4.8 ★★★★★ Excellence since 2016

4.8 ★★★★★ Excellence since 2016 Home > Income Tax > Help Center > Indian Budget 2021Last Updated: Sep 30th 2022

The budget is done, and it has been analysed over and over again. One of the general complaints about the budget is that it is has nothing for the middle class. However, the budget did have some proposals which can benefit retail investors and bank depositors.

One of the biggest takeaways from the budget, as far as personal finance and investment community is concerned is the following announcement by the Finance Minister.

I propose to introduce an Investor Charter as a right of all financial investors across all financial products.

This is a significant announcement and if it is implemented in a proper manner and comes with robust enforcement mechanisms in place, it can change the way retail investors invest in various investment products.

Such an investor charter would be a part of the regulatory framework and would be set up with the help of Securities and Exchange Board of India (SEBI) and the Insurance Regulatory and Development Authority of India (IRDAI). Now it is in stage of a proposal, but it would have to be brought in shape with consultation with the regulators. It is expected to establish the rights of the investor also strengthen the grievance redressal mechanism.

This announcement is in line with the taxation charter that was announced in Budget 2020. The idea behind introducing the charter was to bring in an element of trust between the taxpayer and the tax authorities.

Similarly, the investor charter would look to bring in an element of trust between the retail investors and the investment community and address issues like mis-selling that are prevalent now. This will in turn, encourage more retail investors invest in financial products and lead to the maturity of the investment landscape in the country.

Quarterly advance tax to be paid on the income received by the taxpayer (that was not already withheld by a Bank or Employer etc). In case of dividend income, it is hard to estimate what would be the income before receiving such to pay the advance tax. A proposal made in the budget may cheer many retail investors who are receiving dividend from the companies. Now it is proposed to have that the event of tax liability arises only after the payment of dividend.

More on Dividends and taxability

Another good news for retail investors is the introduction of tax-deferred zero-coupon bonds for infrastructure. Zero coupon bonds are bonds which do not pay any interest. Instead, they trade at a deep discount. When they are redeemed at full face value at maturity, they can render a profit. Infrastructure debt funds will now be allowed to raise funds through the issuance of such bonds. Zero coupon bonds could be a good addition to your portfolio if you are looking for guaranteed returns for a fixed term period and you have a long-term investment horizon.

Another proposal which will bring relief to small time investors is that a better policy framework has been proposed to be put in place for bank depositors to claim their deposit insurance cover in case their bank goes bust. Last year, in the budget the cover was increased to Rs 5 lakh from Rs 1 lakh. However, this cover is available only in case of liquidation of a bank. With a newer framework in place, depositors may be able to claim this insurance even before a bank is liquidated. This will increase the trust of depositors in banks, especially in light of situations we have seen recently of banks being put under moratorium by RBI and there being access to withdrawals being limited.

More emphasis on Infrastructure spending, raised customs duty to create jobs. No new changes to Taxes (Income Tax & GST)

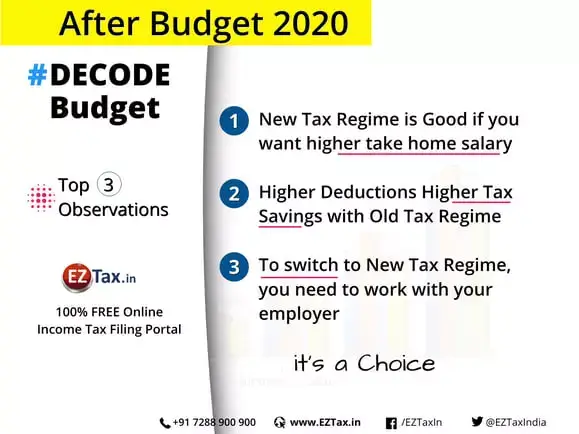

Top three observations from the analysis were

Pictorial analysis on New Vs Old Personal Income Tax Regime

Disclaimer: This article provides an overview and general guidance, not exhaustive for brevity. Please refer Income Tax Act, GST Act, Companies Act and other tax compliance acts, Rules, and Notifications for details.