4.8 ★★★★★ Excellence since 2016

4.8 ★★★★★ Excellence since 2016 Home > Income Tax > Help Center > Revised Income Tax Return Filing

Made a mistake when filing your ITR? You can revise your ITR within the due date to get it re-processed by the income tax department in India.

Budget 2026 rationalized the period of filing revised return by taxpayers.

The due date to file Revised Income Tax returns for FY 2023-24 (AY 2024-25) for Resident Individuals has been extended to 15th Jan 2025 from 31st December 2024. However the extension is not applicable to

This document covers

Once the ITR due date is over, you have an opportunity to select "Belated" OR "Revised" IT Return upto the revision period for an assessment year. (For eg., Dec 31st 2024 for FY 2024-25 or AY 2025-26).

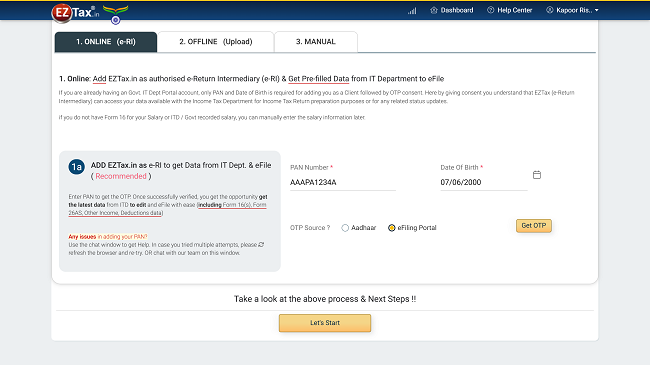

Select the Self-Service IT Filing service from the dashboard after the creation of an account (refer How to create a EZTax.in Account for IT Filing?) and login. Select appropriate options (Refer How to select a Service to File Income Tax Return?).

If you have filed the Original ITR from EZTax.in, search your inbox for the email subject of "eFiled Successfully" to know your acknowledgement number.

That's it, EZTax.in populates the original return data automatically into your Revised Filing. Now change the data that you want to change to eFile the same.. in few minutes.

EZ Help | Express Filing | Highest Security Standards | Auto read Form 130 (a.k.a Form 16), Form 168 of IT Act 2025 (Form 26AS of IT Act 1961) | Tax Optimizer | Creative Audit | Secure File Manager

Confused which Income Tax Return Type to use? IT Return types - Explained

If you are already having an Govt. IT Dept Portal account, only PAN and Date of Birth is required for adding you as a Client followed by OTP consent. Here by giving consent you understand that EZTax (e-Return Intermediary) can access your data available with the Income Tax Department for Income Tax Return preparation purposes or for any related status updates.

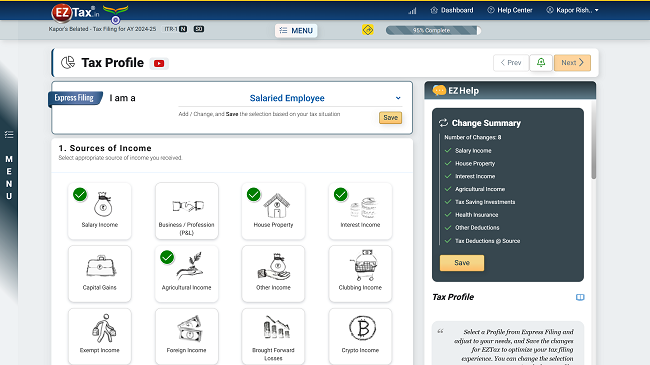

Introducing Express filing, a unique feature in filing your taxes where the tax engine will ask the relevant questions based on your profile, whether you are a salaried employee, trader, etc. It's that EZ (easy)!

Select your profile, EZTax will refine your questionnaires for you. More @ How to select Tax Profile while IT Filing ?

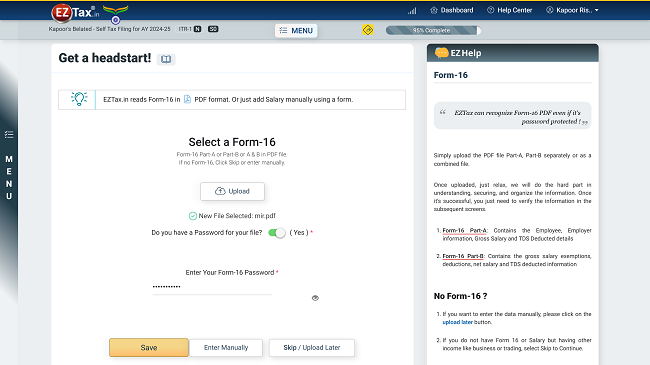

Smart. Intuitive. Convenient. Choice. We auto read your Form 130 (a.k.a Form 16) many ways to reduce your data key-in.

More help on How to declare Income from Salary & House Property?

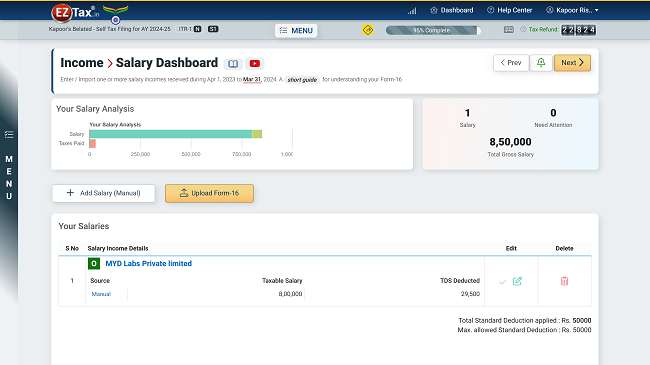

Review Salary information that was uploaded or added manually and add additional salaries if you have switched the jobs during the financial year you selected.

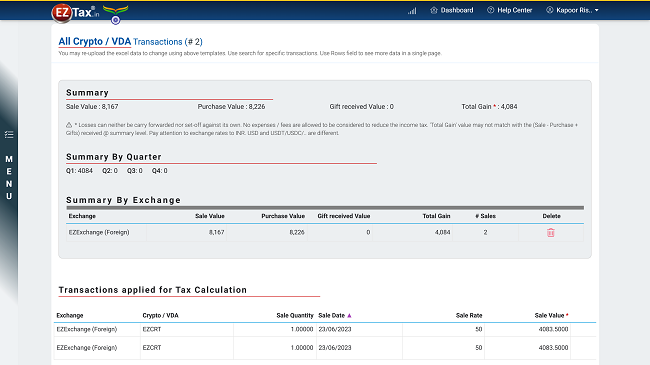

In addition to Salary Income, add additional sources of income from Interest Income, House Property, Business & Profession, Capital Gains, Exempt Income, Other Income, Clubbing Income, Crypto Income, Foreign Income, and add Deductions, Taxes Paid, Advance Tax, Self-Assessment Tax that is applicable to you.

Know more on How to declare Investments & Deductions?

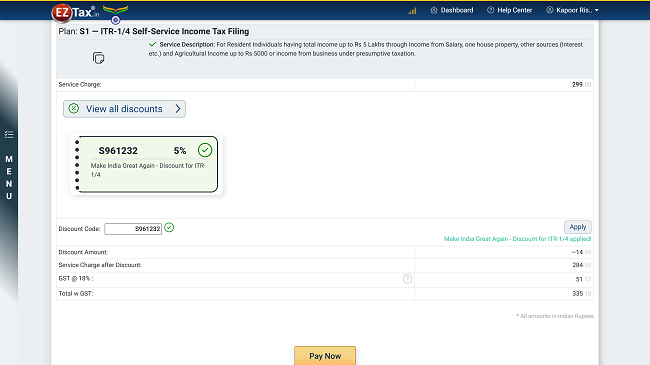

Choose the service plan and make payment for it.

We are by far the fastest e-Filer in the market today in India. Once prepared, takes just a few seconds to upload your return!

Once e-filed, you can download your customized ITR Report in PDF format along with email communication and reminders.

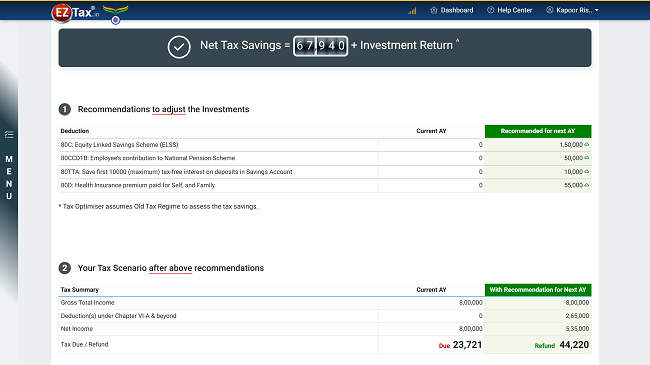

Introducing EZTaxTax Optimizer, to save on taxes and increase the potential investment return. Per independent study* assesses on an average could save Rs. 10,000 or more on their taxes.

EZTax made it so simple that it will build a complex what-if scenario in real-time to show the current refund and new refund possible after recommendations for the coming year. more details about Tax Optimizer

Know more on How to declare Investments & Deductions?

Typically, it's Jul 31st of every year, for FY 2024-25 it is Jul 31st, 2025.

For FY 2024-25(AY 2025-26), the due date to file Income Tax Return is extended to 16th Sep 2025 from 31st July 2025

No Worry, you can file your taxes using Belated return type up to Dec 31st, 2025 (for income generated during FY 2024-25).

For latest due dates, refer Tax Compliance Calendar

Yes. The Government of India (GOI) Feb 2017 introduced a maximum late fee of Rs. 10,000 for delayed ITR filing by individuals. Later it was adjusted to a max of Rs. 5000/-

Refer @ Income Tax Penalties: What and When? for more information.

You can file a Revised Return for the Original before the end of the current assessment calendar year i.e., before Dec 31st. W.e.f Budget 2026, the revised return can be filed until 31st March with a nominal fee

Deadline for linking PAN, Aadhaar cards, a must for filing ITR, is Jun 30th 2023 without a processing fee. Without it your ITR won't be accepted. There are few exceptions to this such as those who are senior Citizens (Age > 80 years) OR who are residing in the States of Assam, Jammu and Kashmir and Meghalaya OR a non-resident as per the Income-tax Act, 1961; OR not a citizen of India. Link Now

Now, you can still link your aadhaar and PAN with a govt. fee of Rs. 1000. until further notice or before Dec 31st 2023.

Refer @ How to link PAN Card with Aadhaar Card? for more information.

Disclaimer: This article provides an overview and general guidance, not exhaustive for brevity. Please refer Income Tax Act, GST Act, Companies Act and other tax compliance acts, Rules, and Notifications for details.