4.8 ★★★★★ Excellence since 2016

4.8 ★★★★★ Excellence since 2016 Home > Income Tax > Help Center > Indian Budget 2021Last Updated: Sep 21st 2022

The budget announcement for Agri sector maintained the reform momentum but lacked coverage of wider issues of the sector. Some announcement such as extension of farm credit provision to farmers, commodity expansion to operation green and extension of AIF to APMC did hit the target and will boost the Agri supply chain for perishables and non-perishable commodities. The coverage of allied farming activity showed the continuous focus to mainstream these segments. New initiatives like multi state cooperatives can also be helpful in strengthening a one India - one market concept.

The push on high infrastructure spends across roads, rural, textile parks, Agri sector support across MSP, will put more money in the hand of consumers. In addition, the infrastructure focus will enable companies to expand their rural and urban coverage, further helping to drive consumption across the country. Finally, the lack of any increase in Direct taxes (such as Covid or Wealth tax) will further enable spending of increased savings due to Covid.

to collect additional funds for agri infra, without increasing the tax burden on consumers

The Finance Minister Nirmala Sitharaman, in her Budget 2021-2022 speech also announced imposition of an Agriculture Infrastructure and Development Cess (AIDC) on specified goods -- including alcoholic beverages, gold, silver, cotton, apple, peas, petrol, and diesel.

Union Finance Minister Nirmala Sitharaman imposed agri infra cess of 100% on alcoholic beverages via Agriculture Infrastructure and Development Cess (AIDC) scheme. The cess has been imposed on all alcoholic beverages like Whiskey, Scotch, Brandy among others.

On Gold, silvers and dore bar, agri-infra cess of 2.5% has been levied, while on apples a 35% infra cess has been imposed, and on cotton a 5% infra cess has been imposed.

The finance minister said in its Union Budget 2021 speech, that the government is raising customs duty on cotton from nil to 10% and on raw silk and silk yarn from 10% to 15%, in a bid to benefit the farmers. The finance minister also announced withdrawing end-use based concession on denatured ethyl alcohol.

A component to develop farm infrastructure has been added to the cost of petrol and diesel in the Union Budget. An Agriculture Infrastructure and Development Cess (AIDC) of Rs 2.5 per litre has been imposed on petrol and Rs 4 per litre on diesel. Consequent to imposition of AIDC on petrol and diesel, the Basic excise duty (BED) and Special Additional Excise Duty (SAED) rates have been reduced on them so that overall consumer does not bear any additional burden, the Finance Minister said. Consequently, unbranded petrol will attract basic excise duty of Rs 1.4 per litre and diesel will attract basic excise duty of Rs 1.8 per litre.

The SAED on unbranded petrol will be Rs 11 and diesel will be Rs 8 per litre. Similar, changes have also been made for branded petrol and diesel.

There will be no pressure on consumers as other duties and cess were revised before the new agriculture infrastructure cess was calculated, Ms Sitharaman said. Consequent to imposition of Agriculture Infrastructure and Development Cess on petrol and diesel, basic excise duty and special additional excise duty rates have been reduced on them so that overall consumer does not bear any additional burden.

A similar readjustment has been made for alcoholic beverages that currently attract 150% basic customs duty. That basic import duty has now been slashed to 50%, even as the Budget has proposed an AIDC of 100%. Net net the consumer does not have to pay anything extra. The markets reacted positively to today's Union Budget announcements, with Sensex surging over 2,000 points to Rs 48,600.61 (up 5% from its previous close), and Nifty went up above 14,281, up more than 4.74% from its previous close.

More emphasis on Infrastructure spending, raised customs duty to create jobs. No new changes to Taxes (Income Tax & GST) more @ Indian Budget 2021 Presentation, Analysis

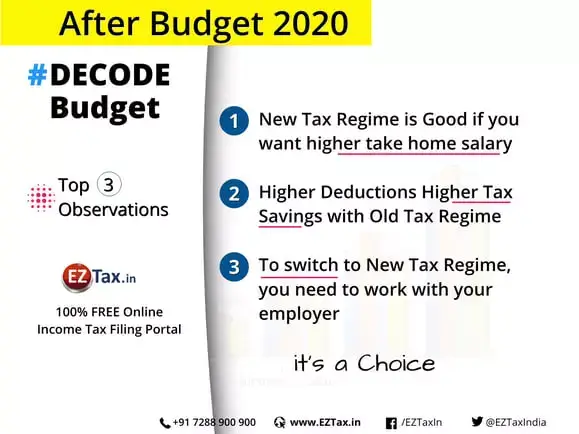

Top three observations from the analysis were

Pictorial analysis on New Vs Old Personal Income Tax Regime

Disclaimer: This article provides an overview and general guidance, not exhaustive for brevity. Please refer Income Tax Act, GST Act, Companies Act and other tax compliance acts, Rules, and Notifications for details.