4.8 ★★★★★ Excellence since 2016

4.8 ★★★★★ Excellence since 2016 Home > Income Tax > Help Center > Indian Budget 2021 Last Updated: Apr 09th 2023

The Finance Minister has announced in Indian Budget 2021 that the interest on employee contributions will be taxable from April 1 2021. Presently, the interest on Employee Contributions to Provident Fund is fully exempt.

Employee provident Fund is a savings scheme which is to be used for Post retirement by employee all over the country. The Employer and Employee should Contribute minimum 12% each of basic Salary. Interest will be accumulated on both contributions in EPF account

Employer Contribution towards EPF is tax exempted up to a certain limit. As per new rule, Employer Contribution to EPF, National Pension Scheme and Superannuation Fund on an aggregate basis exceeds Rs 7.5 lakhs, it would be taxable in the hands of employee.

Employee Contribution to PF can be claimed as deduction u/s 123 of IT Act 2025 (u/s 80C of IT Act 1961) upto a limit of Rs 1.5 lakhs. If PF is withdrawn at the time of maturity or after five years of continuous service then it is tax exempt.

Key Changes in Budget 2021 about taxability of Interest on Employee Contribution and how it effects your Salary & Taxes?

Earlier the rate of TDS on taxable EPF withdrawal is 30% in Non-PAN cases. NEW As per Budget 2023 i.e., w.e.f 1st Apr 2023, TDS rate on EPF withdrawal is reduced to 20%

More emphasis on Infrastructure spending, raised customs duty to create jobs. No new changes to Taxes (Income Tax & GST)

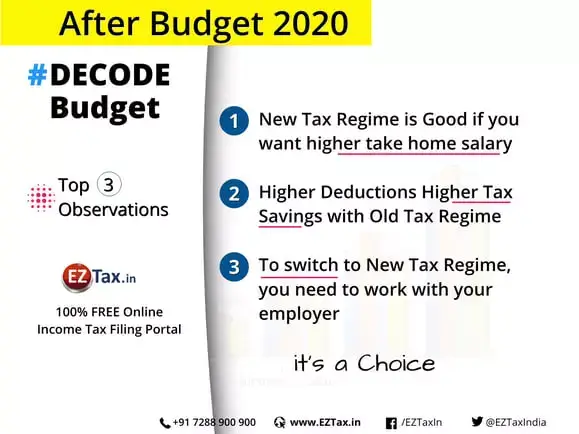

Top three observations from the analysis were

Pictorial analysis on New Vs Old Personal Income Tax Regime

Disclaimer: This article provides an overview and general guidance, not exhaustive for brevity. Please refer Income Tax Act, GST Act, Companies Act and other tax compliance acts, Rules, and Notifications for details.