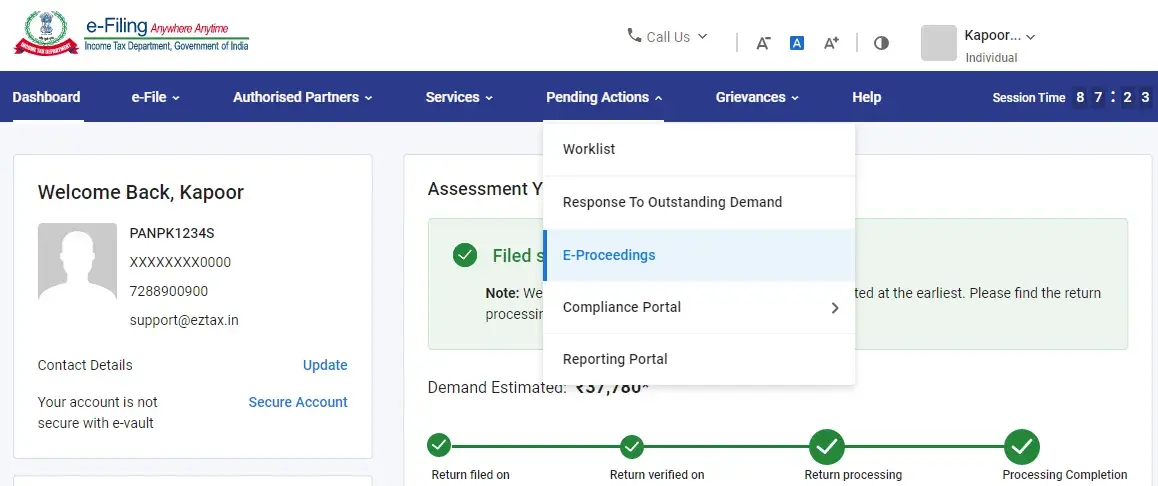

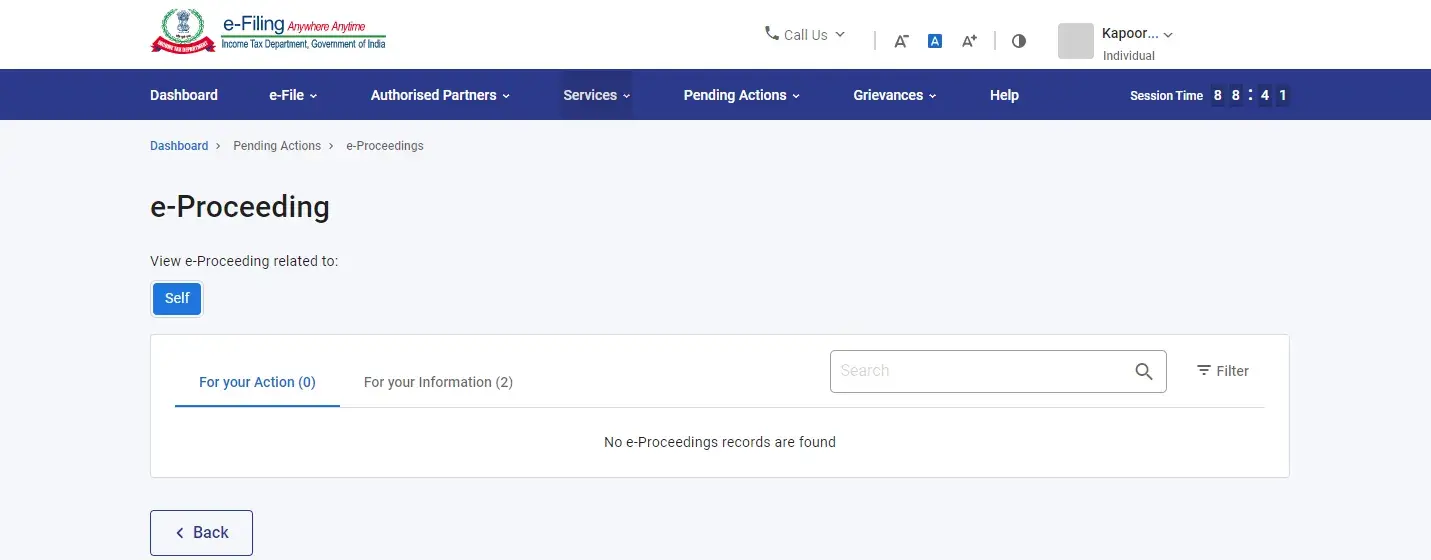

In this module all the notices received, pending limited scrutiny, arithmetic errors related to previous filings; any pending responses to ITD are available against the taxpayers.

To view the notices, please select the e-Proceedings option from the e-Proceedings menu (see image).

Once clicked, the system will show all the notices attributed a Taxpayer. Please refer the image.

In general, addressing notices is a difficult topic since it necessitates in-depth understanding of the outcomes of your response. Refer Income Tax Notice Handling Service Plan if you require a tax notification processing service.

Disclaimer: This article provides an overview and general guidance, not exhaustive for brevity. Please refer Income Tax Act, GST Act, Companies Act and other tax compliance acts, Rules, and Notifications for details.