4.8 ★★★★★ Excellence since 2016

4.8 ★★★★★ Excellence since 2016 Home > Income Tax > Help Center > EZTax Taxes Paid HelpLast Updated: Feb 28th 2026

One of the important declarations to be made during IT filing is about Tax. Tax declaration is in different modes, they are Tax Deducted at Source (TDS), Tax Collected at Source (TCS), Advance Tax, and Self-Assessment Tax. While timely Tax payments are useful to avoid the penalties, interest, fines, its even more important to declare them at the time of income tax filing to make sure you get the due credit for such payments.

All the data related to TDS, TCS, Advance tax, Self-Assessment tax, available in single document called Form 168 (a.k.a Form 26AS), EZTax.in has the provision to upload Form 168 of IT Act 2025 (Form 26AS of IT Act 1961) automatically to extract the data. Depending up on the tax payments or deductions, your refund or tax due is calculated.

| Tax Deducted at Source(TDS): TDS means Tax Deducted at Source. Certain percentage of amount is deducted by an employer, organisation, contactor, and your tenant at the time of making / crediting certain specific nature of payment. | |

| Upload Form-168 (a.k.a Form-26AS):Form-168 (a.k.a Form-26AS) shows various taxes that are deducted from your income by your employer, bank, consultancy or your tenant. It also shows your advance tax or self-assessment tax that paid during financial year. | |

| Browse: EZTax will automatically extract the data from Form-168 (a.k.a Form-26AS), simply you need to do is that, click on the browse and upload the Form-168 (a.k.a Form-26AS). | |

| Form-168 (a.k.a Form-26AS) Password: If your Form-168 (a.k.a Form-26AS) has the password please enter it, password should be date of birth with-out any spaces (ddmmyyyy). | |

| Save: After completion of declaration of all the data you can simply click save |

| TDS Credit in the Name: Deduction of tax can be applied according to the PAN and transaction amount; if you are claiming the TDS on your PAN (reflected in your Form 168 (a.k.a Form 26AS)) you need to select self. And if you are claiming the TDS of minor child or spouse, you need select the other PAN and you have to declare the relevant income of that TDS in related head. | |

| Amount paid / credited as per Form 131 (a.k.a Form 16A) : Here you have to declare the total amount of transaction on deducted TDS. | |

| Tax deducted at source on above amount: Here you have to declare the deducted TDS mount. | |

| Do you want to adjust TDS or Income ? ( Yes ): If the total transaction amount is not received and you want to declare the only received amount & related TDS is called TDS adjustment. If you want to adjust the TDS please click on the check box, enter the adjusted income, TDS, reason. | |

| Do you have any brought forward TDS ? ( Yes ): The claiming of previous year’s TDS amount is called brought forward TDS, but you must declare these as in previous years as a carry forward TDS. If you want to declare the brought forward TDS please click on the check box and select the year and enter the amount | |

| PAN of the Entity: Tax deduction account number, you have to declare the TDS deducted Entity /Organisations TAN number, if it the tax deducted on sale of property or rent you can declare the PAN of the deductor. | |

| Name of the Deductor: You have to provide the TDS deducted person name. | |

| Details of Receipt as mentioned in Form 168 (a.k.a Form 26AS): Here you have to declare the total amount of transaction on deducted TDS. | |

| Save: After completion of declaration of all the data you can simply click save. |

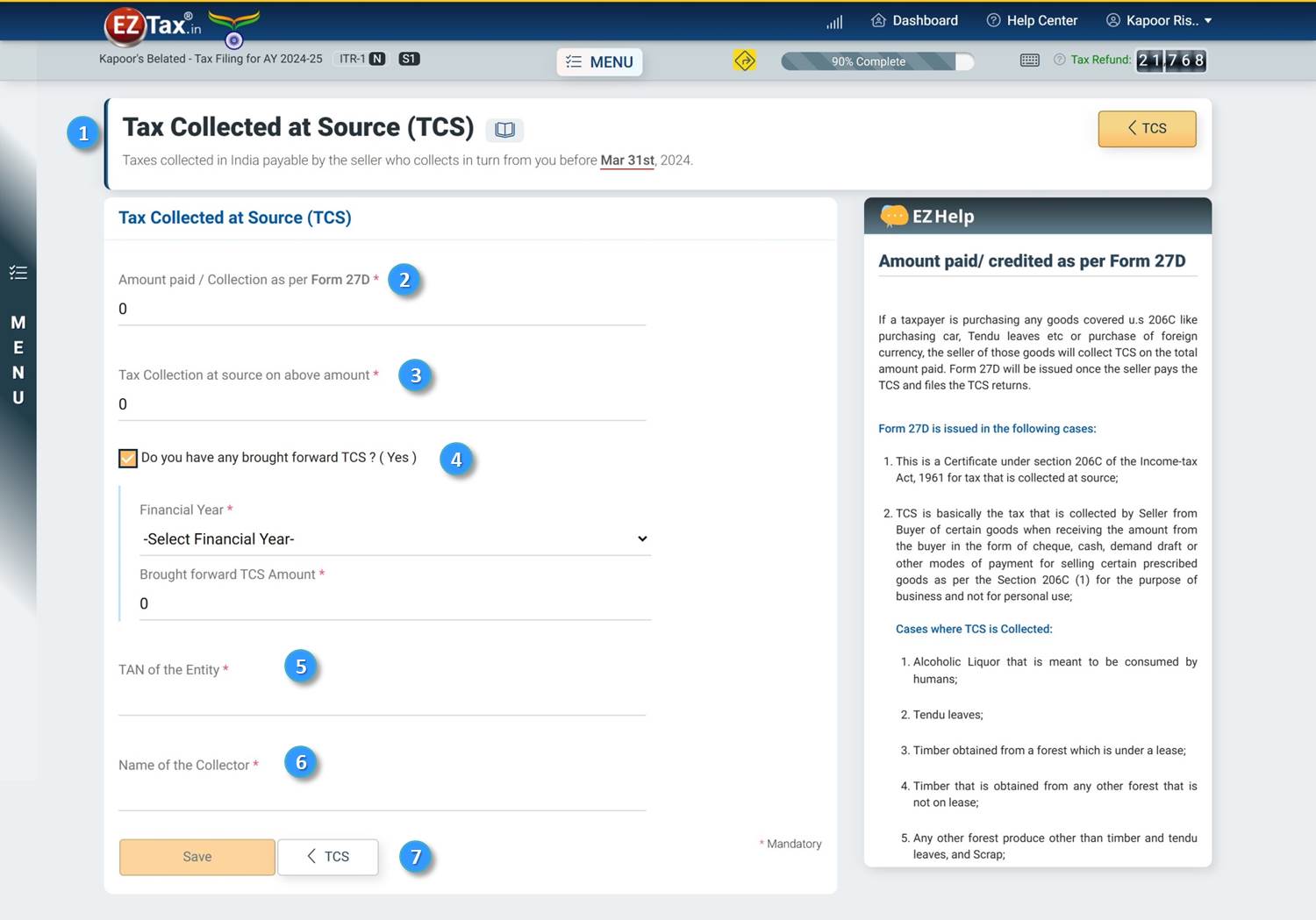

| Tax Collected at Source: It means the receiver extracts a certain amount as tax of the payer and deposits the same with the government. For example, Kapoor is selling a Motor Car worth Rs. 12 Lakhs Mr. Ram, Mr. Kapoor is liable to collect TCS @ 1% on the sale consideration, and deposit the same with the Govt. Now, Ram pays Rs. 12.12 Lakhs (12 Lakhs + 1%) to Mr. Kapoor | |

| Amount paid / Collection as per Form 133 (a.k.a Form 27D) : Here you have to declare the total amount of transaction, like in the above example 12.12 lakhs. | |

| Tax Collection at source on above amount: Here you have to declare the amount of TCS collected. | |

| Do you have any brought forward TCS ? ( Yes ): The claiming of previous year’s TCS amount is called brought forward TCS, but you must declare these as in previous years as a carry forward TCS. If you want to declare the brought forward TCS please click on the check box and select the year and enter the amount | |

| TAN of the Entity: Tax deduction account number, you have to declare the TCS collected Entity /Organisations TAN number. | |

| Name of the Collector: Please enter the Name of the TCS collected Entity /Organisations. | |

| Save: After completion of declaration of all the data you can simply click save. |

| Advance Assessment Tax: Paying the tax in instalment (every quarter) instead of entire amount payment at the end of the financial year. It is use full to avoid the interest or penalty on taxes. EZTax allows any no of Advance tax payments. | |

| Self-Assessment Tax: Balance tax payment by the assesses on the income earned after considering TDS and Advance tax into account before filing the Return of income. Simply after March 31st the entire tax payments are called Self-Assessment tax. | |

| Bank Name: Enter the bank name thru which you have paid the Advance or Self-Assessment Tax. | |

| BSR Code: It is a 7-digit code allotted to banks by reserve bank, at the time of tax payment online or offline you will get the BSR code. Please enter the BSR code. | |

| Challan Serial Number: It is one to 5 digits code, at the time of tax payment online or offline you will get the Challan number. Please enter the received Challan number | |

| Date of Deposit: You need to enter the tax amount paid Date | |

| Amount of Tax: You have to enter the amount of tax paid. | |

| Save: After completion of declaration of all the data you can simply click save. |

Disclaimer: This article provides an overview and general guidance, not exhaustive for brevity. Please refer Income Tax Act, GST Act, Companies Act and other tax compliance acts, Rules, and Notifications for details.