4.8 ★★★★★ Excellence since 2016

4.8 ★★★★★ Excellence since 2016 Home > GST > Help Center > Google Drive IntegrationLast Updated: Sep 23rd 2022

While the invoices can be generated, printed, shared through emails any number of times through EZTax.in Books existing functionality, the Google Drive Integration is an additional dimension to copy, share, link to an existing Google Drive to use for future reference, can be further designed to have a team collaborative environment for an effective sharing among employees / stakeholders of your business.

Works Directly with EZTax.in Books

No additional Software needed

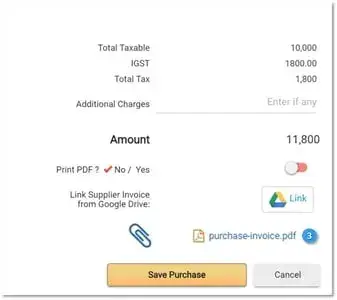

Often times, business need to refer Original invoices or photo copies of such documents delivered by your suppliers need to be kept for future reference and/or an Audit. While creation of a Purchase Invoice or an Expense is to include a financial transaction, it is a best practice to link a Original Supplier invoice to the newly created Purchase / Expense entry.

To do this, go to Purchases > Create Purchase Invoice, before Saving the Invoice, Click Google Drive Link to link an image / document in any format.

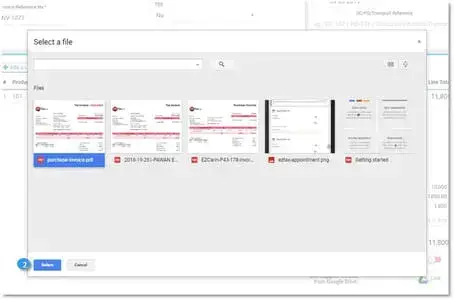

A new window will appear to select a document from your Google Drive.

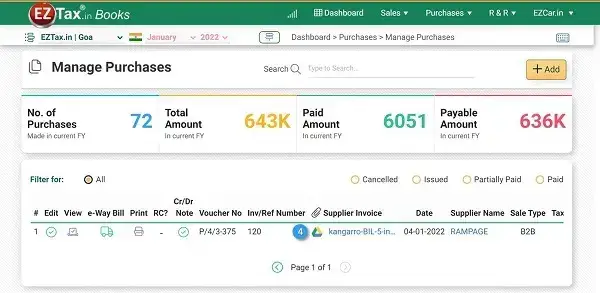

Once linked and Saved, the link will appear in Manage Purchases screen for viewing, searching and editing.

Go to Purchases > Manage Purchases > search for an invoice and click on Supplier Invoice Link

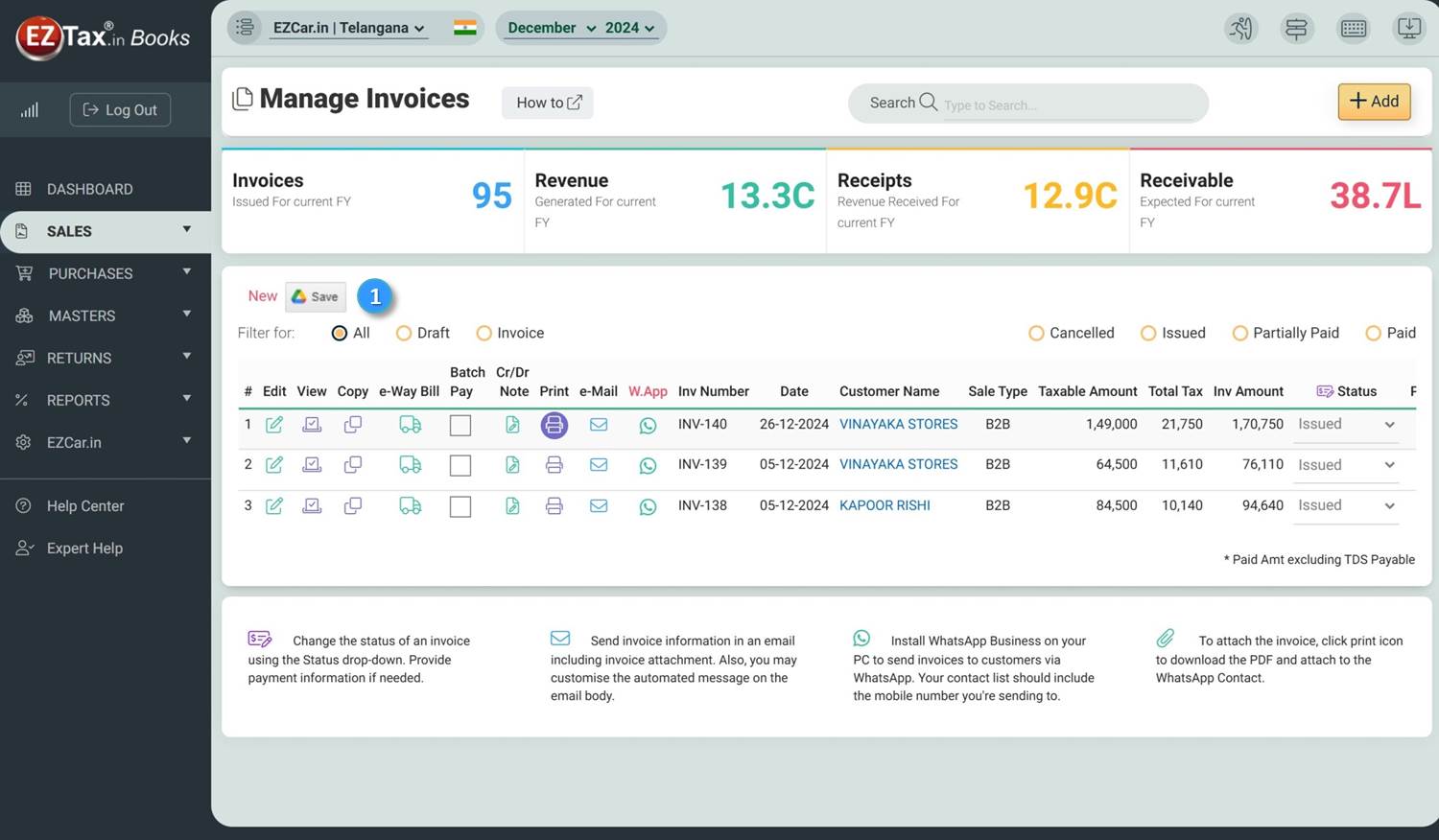

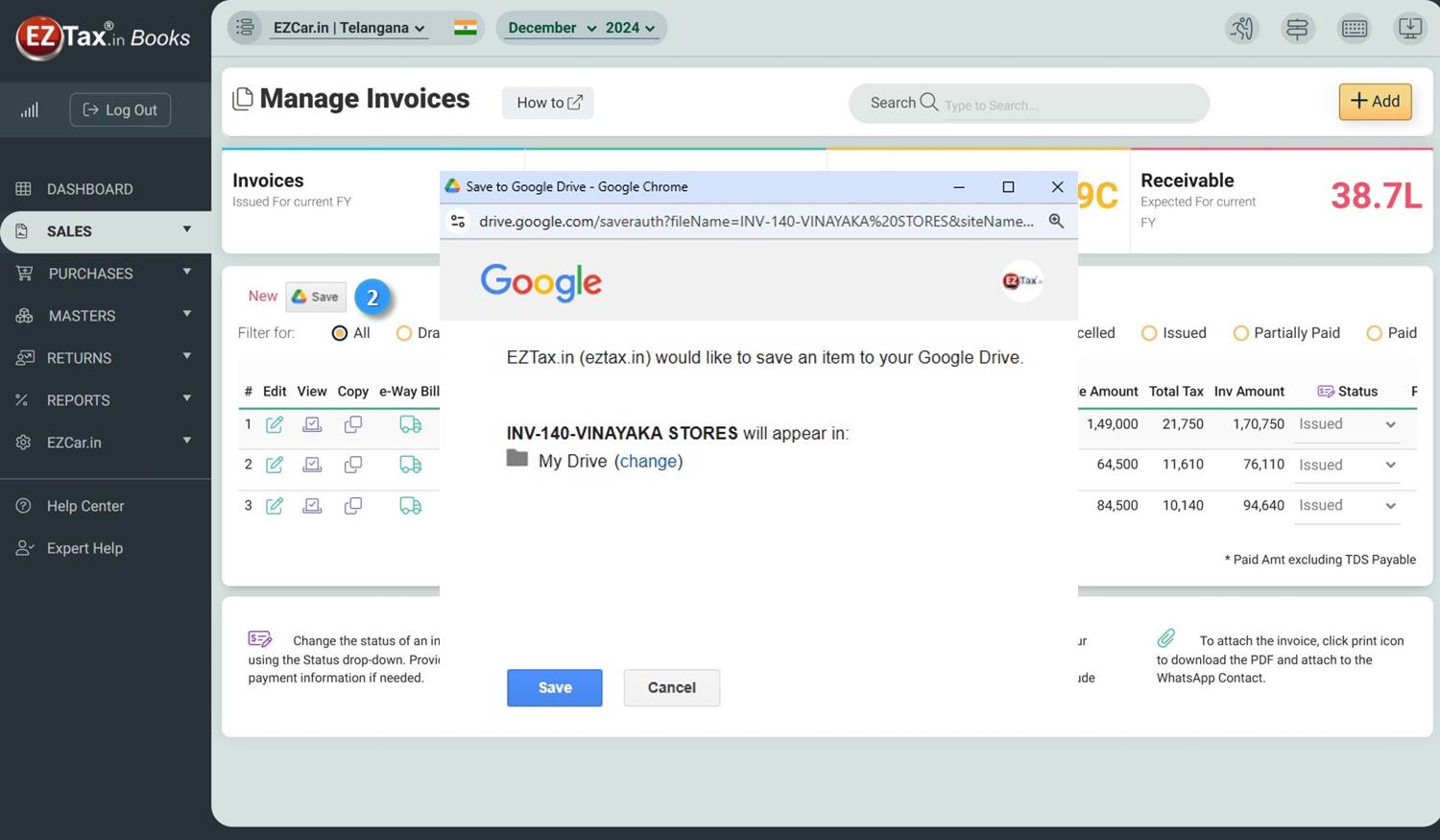

Once Print button is clicked, a new Save on Google Drive button will appear on top-left side of the Invoice Listing area.

Click on the above Save button to save the document in to your Google Drive.

For the First time, the system will ask you permission for EZTax.in Books application to access your Google Drive.

For the Next time onwards, if you have multiple Google accounts logged in to the browser, it will ask you to select right G Drive.

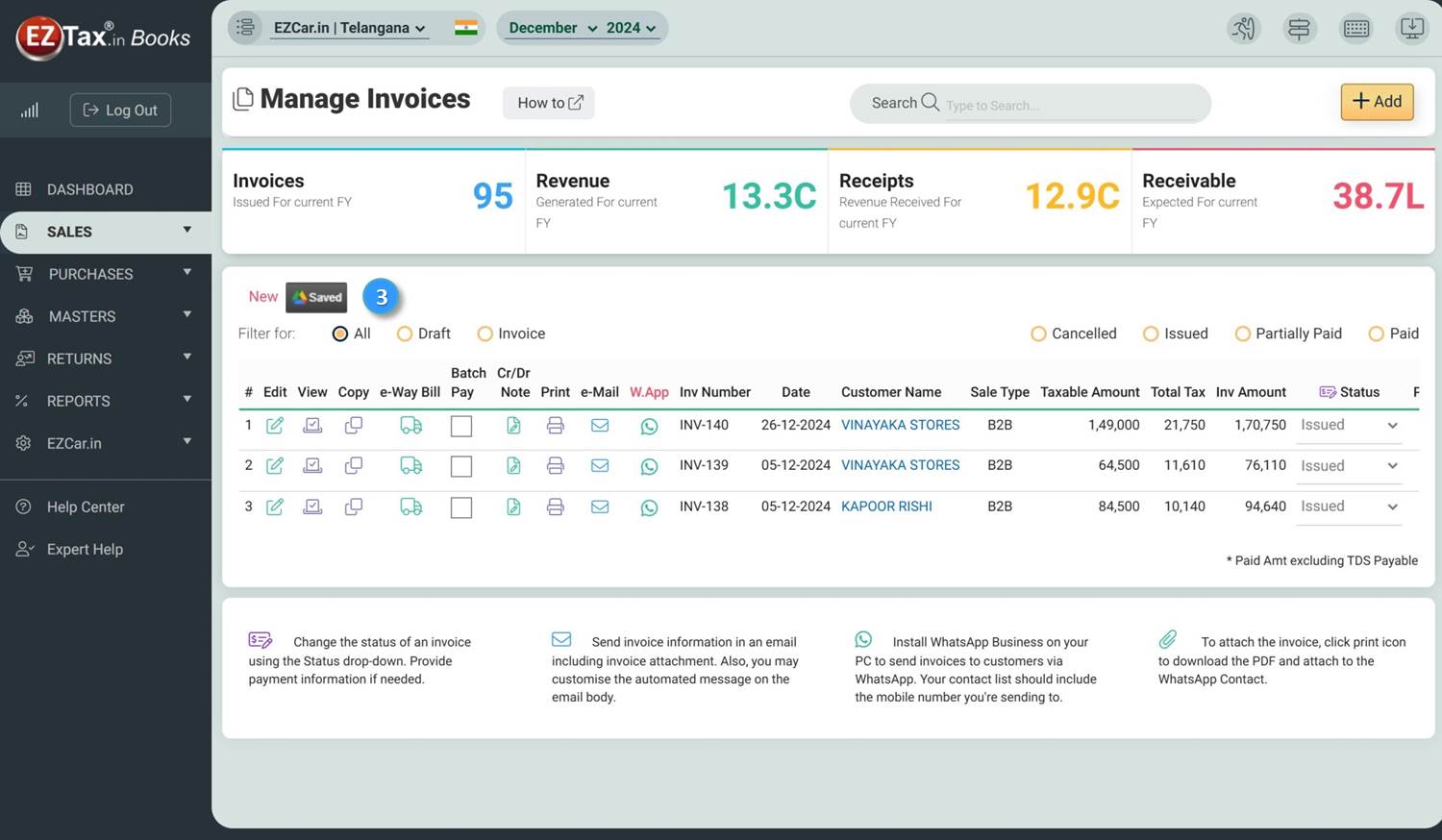

Once the File is Saved in Google Drive, the Save button change to 'Saved'. This is a confirmation that the document is successfully saved in to your G Drive.

Disclaimer: This article provides an overview and general guidance, not exhaustive for brevity. Please refer Income Tax Act, GST Act, Companies Act and other tax compliance acts, Rules, and Notifications for details.