4.8 ★★★★★ Excellence since 2016

4.8 ★★★★★ Excellence since 2016 Home > GST > Help Center > GSTR-3B JSON fileLast Updated: Jan 23rd 2025

EZTax.in is giving an easiest solution to prepare JSON file by using EZTax.in GST Accounting Software. The software caters for not only for accounting but also useful for seamless ways to prepare and upload GSTR-3B Json File on GST portal for your business.

The GST portal will automatically generate the GSTR 3B based on your filed GSTR 1. Hence it is recommended to file GSTR 3B based on the auto generated data by the GST portal. It is not required to upload the GSTR 3B JSON file generated from EZTax.

Prepare your GSTR-3B return by using EZTax.in GST accounting. It is the simplest way to file your GSTR 3B. If you have created your sales invoices, purchases and expenses in EZTax.in GST Accounting, you can directly import all the data to GSTR 3B.

| 1 | Month and Year: GSTR 3B is a simple tax return which contains the details of outward supplies (Sales) and inward supplies (Purchases/Expenses). It needs to be filed every month. The due date of filing GSTR 3B is 20th of every following month. You need to select the month and year for which you are filing return. |

| 2 | Update GSTR-3B/Add Data: You need to click on update GSTR 3B after selecting the month and year. It will automatically import the data for the selected month. If you click on Add data, you can enter the invoices which were not entered earlier in the system. |

| 3 | Outward Taxable supplies(other than Zero,Nil,Exempted): Outward supplies are goods sold or services provided within India. This includes taxable value of goods or services , IGST, CGST,SGST/UTGST, cess payable |

| 4 | Outward Taxable supplies (Zero Rated): It includes the taxable value of exports or sales made to SEZ. If you select the customer type as SEWOP/EXWOP, IGST will not come. If you select the customer type as SEZWP/EXWP, IGST will come |

| 5 | Outward Taxable supplies (Nil, Exempted Rated): Nil rated supplies means goods or services on which GST rate is 0%. Exempted supplies means goods or services which are specifically exempted from GST through Government notification. When you select the product type as Nil rated or Exempted, it will be imported here |

| 6 | Inward Taxable Supplies (liable to Reverse Charge): When you purchase the goods / services from a unregistered supplier or notified goods, you need to pay the tax on reverse charges. When you select the reverse charge as yes in your purchases or expenses, these inward supplies will be imported here |

| 7 | Non GST Taxable Supplies: Non GST supplies mean supply of goods or services on which GST is not leviable. Non GST supply means non-taxable supply. When you select the product type as non gst, these values will come here. |

| 8 | Download GSTR-3B JSON File: Download the GSTR-3B JSON file from EZTax GST. If you already created your Invoices through EZTax GST, it will automatically Import all the sales invoice data to GSTR-3B (on JSON file). Directly download the JSON file & upload it. Refer: How to solve 'emSigner failure' while using DSC? |

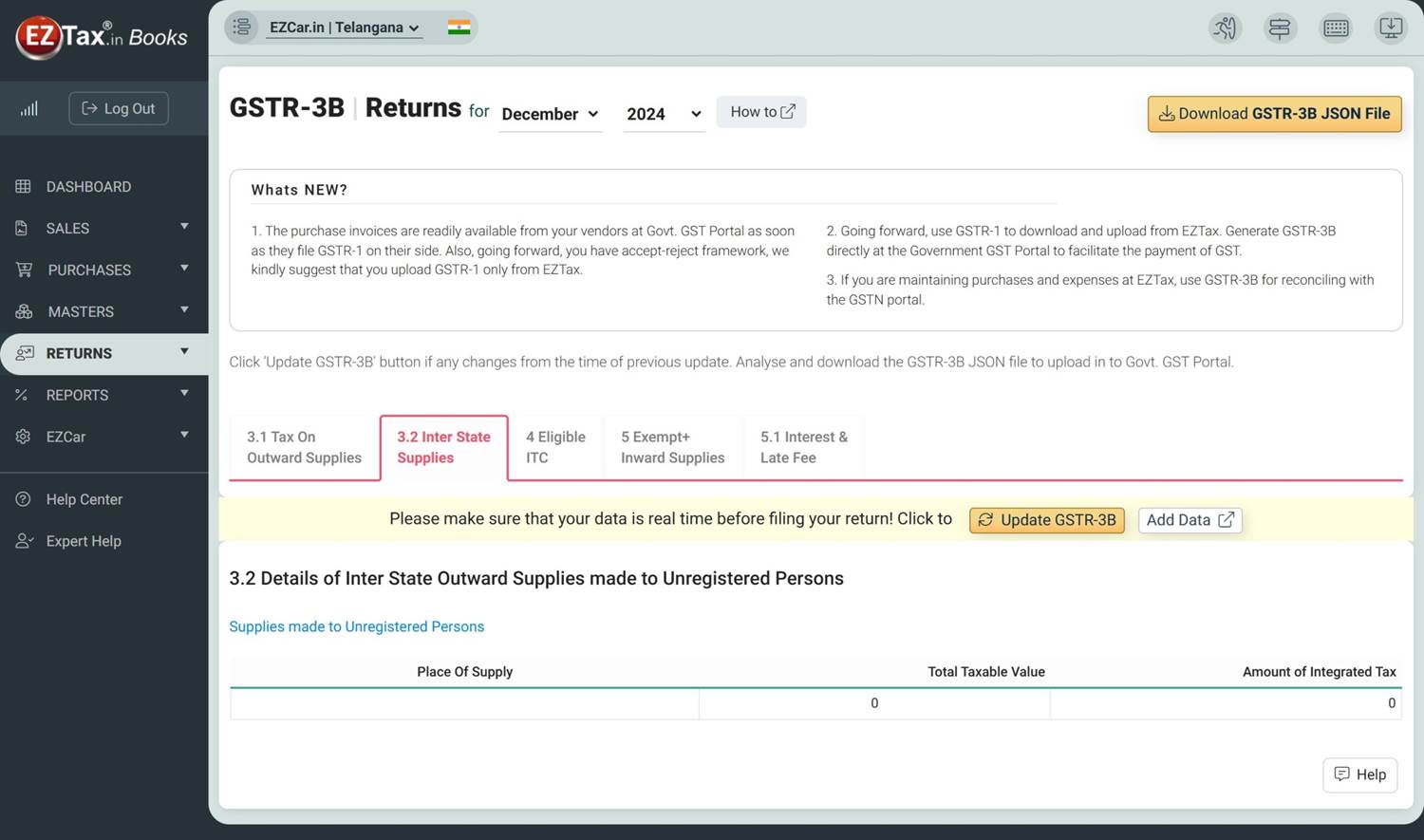

The details of sales made to unregistered persons located in different states will be declared here. When the Place of supply in sales is different from your GST registration states, those sales made will be declared here.

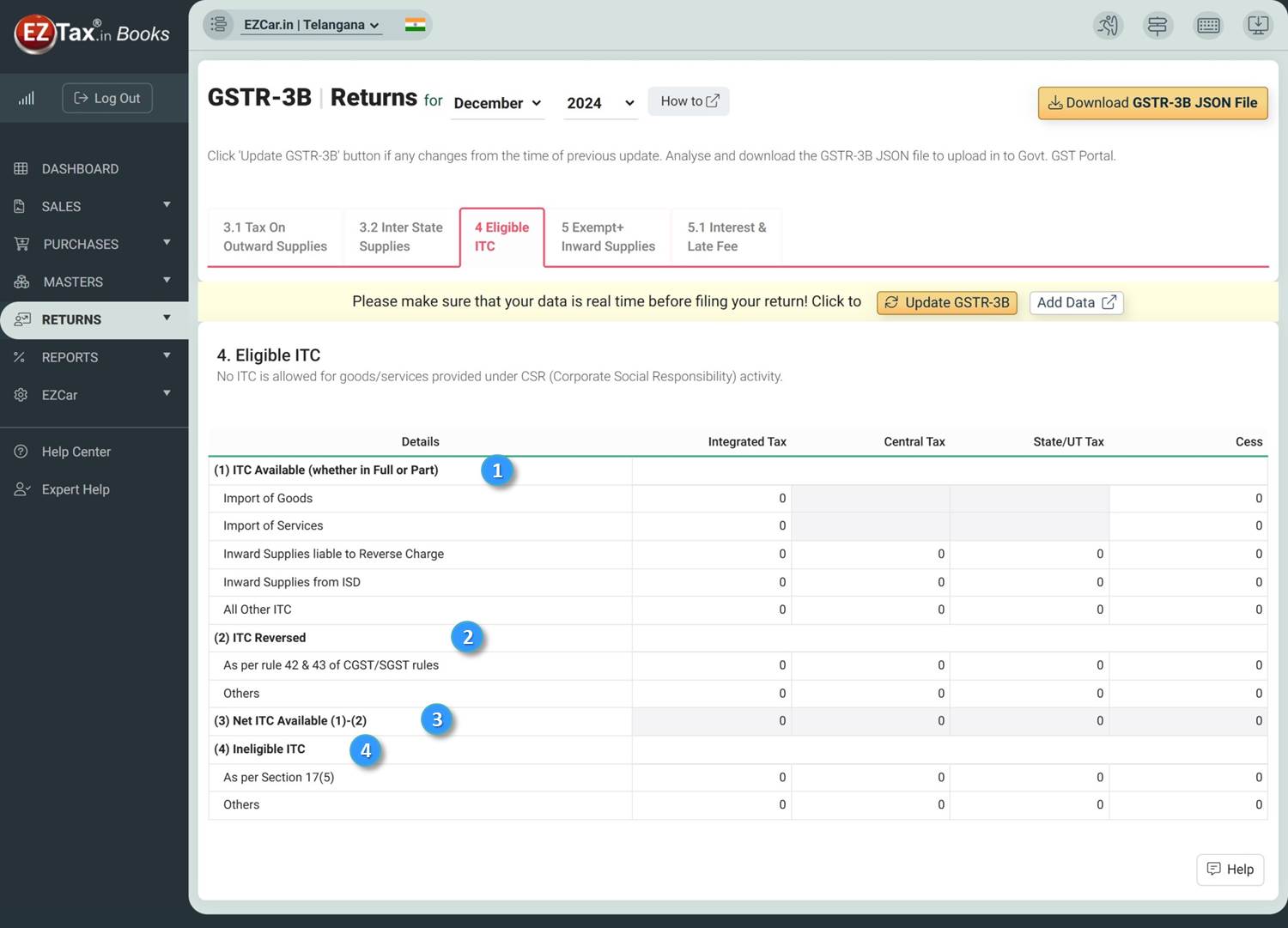

Input Tax Credit means claiming the credit of the GST paid on purchase of goods and services which are used for the furtherance of business. The Mechanism of ITC is the backbone of GST and is one of the most important reasons for the introduction of GST. Eligible ITC mainly define in four categories like:

ITC Available (whether in Full or Part): When you purchase or sell the tangible assets, it needs to be purchased or sold either in cash or bank.

ITC Reversed: Rule 42 and 43 of the CGST rules are applicable for claim of input tax credit wherein the supply is being partly used for the purposes of business and partly for other purposes. In such cases, input tax credit cannot be claimed fully by the taxpayer and part of the input tax credit claim must be reversed.

Net ITC Available (1)-(2): It will be automatically calculated in the system

Ineligible ITC:

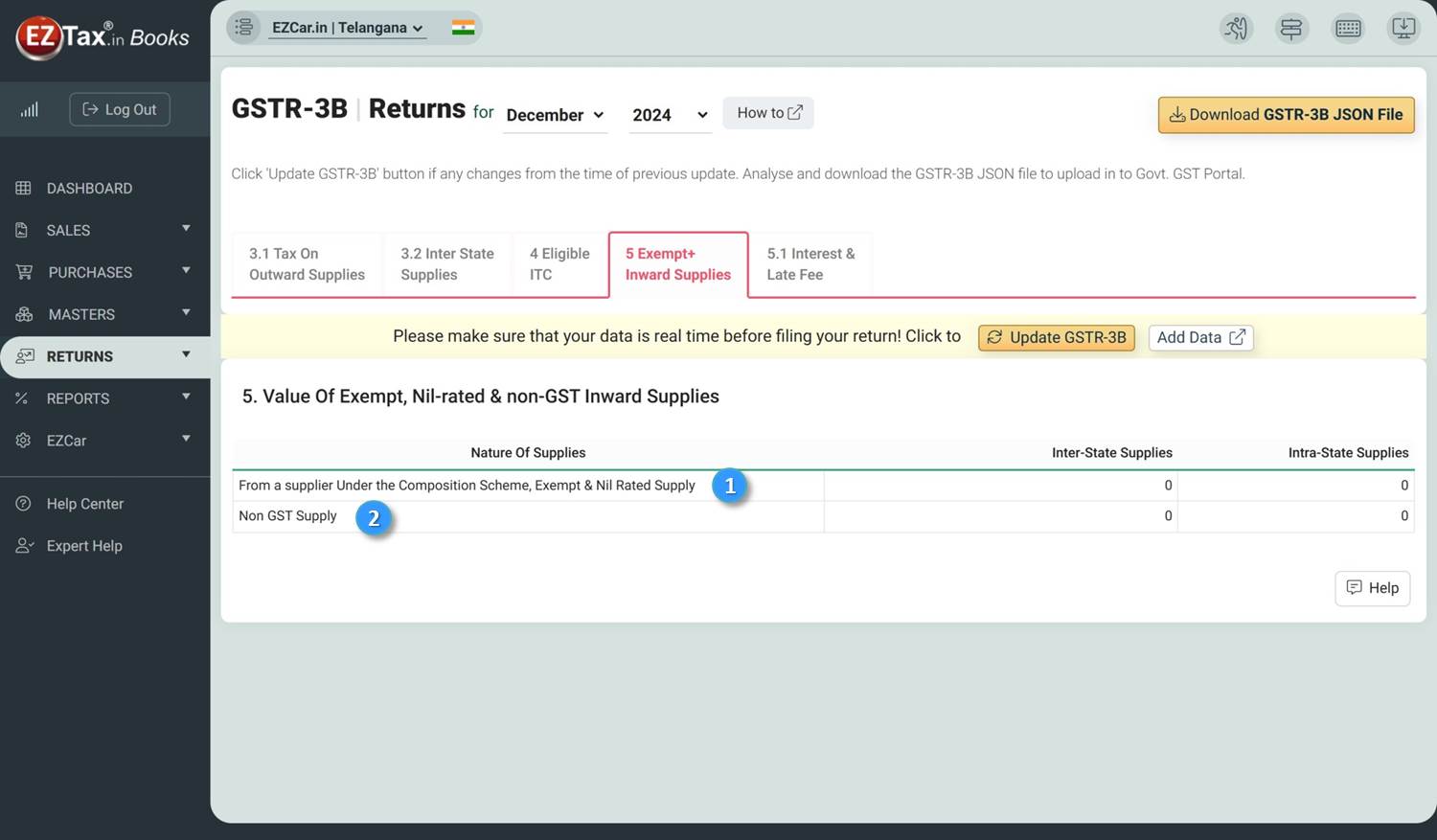

Nil rated supplies are those for which the GST rate is nil. Or which have been kept exempt from GST. For e.g. salt, puja samagri, curd, lassi, fresh milk.

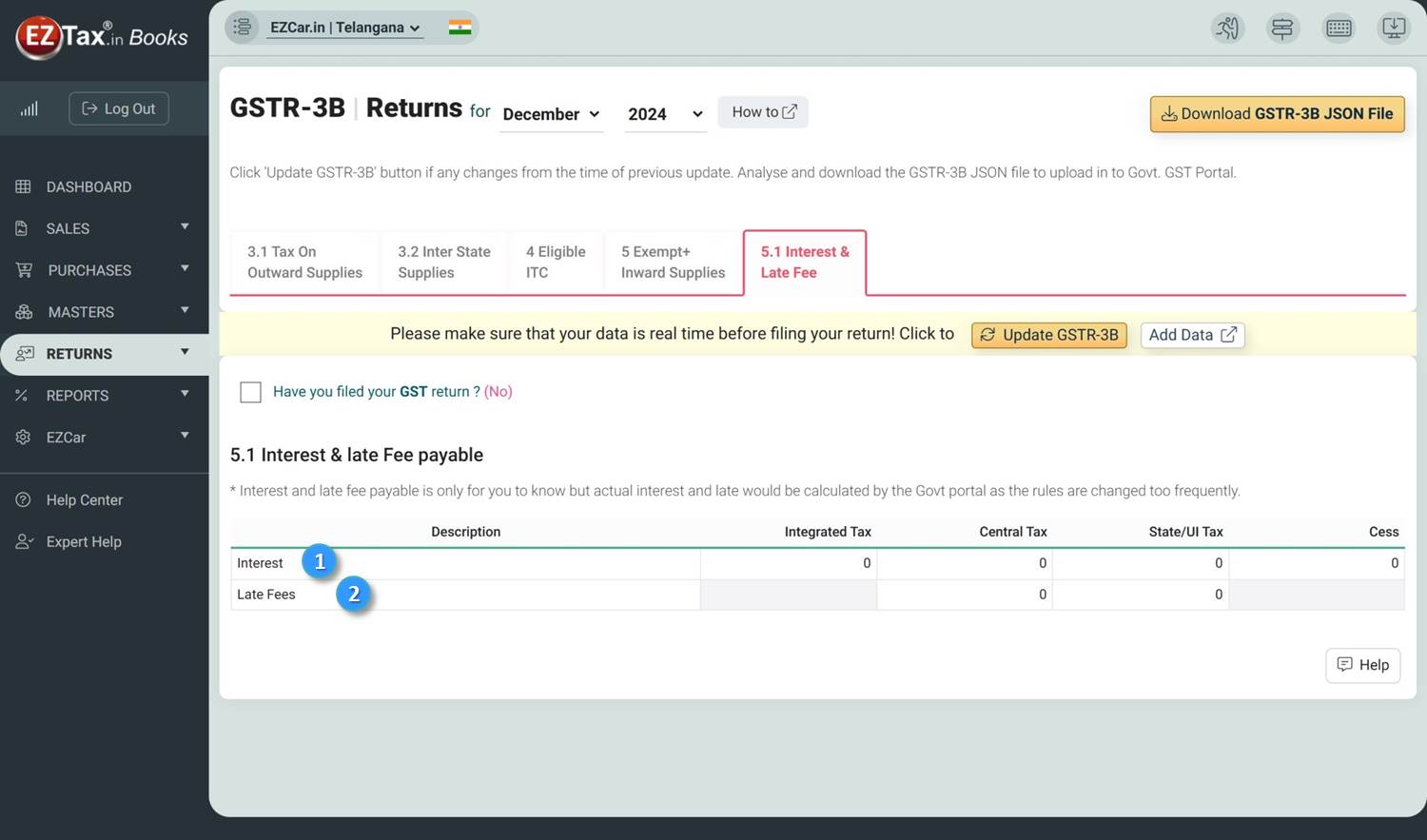

When a Registered Dealer misses filing GST Returns within due date, late fees is levied by the government. It should be calculated directly based on given the date in EZTax GST accounting.

The amount is separately reported under IGST, CGST, SGST, and UTGST. And also report the credit which has been availed against these. This amount is under 4(C). The balance tax must be deposited by you and appears under column 8. If any interest or late fee has been deposited that must also be reported

There are two modes to make a payment

The form would not allow cross utilizing of the CGST and SGST https://payment.gst.gov.in/payment/

Disclaimer: This article provides an overview and general guidance, not exhaustive for brevity. Please refer Income Tax Act, GST Act, Companies Act and other tax compliance acts, Rules, and Notifications for details.