4.8 ★★★★★ Excellence since 2016

4.8 ★★★★★ Excellence since 2016 Home > GST > Help Center > Voucher CreationLast Updated: Sep 23rd 2022

Beyond Sales & Purchase side invoices, many other transactions need to be tracked to have 100% statutory compliance & to know how well a business is doing. Voucher entry required for Short / Long term, Secured / Un-Secured Loans, Investments, Cash in-Hand, Cash in-Bank, Capital, Opening Balances.

If you are already using EZTax.in/gst accounting software, you must be quite familiar with voucher entry that is available. However, if you are a new user, below are step by step guide on 'How to create GST Vouchers' will help and make it easier for you to create vouchers.

In EZTax.in GST Accounting, go to Purchase menu and click on Voucher option to Create a Voucher. While you need to go through a few clicks to create a Voucher, there is much functionality in the Create Voucher Screen. Follow below step by step process explanation to Create Voucher in EZTax.in GST Software.

| 1 | Voucher Date: Accounting dates are highly important for a business. The date of the transaction should be given here. The transaction date means the date on which an event or transaction occurs in the business. |

| 2 | Category: It will help you in the classification of the financial information. By selecting the right category, the financial information will get reflected in the correct category. It helps in categorizing the Profit & Loss and Balance Sheet items |

| 3 | Affected On: The category selected needs to be settled by either cash in hand or cash in bank. |

| 4 | Transaction Type: The transaction type might be of different types. The category selected may be purchased, sold , withdrawn, deposited, granted, repaid, added or set-off etc. |

| 5 | Description: Description is short explanation of every transaction. It explains the significance of transaction. It will be helpful for future reference. |

| 6 | Amount: Amount is the sum of money for which you bought, sold, deposit, withdraw etc. |

| 7 | Reference No: A reference number is a unique identifier assigned to each transaction. It is separate for every transaction |

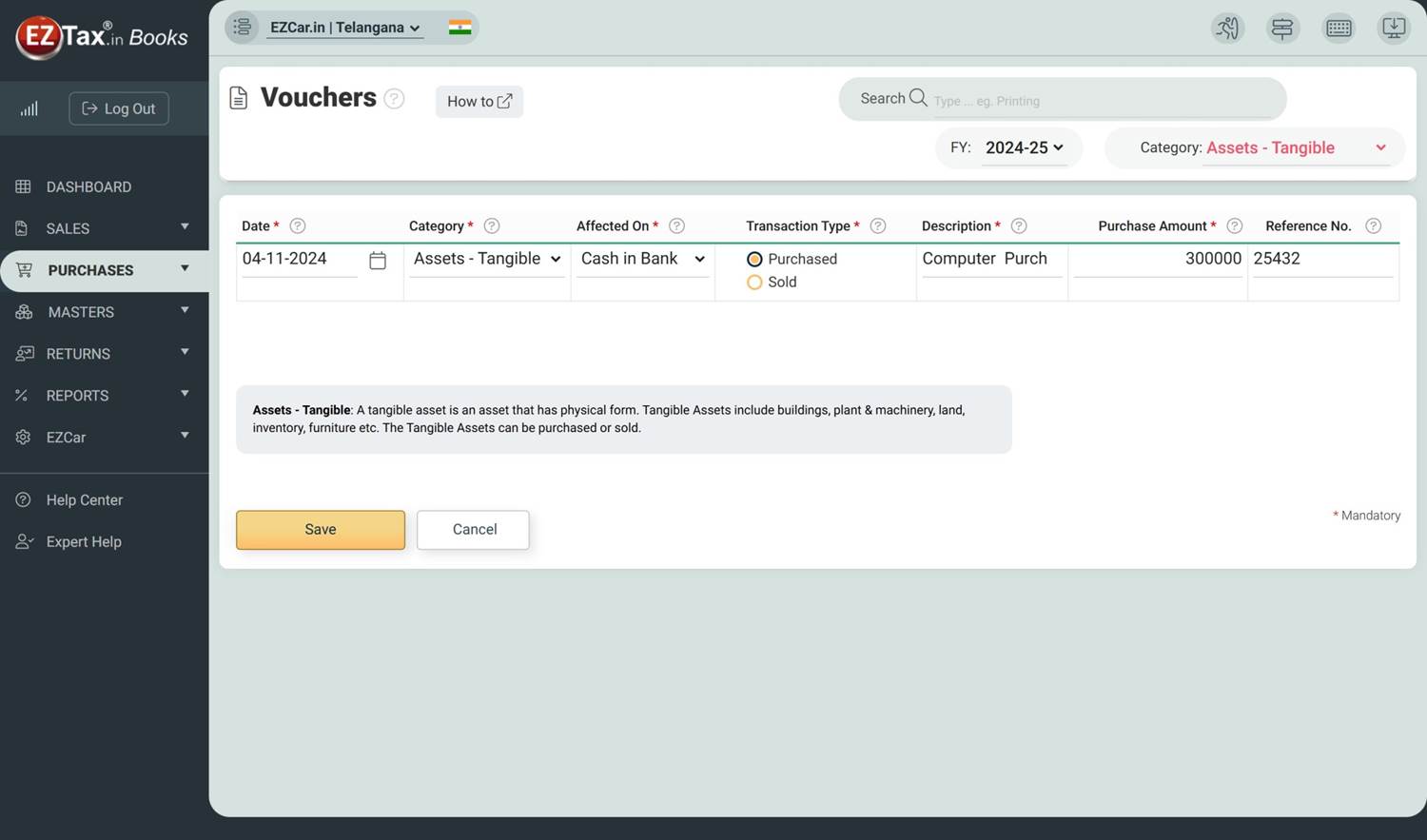

Category > Tangible Assets: A tangible asset is an asset that has physical form. Tangible Assets include buildings, plant & machinery, land, inventory, furniture etc. When you the purchase the above assets or like, you need to mention tangible assets here

Affected on: When you purchase or sell the tangible assets, it needs to be purchased or sold either in cash or bank.

Transaction Type:

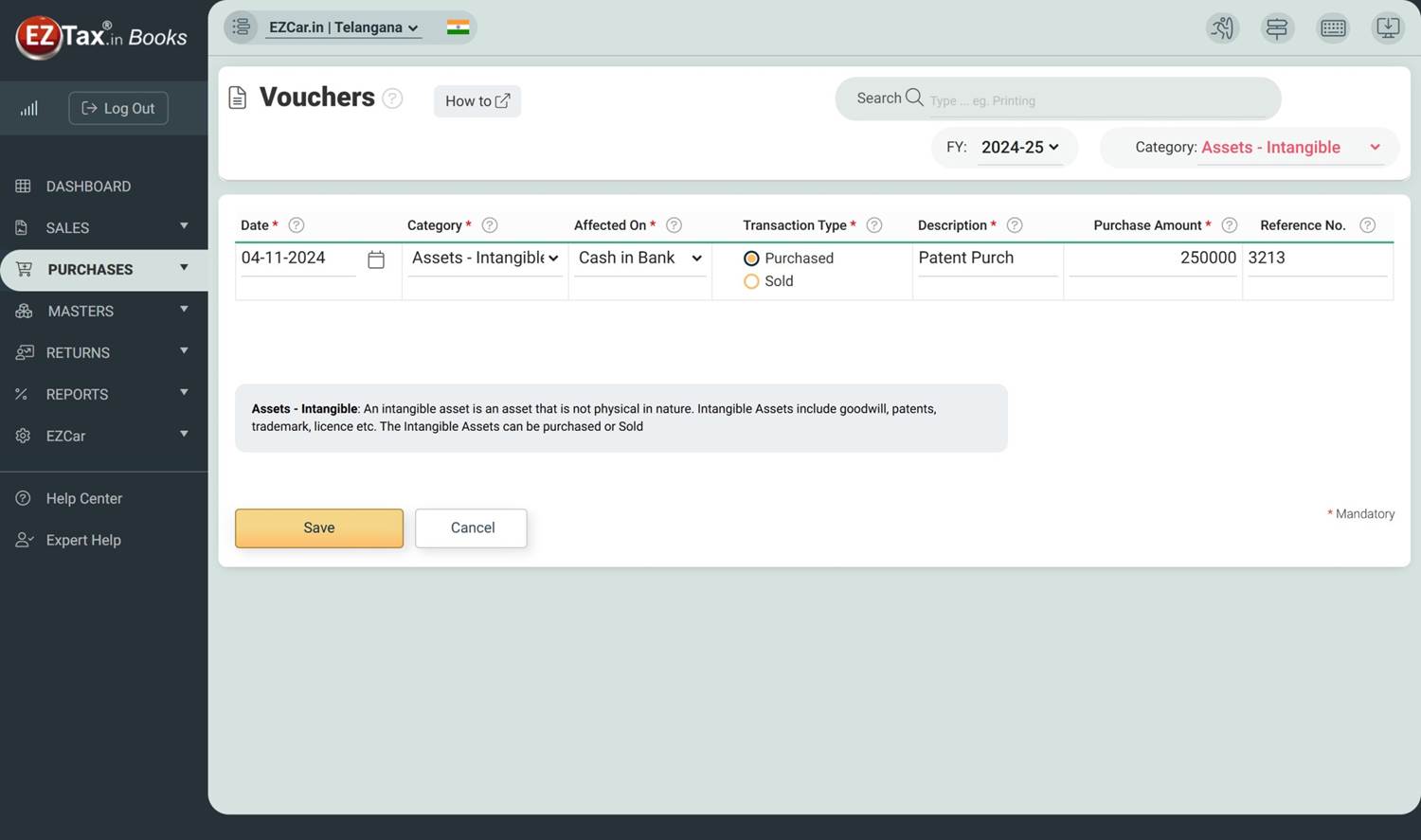

Category > Intangible Assets An intangible asset is an asset that is not physical in nature. Intangible Assets include goodwill, patents, trademark, licence etc. When you purchase the above assets or like, you need to mention intangible assets here

Affected on: When you purchase or sell the intangible assets, it needs to be purchased or sold either in cash or bank.

Transaction Type:

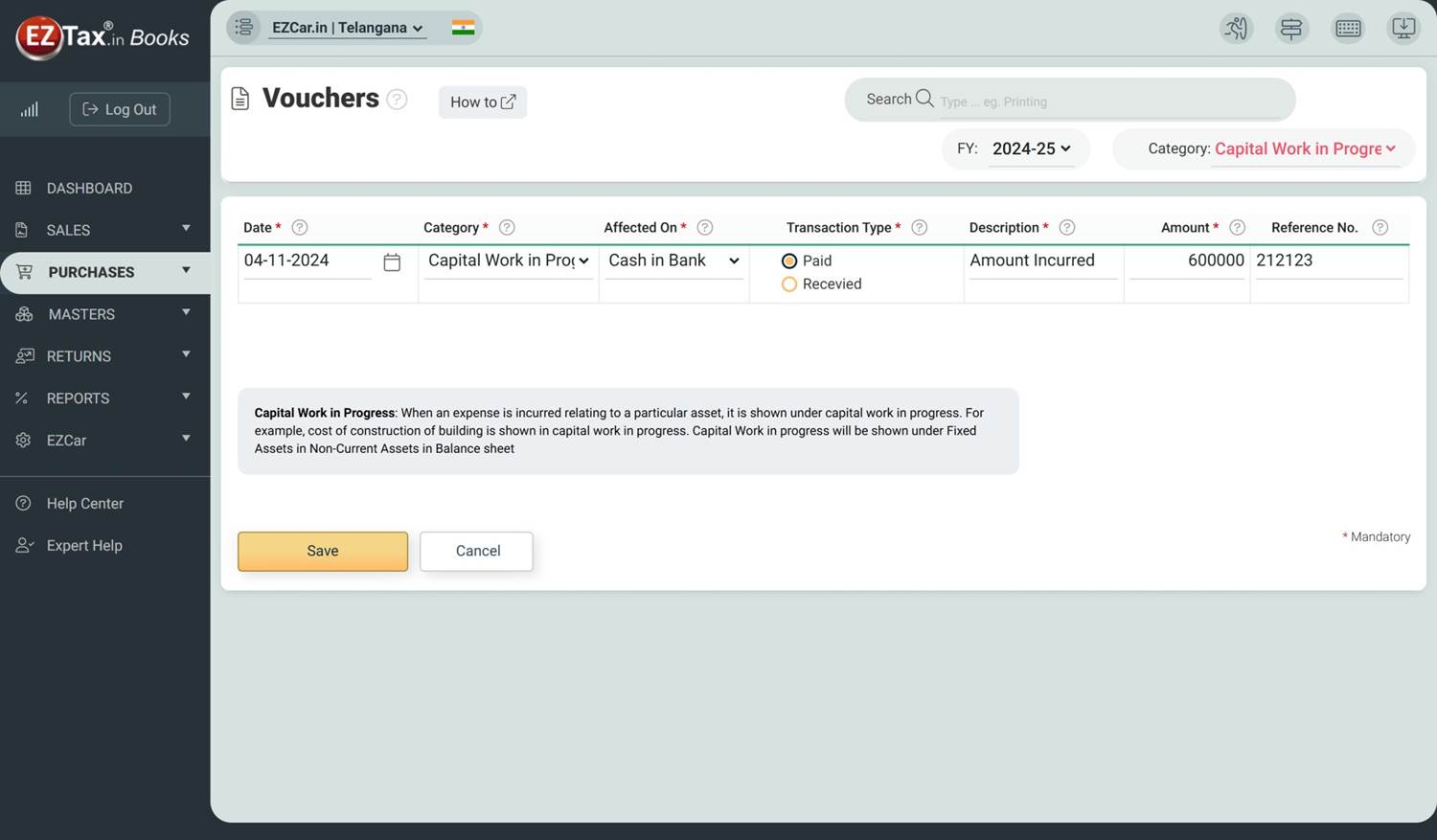

Category > Capital Work in Progress: When an expense is incurred relating to a particular asset, it is shown under capital work in progress. For example, cost of construction of building is shown in capital work in progress.

Affected on: When you incur an expense, it needs to be incurred either in cash or bank. When you incur the expenditure by paying cash in bank, you need to mention cash in bank or when you incur the expenditure by paying cash in hand, you need to mention cash in hand.

Transaction Type:

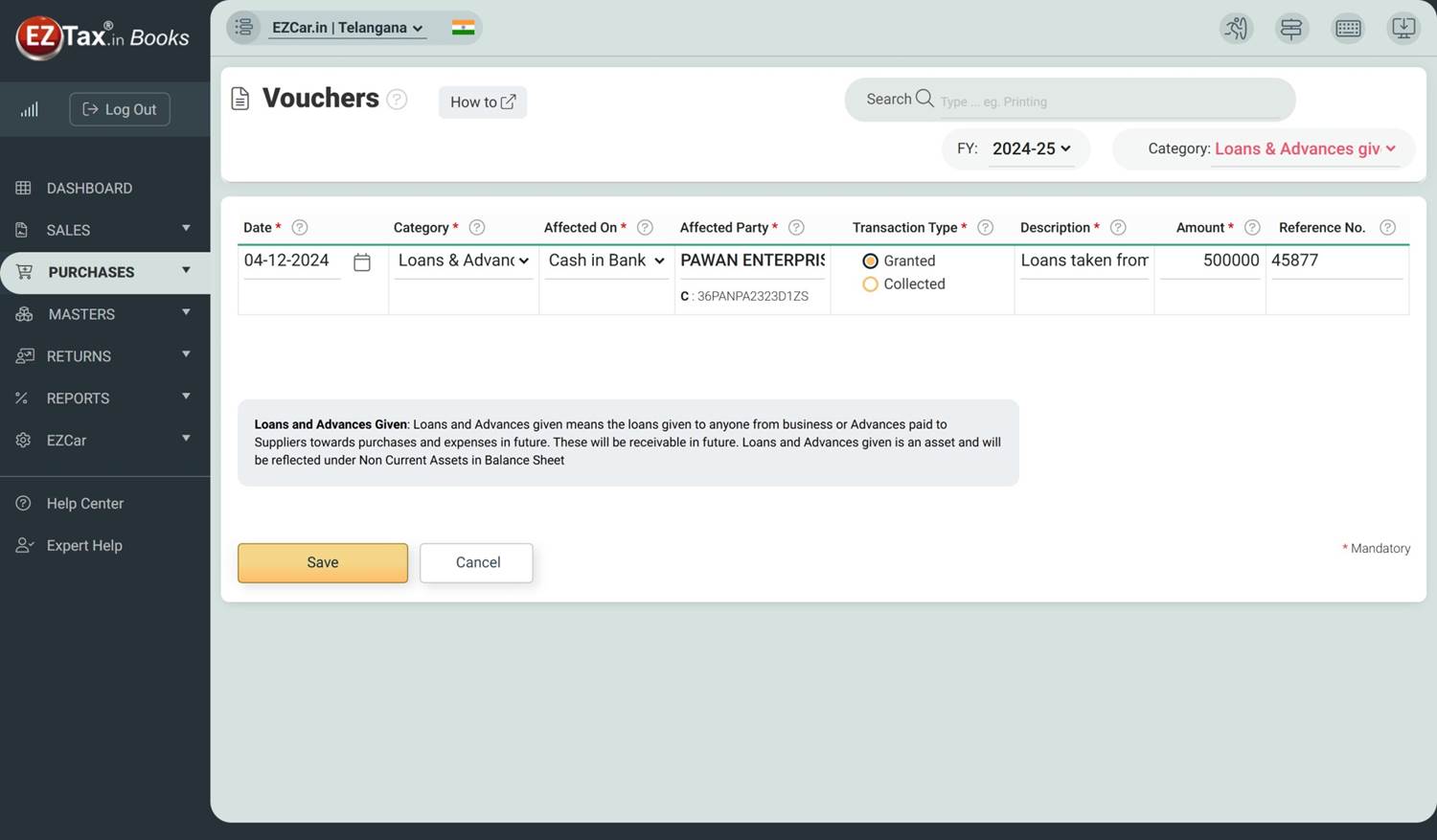

Category > Loans & Advances: Loans and advances means money you have received from banks, financial institutions, friends etc or money you have given to some other person with the promise of repayment in future date.

Affected on: When you receive money from bank, financial institutions etc or you may pay money to some other person, it may be in the form of cash in hand or cash in bank.

Transaction Type:

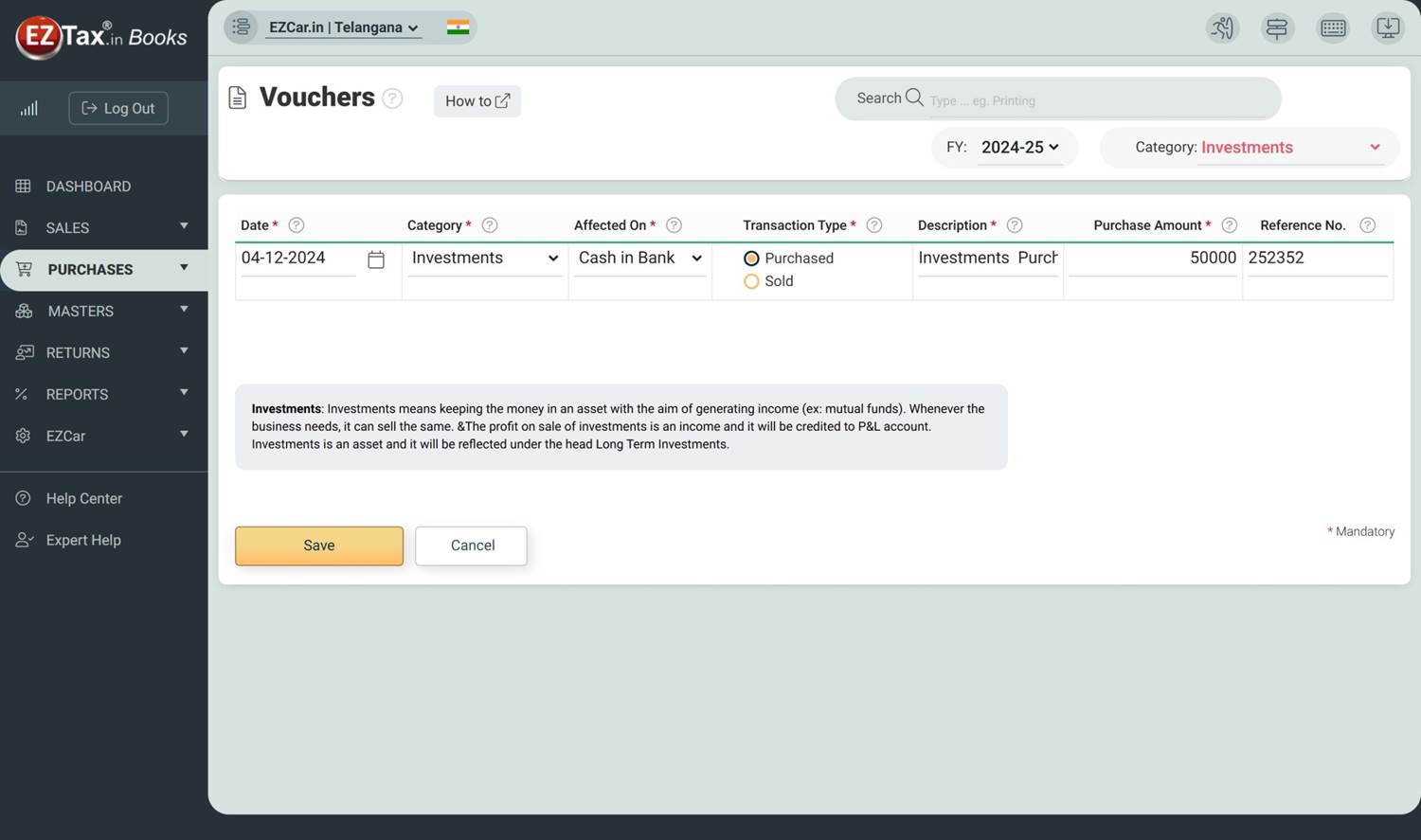

Category > Investments: Investments are monetary assets purchased with the idea that the asset will provide income in future or it will be sold at a higher price in future.

Affected on: When you purchase or sell investments, it needs to be purchased or sold either in cash or bank.

Transaction Type:

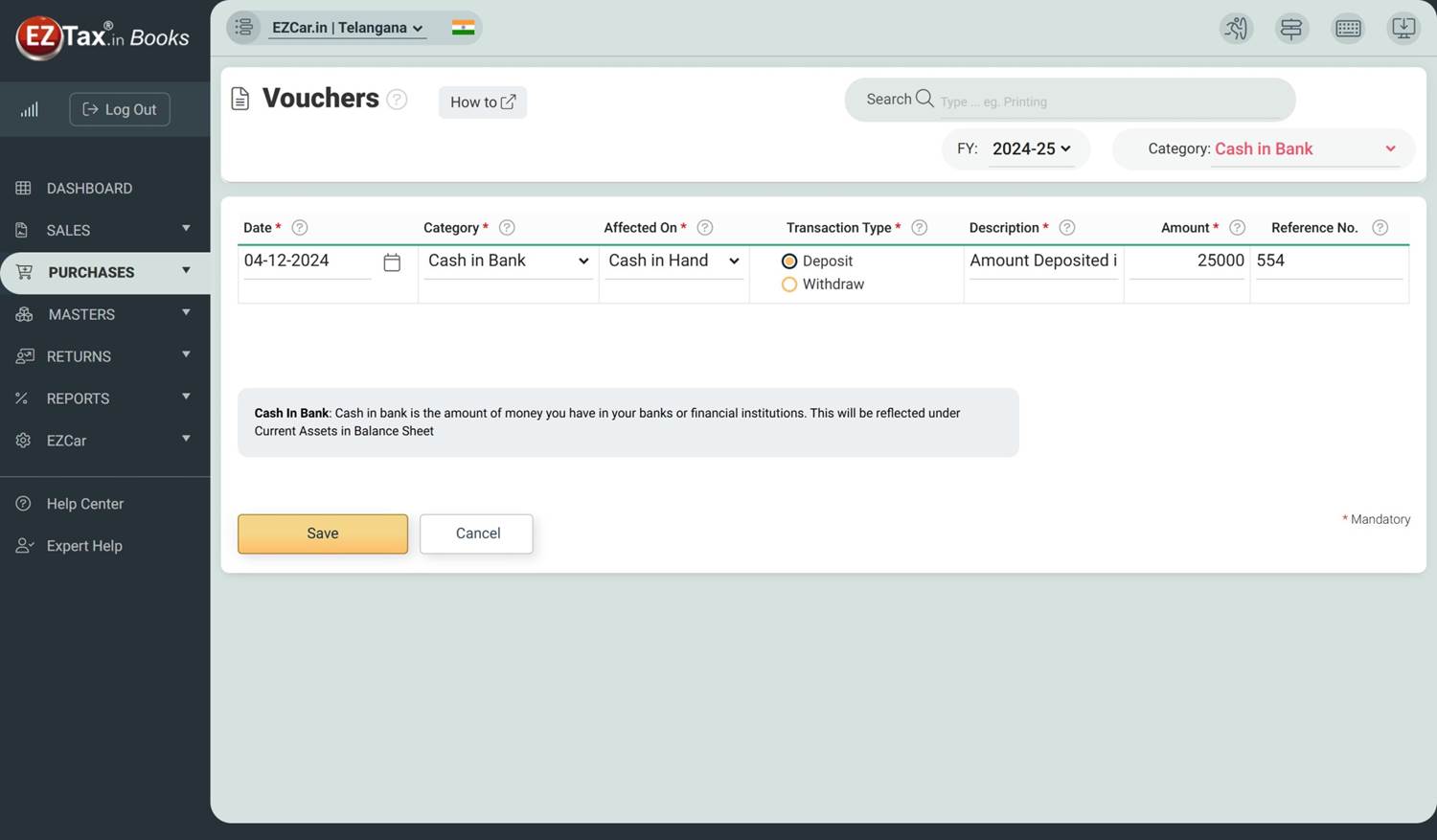

Category > Cash in Bank / Cash in hand: Cash in bank is the amount of money you have in your banks or financial institutions. Cash in hand means liquid amount you are having with you in running your business.

Affected on: When you select the category as cash in bank / cash in hand, you may withdraw or deposit in the form of cash in hand /cash in bank

Transaction Type:

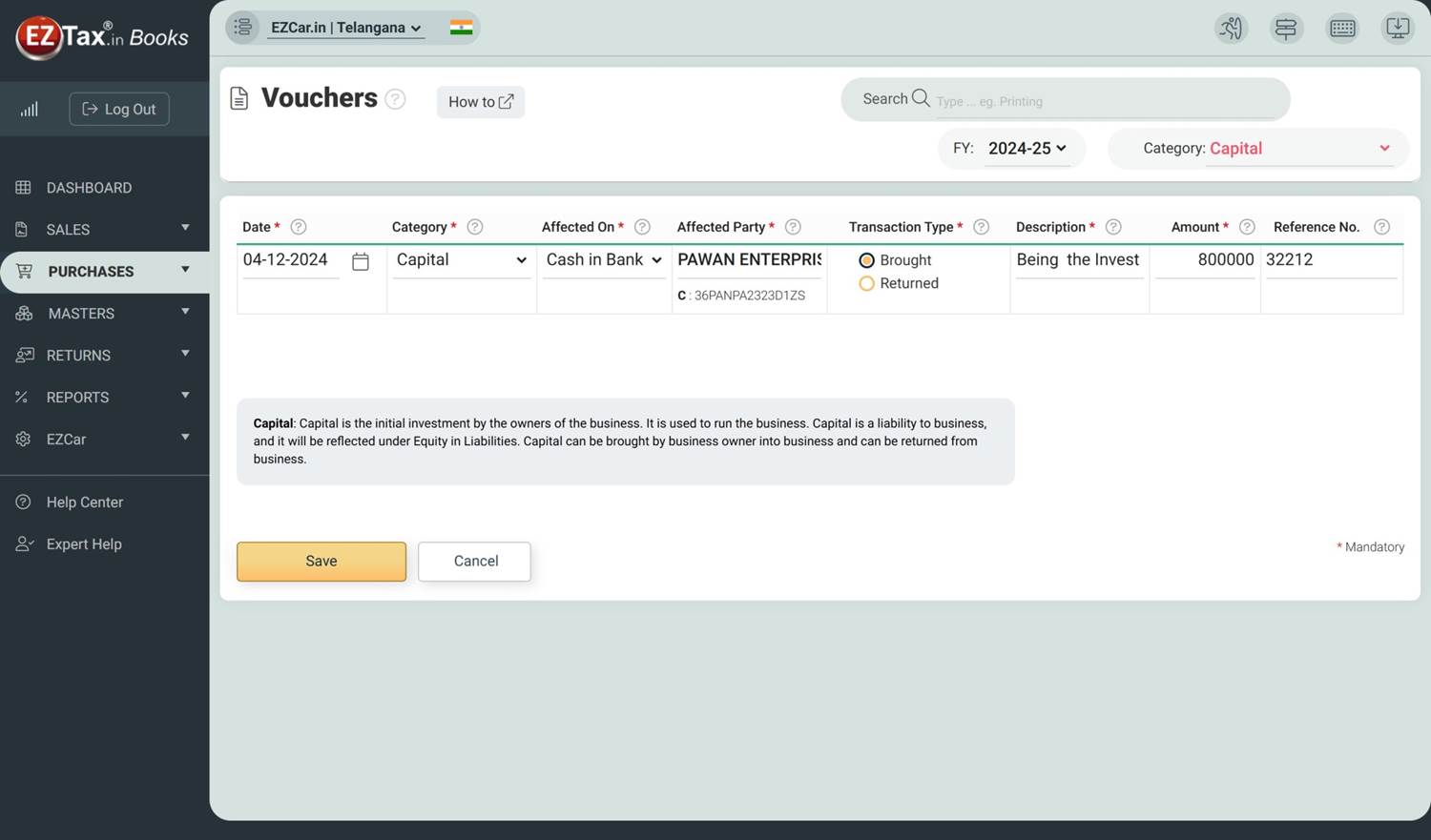

Category > Capital: Capital is the initial investment by the owners of the business. It is used to run the business.

Affected on: When you brought /withdraw the capital into /from business, it may be either in cash in hand or cash in bank

Transaction Type:

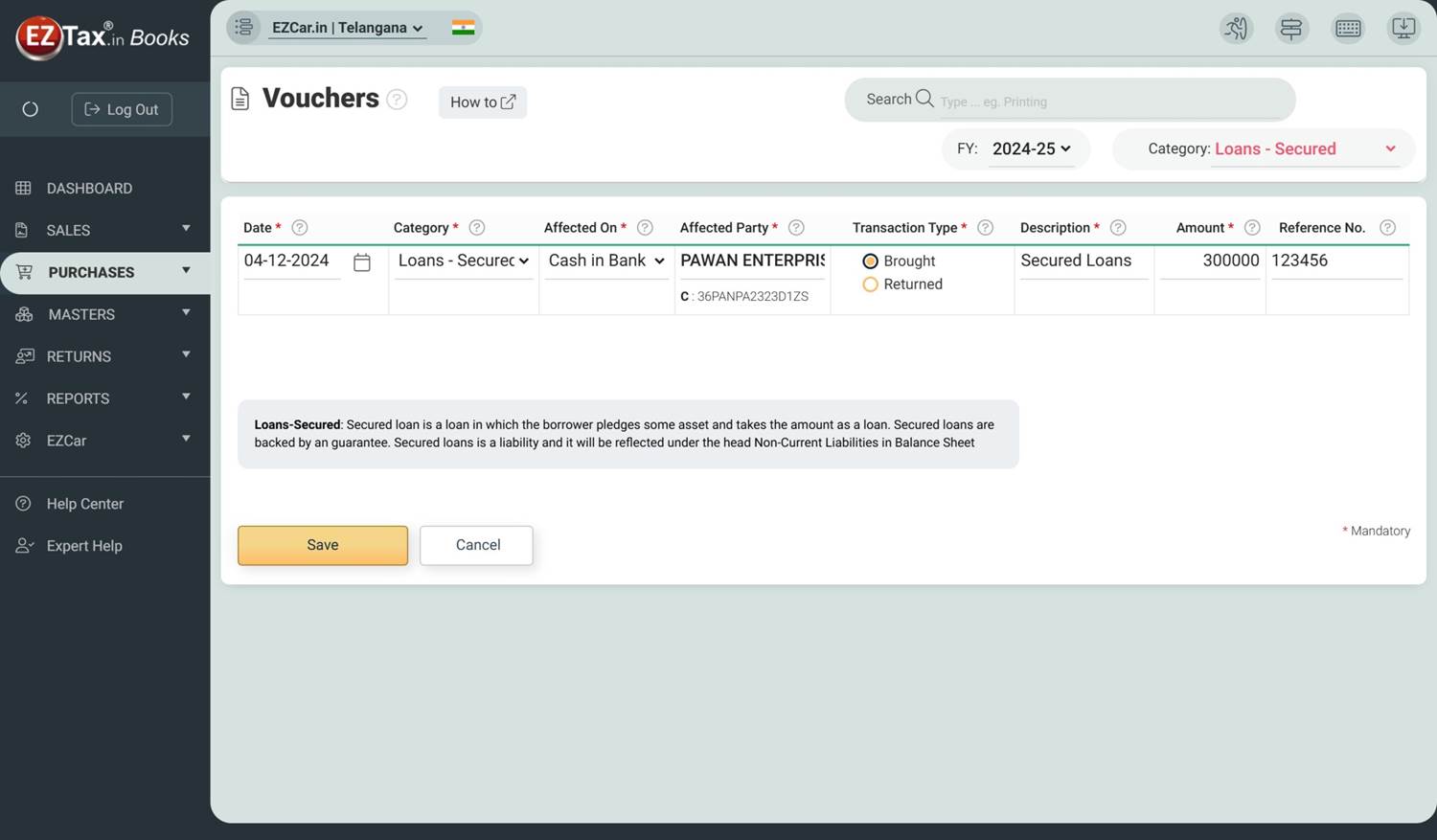

Category > Secured Loans / Unsecured Loans: Secured loan is a loan in which the borrower pledges some asset whereas unsecured loans are loans in which the loans are given only on the credit worthiness of borrower.

Affected on: When you brought / repaid the secured or unsecured loans, it may be either in cash in hand or cash in bank.

Transaction Type:

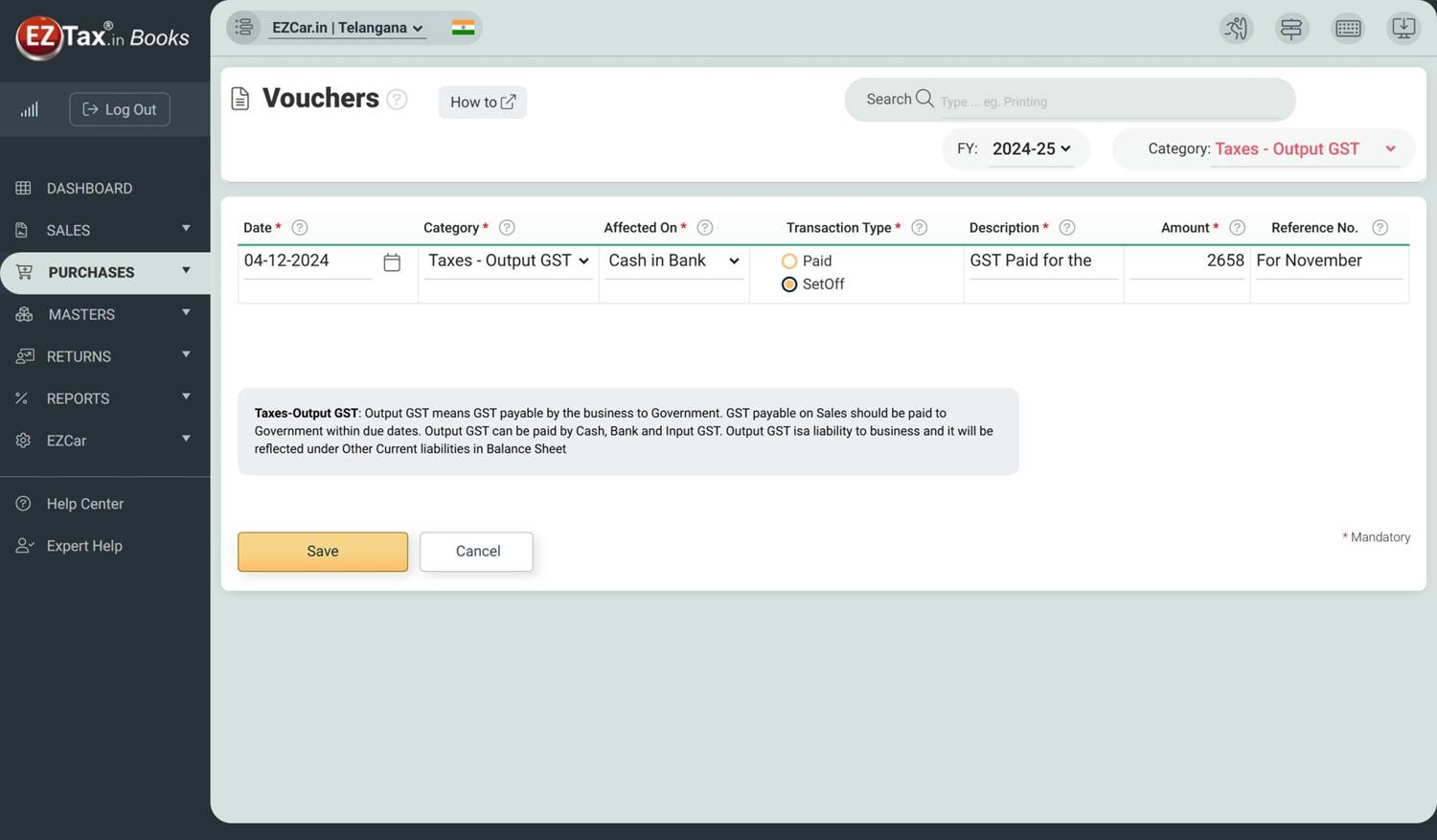

Category > Output GST: Output GST means GST payable on sales. When you registered in GST and made sales, you need to pay GST on the Sale value.

Affected on: The GST payable (Output GST ) may be payable by the taxpayer through cash in bank or input tax credit (ITC) i.e., GST paid on purchases or expenses.

Transaction Type:

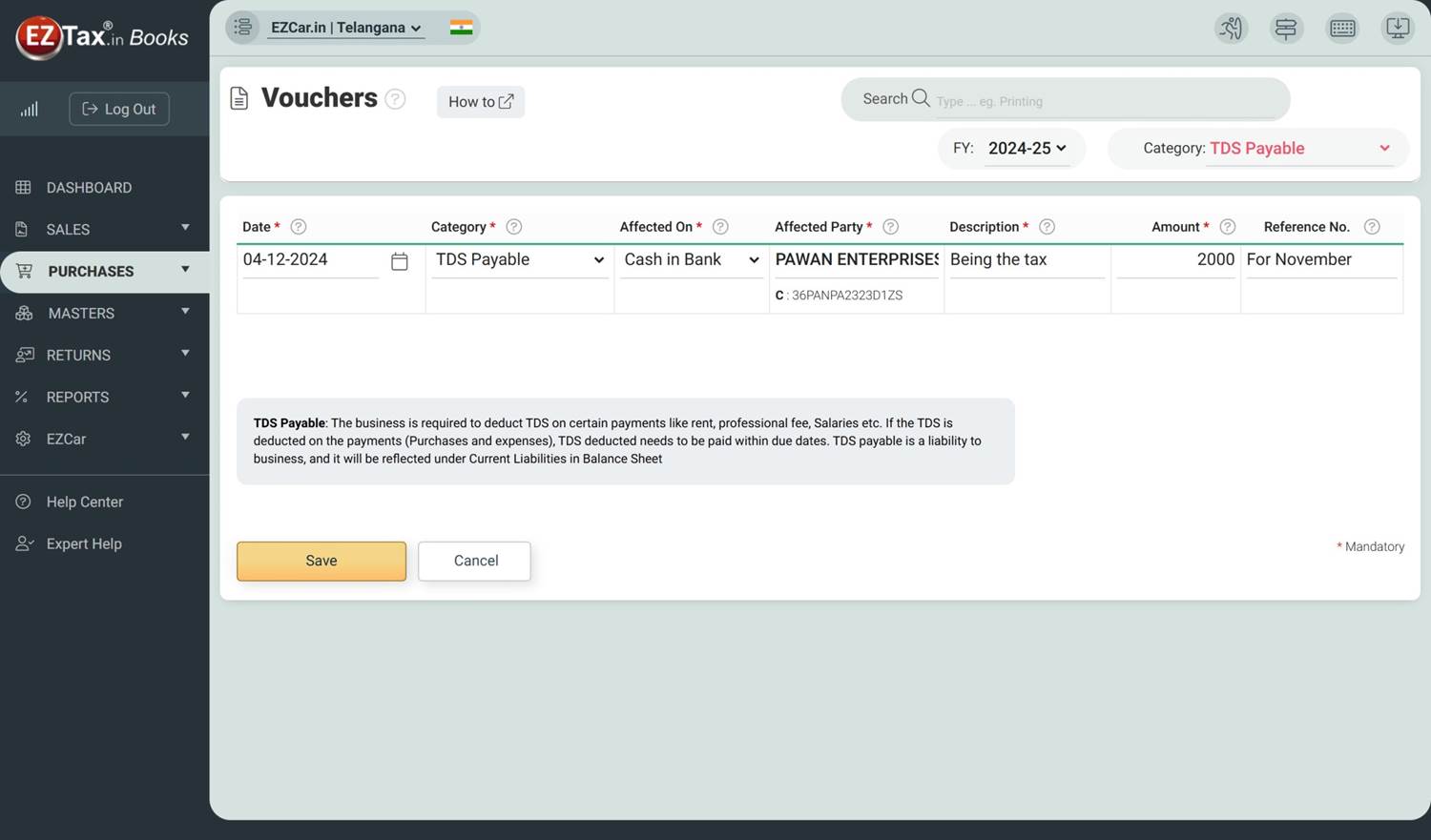

Category > Direct tax /Indirect Direct taxes means the taxes which are levied on your income. Direct taxes includes income tax, tax deducted at source (TDS). Indirect taxes means the tax levied on goods or services.

Affected on: When you have the income tax or TDS payable or GST, you need to pay the amount in cash in hand or cash in bank. Then you need to select cash in hand or cash in bank.

Transaction Type:

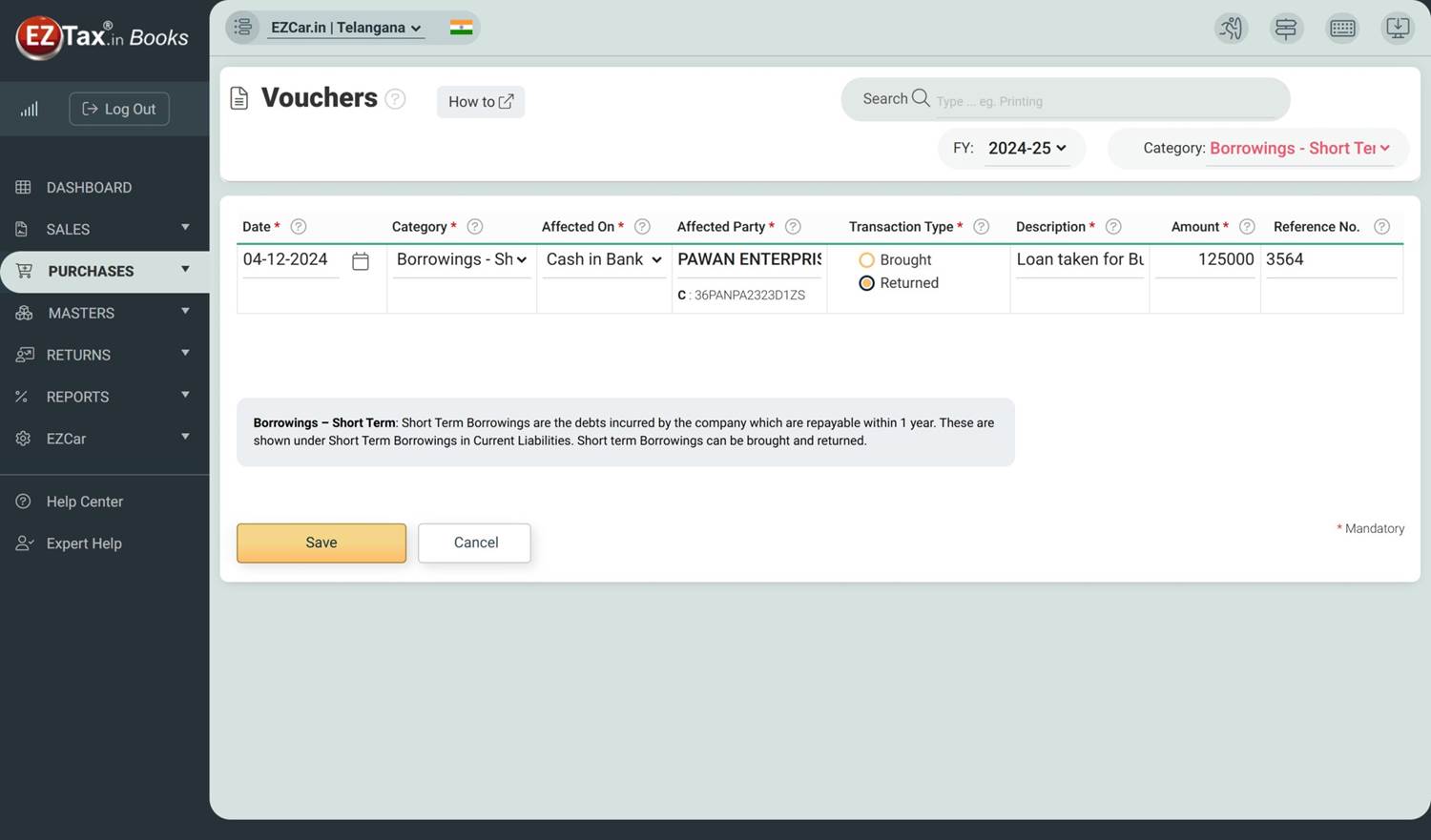

Category > Short term Borrowings Short term borrowings are the debts which are incurred by the company and repayable within 1 year. These are generally shown under current liabilities.

Affected on: Short term borrowings may be taken in cash in hand or cash in bank. When you receive the amount in cash in hand or cash in bank, you need to select cash in hand /cash in bank.

Transaction Type:

Check How Voucher Entries impact Balance Sheet?

Disclaimer: This article provides an overview and general guidance, not exhaustive for brevity. Please refer Income Tax Act, GST Act, Companies Act and other tax compliance acts, Rules, and Notifications for details.